Set up salary deposit

Plano Mais Colaborador Exclusive

Give your salary extra benefits

Are you an employee of a company with the Plano Mais Colaborador Exclusive? Receive your salary at Millennium and enjoy the benefits!

Are you an employee of a company with the Plano Mais Colaborador Exclusive? Receive your salary at Millennium and enjoy the benefits!

More benefits for employees

Receiving your salary at Millennium brings you benefits

Want a little extra without breaking a sweat?

Getting your salary deposited at Millennium could give you extra reasons to smile.

Exclusive to new Customers1

And, if you're already a Plano Mais Colaborador Customer, there's a little extra for you as well!2 View campaign

Exclusive to new Customers1

And, if you're already a Plano Mais Colaborador Customer, there's a little extra for you as well!2 View campaign

Making purchases with this card is extra

Receive 1% cashback9 on your credit card for purchases made until December 31st, 2026, with a maximum limit of €4 per month.

To activate the cashback, simply sign up through the banner in the Millennium App.

Classic - TAEG 15.7%4 Apply for card

To activate the cashback, simply sign up through the banner in the Millennium App.

Classic - TAEG 15.7%4 Apply for card

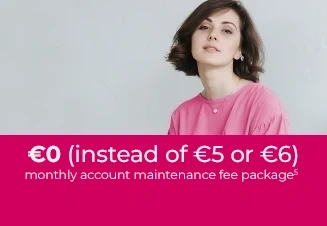

Discount on the account maintenance fee package3

Take advantage of reduced fees on the Integrated Banking Products and Services Solutions: Prestige Program4 or Cliente Frequente5.

Making purchases with this card is extra

Receive 1% cashback9 on your credit card for purchases made until December 31st, 2026, with a maximum limit of €4 per month.

To activate the cashback, simply sign up through the banner in the Millennium App.

Classic - TAEG 15.7%4 Apply for card

To activate the cashback, simply sign up through the banner in the Millennium App.

Classic - TAEG 15.7%4 Apply for card

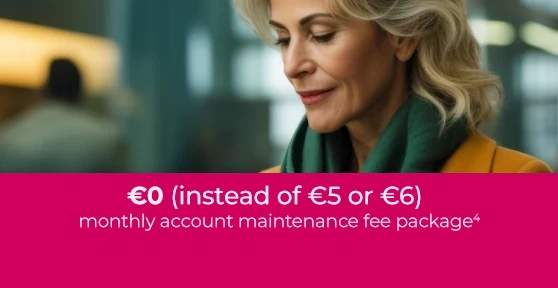

€0 for the account maintenance fee package3

Exemption from the monthly account maintenance fee package in the integrated banking products and services solutions of the Programa Prestige4 or Cliente Frequente5.

Campaign valid until May 31st, 2026.

Campaign valid until May 31st, 2026.

Zero has never been worth so much

Unlock preferential conditions on mortgage solutions6.

Credit subject to approval. Calculate mortgage

Credit subject to approval. Calculate mortgage

Preferential spread after the first two years

Plus a 50% reduction on the file fee (€290 + VAT without reduction) and formalization fee (€200 + VAT without reduction), with optional associated sales6.

Zero has never been worth so much

Unlock preferential conditions on mortgage solutions6.

Credit subject to approval. Calculate mortgage

Credit subject to approval. Calculate mortgage

Preferential spread after the first two years

Plus a 50% reduction on the file fee (€290 + VAT without reduction) and formalization fee (€200 + VAT without reduction), with optional associated sales6.

Want a little extra without breaking a sweat?

Getting your salary deposited at Millennium could give you extra reasons to smile.

Exclusive to new Customers1

And, if you're already a Plano Mais Colaborador Customer, there's a little extra for you as well!2 View campaign

Exclusive to new Customers1

And, if you're already a Plano Mais Colaborador Customer, there's a little extra for you as well!2 View campaign

€0 for the account maintenance fee package3

Exemption from the monthly account maintenance fee package in the integrated banking products and services solutions of the Programa Prestige4 or Cliente Frequente5.

Campaign valid until May 31st, 2026.

Campaign valid until May 31st, 2026.

Making purchases with this card is extra

Receive 1% cashback9 on your credit card for purchases made until December 31st, 2026, with a maximum limit of €4 per month.

To activate the cashback, simply sign up through the banner in the Millennium App.

Classic - TAEG 15.7%4 Apply for card

To activate the cashback, simply sign up through the banner in the Millennium App.

Classic - TAEG 15.7%4 Apply for card

Zero has never been worth so much

Unlock preferential conditions on mortgage solutions6.

Credit subject to approval. Calculate mortgage

Credit subject to approval. Calculate mortgage

Discount on the account maintenance fee package3

Take advantage of reduced fees on the Integrated Banking Products and Services Solutions: Prestige Program4 or Cliente Frequente5.

Preferential spread after the first two years

Plus a 50% reduction on the file fee (€290 + VAT without reduction) and formalization fee (€200 + VAT without reduction), with optional associated sales6.

Making purchases with this card is extra

Receive 1% cashback9 on your credit card for purchases made until December 31st, 2026, with a maximum limit of €4 per month.

To activate the cashback, simply sign up through the banner in the Millennium App.

Classic - TAEG 15.7%4 Apply for card

To activate the cashback, simply sign up through the banner in the Millennium App.

Classic - TAEG 15.7%4 Apply for card

Zero has never been worth so much

Unlock preferential conditions on mortgage solutions6.

Credit subject to approval. Calculate mortgage

Credit subject to approval. Calculate mortgage

Preferential spread after the first two years

Plus a 50% reduction on the file fee (€290 + VAT without reduction) and formalization fee (€200 + VAT without reduction), with optional associated sales6.

Integrated banking products and services solutions

Everything you need, for less

Programa Prestige

The account for those seeking exclusivity, including free transfers, no card issuance fees, and much more.

View solution

Cliente Frequente

A complete solution with free transfers and MB WAY, plus no card issuance fees.

View solution

Programa Prestige

The account for those seeking exclusivity, including free transfers, no card issuance fees, and much more.

View solution

Cliente Frequente

A complete solution with free transfers and MB WAY, plus no card issuance fees.

View solution

For Plano Mais Colaborador Top

Enjoy benefits in insurance as well

Médis Insurance (health)

Options 1, 2, 3, Vintage, or Vintage Plus

Exemption of the 12th and 24th monthly payments in the first two years

Exemption of the 12th and 24th monthly payments in the first two years

Other insurance

10% discount throughout the entire contract period on YOLO! (life), Móbis (auto), HOMIN (home), Pétis (pet), Volta/Volta 55+ (personal accidents), and Travel insurance

Médis Insurance (health)

Options 1, 2, 3, Vintage, or Vintage Plus

Exemption of the 12th and 24th monthly payments in the first two years

Exemption of the 12th and 24th monthly payments in the first two years

Other insurance

10% discount throughout the entire contract period on YOLO! (life), Móbis (auto), HOMIN (home), Pétis (pet), Volta/Volta 55+ (personal accidents), and Travel insurance

Learn more about Millennium insurance and take advantage of current promotions.

Discounts apply to the total premium payable and do not apply to policy issuance and documentation costs. Conditions valid for new policy subscriptions until December 31, 2026.

PUB. Does not replace the consultation of pre-contractual and legally required contractual information.

How to join

To join, talk to us

How to join

To join, talk to us

Campaign details

Campaign terms and conditions

DownloadSalary Domiciliation Campaign

1Campaign valid from 16/01 to 15/04/2026 for individual Customers who are first holders of a current account, aged 18 or over, who get their salary/pension at Millennium, net equal to or greater than €1000 (without any salary/pension deposits since 15/10/2024), with an active credit card (1) linked to the account where the salary/pension is deposited, no payment defaults, and who register in the Millennium App by 31/05/2026.

A new Customer is anyone who, as of Jan 15, 2026, was not the primary holder of any account with Millennium bcp and opens their first account as the primary holder during the campaign.

Refund, credited to the credit card, of 20% of the lower value of the first two salary/pension deposits, up to €500. The refund is made in a single payment, provided that the first salary/pension credit occurs by 30/04/2026 and the second by 31/05/2026.

A 24-month commitment to keep the salary/pension domiciled in the account is required.

Account maintenance fee: €64.92/year, charged monthly in arrears at €5.41/month (tax included). Account opening requires a minimum deposit of €250 and is subject to the Bank's Client acceptance policy.

2Campaign valid from 16/01 to 15/04/2026 for Current Clients Plano Mais Colaborador who are first holders of a current account, aged 18 or over, who get their salary at Millennium, net equal to or greater than €1000, with an active credit card (1) linked to the account where the salary is deposited, no payment defaults, and who register in the Millennium App by 31/05/2026.

Refund, credited to the credit card, of 10% of the lower value of the first two salary deposits, up to €500. The refund is made in a single payment, provided that the first salary credit occurs by 30/04/2026 and the second by 31/05/2026, and that no salary/pension credit has occurred in the account since 15/01/2025.

A 24-month commitment to keep the salary/pension domiciled in the account is required.

For the purpose of this campaign, salary or pension amounts are considered to be the sum of credits processed monthly and on a regular basis through bank transfers duly identified at source with the ISO code "SALA" (salary) or "PENS" (pension).

The bonus will be paid once, one month after your eligibility is confirmed. If, during the 24-month commitment period, you stop receiving your salary for three months in a row, you must repay Millennium the full bonus, including any income tax that Millennium has paid on it.

The bonus amount is considered taxable income under Article 5, paragraph 1 of the Portuguese Personal Income Tax Code (CIRS), and is subject to withholding tax at the flat rate of 28%, unless the Client opts for aggregation, in which case the general IRS rates apply. The gross value of the benefit will be a maximum of €694.44, with €194.44 withheld at source as IRS.

3Salary domiciled with a monthly amount equal to or greater than €750, electronic transfers with SALA code, duly coded at the origin.

Representative examples of integrated banking products and services solutions for Individual Customers

4The Prestige Program has a monthly package account maintenance fee, charged at the beginning of the month following the reference month, amounting to €5 or €6 plus Stamp Duty, depending on the client's age and financial engagement with the Bank. Otherwise, the fee is €15 plus Stamp Duty (maximum annual amount of €187.20, including Stamp Duty). Access to the lowest price tier (€5) requires subscription to the digital documents service.

5The Frequent Customer solution has a monthly package account maintenance fee, charged at the beginning of the month following the reference month, amounting to €5 or €6 plus Stamp Duty, depending on the Client's financial engagement with the Bank and subscription to the digital statement service. Otherwise, the monthly package account maintenance fee will be €8 plus Stamp Duty (maximum annual amount of €99.84, including Stamp Duty). Additional charges may apply for the use of associated products and services.

Home Loan Solutions

6For the first 2 years, Millennium will not charge interest corresponding to the contracted spread on new home loans approved by 31/03/2026 and signed by 30/04/2026, provided that a Millennium current account is maintained. This offer includes optional bundled products and cannot be combined with other ongoing promotions.

- If you are 18-35 years old and purchasing your primary residence, you will be exempt from all initial fees, including:

- Dossier Fee: €290 + Stamp Duty

- Formalization Fee: €200 + Stamp Duty

- Appraisal Fee: €230 + Stamp Duty

- Total Exemption Value: €748.80

Requires the following products

-

Domiciliation of salary of €1,000/month in the account associated with the loan;

-

Meet additionally three of the five listed requirements products services:

-

Credit card with transactions in payments for purchases and services with a minimum usage of €250/month with semi-annual control of the accumulated amount - TAEG 15.7%4;

-

Consumer credit ALD or Auto Leasing with a minimum outstanding balance of €1,500;

-

Domiciliation of 2 monthly payments in the account associated with the financing for utility payments electricity water gas communications;

-

Life insurance associated with the credit with Ocidental Vida8;

-

5. Multi-risk home insurance associated with the credit marketed by Ageas Portugal under the Ocidental8 brand with active policies registered to the loan.

Representative Examples Home Loan

PURCHASE / CONSTRUCTION

TAEG 4.4% | TAEG 3.5% with optional associated sales

With optional associated sales:

-

Spread 0% during the first 2 years

-

Spread 0.65% thereafter

-

Rates Variable Mixed Fixed rate during the first 2 3 or 5 years followed by a variable rate indexed to Euribor Fixed Rate from 5 to 30 years

-

Reduction of Fees

-

Dossier Fee €145 + IS without reduction €290 + IS

-

Formalization Fee €100 + IS without reduction €200 + IS

-

Total reduction amount €254.80

And if you are between 18 and 35 years old you also get an exemption from all initial fees if you are purchasing your primary residence:

-

Dossier Fee €290 + IS

-

Formalization Fee €200 + IS

-

Evaluation Fee €230 + IS

-

Total exemption amount €748.80

Example for a 30-year-old consumer financing €150,000 with a property valuation of €187,500 over a 30-year term for the purpose of purchase with contract expenses of €501.40 stamp duty on credit use of €900; Mortgage Cancellation Fees: €101.09 and home insurance of €20.01/month.

TAEG without optional associated sales 4.4% - variable TAN of 3.745% (Euribor 12 months of January, 2026 of 2.245% and base spread of 1.50%); Initial Fees (Dossier, Setup and Valuation Fees) €748.80. Monthly Life Insurance Premium of €20.50; 360 monthly payments of €694.25; Total amount charged to the consumer of €266,765.77.

TAEG with optional associated sales 3.5% - variable TAN of 2.895% (Euribor 12 months of January, 2025 of 2.245% and base spread of 0.65%. Inicial Fees (Dossier, Formalization and Evaluation Fee) of €494.00. Monthly Life Insurance Premium of €19.47; 360 monthly payments of €623.94; Total amount charged to the consumer of €240,827.64.

Requires holding the following products:

-

Salary domiciliation of €1,000 in the account associated with the loan;

-

Domiciliation of 2 monthly payments for water gas electricity or communications;

-

Home insurance associated with the loan marketed by Ageas Portugal under the Ocidental8 brand;

-

Life insurance associated with the loan under Ocidental Vida8.

Mortgage is granted by Banco Comercial Português, S.A., without credit intermediation, and is guaranteed by a mortgage on the real estate property. Subject to Banco de Portugal's macro-prudential rules. The interest rate applied (TAN) may be negative depending on the evolution of the respective index.

Conditions valid for proposals approved until 31/03/2026 and signed until 30/04/2026.

All mentioned fees are subject to Stamp Duty.

All mentioned fees are subject to Stamp Duty.

7Classic Credit Card: TAEG 15.7% and TAN 13.600% for a credit limit of 1,500€ paid over 12 equal monthly repayments, plus interest and charges. Annual fee 10.40€, charged in advance. First charge in the month of card issuance and, in subsequent years, in the same month. Stamp duty included. Subject to credit risk assessment.

8Insurance

There are exclusions provided for in the policy.

Advertising. This information does not waive the consultation of the legally required pre-contractual and contractual information.

Banco Comercial Português, S.A. - Registered Office: Praça D. João I, nº 28, 4000-295 Porto - Share Capital 3,000,000,000.00 Euros - Single registration and TIN 501525882. Insurance agent, registered under nr. 419527602, with the Insurance and Pension Funds Supervision Authority - Registration Date: 21/01/2019. Authorization for the brokerage distribution of the life and non-life insurance. For information and further registration details, please consult: www.asf.com.pt. The Insurance Intermediary is not authorized to sign insurance contracts on behalf of the Insurer or receive any insurance premiums payable to the Insurer.

Insurer

Life Protection:

Ocidental - Companhia Portuguesa de Seguros de Vida, Public limited company, with head office at Praça Príncipe Perfeito n.º 2, 1990-278 Lisbon. Legal Person No. 501836926. Lisbon Trade Register. Share Capital of 22.375.000 Euros. Registration ASF 1024, www.asf.com.pt.

Ocidental - Companhia Portuguesa de Seguros de Vida, Public limited company, with head office at Praça Príncipe Perfeito n.º 2, 1990-278 Lisbon. Legal Person No. 501836926. Lisbon Trade Register. Share Capital of 22.375.000 Euros. Registration ASF 1024, www.asf.com.pt.

Non-Life Risk Insurance:

Ageas Portugal - Companhia de Seguros, Public limited company, with head office at Praça Príncipe Perfeito n.º 2, 1990-278 Lisboa. Legal Person No. 503454109. Porto Trade Register. Share Capital of 7.500.000 Euros. Registration ASF 1129, www.asf.com.pt.

Ageas Portugal - Companhia de Seguros, Public limited company, with head office at Praça Príncipe Perfeito n.º 2, 1990-278 Lisboa. Legal Person No. 503454109. Porto Trade Register. Share Capital of 7.500.000 Euros. Registration ASF 1129, www.asf.com.pt.

Médis - exclusive and registered trademark of the products managed by Médis - Companhia Portuguesa de Seguros de Saúde, S.A., insurer, reinsurer and manager of the integrated health care system underlying the insurance policies issued by Ocidental or by other insurers under its authorization.

9Cashback

The 1% cashback is limited to a maximum of €400/month in purchases made using the Visa network, with a maximum cashback of €4/month. This offer is valid for purchases made between January 1st, 2025, and December 31st, 2026, using a Millennium credit card.

To access this cashback, users must register via the banner available in the Millennium App. You must be an app user to tap the banner and activate cashback on your credit card.

The cashback credit is applied to the card account in the month following the purchases. Cashback credits will not be made to card accounts that are in default or without any active card. Purchases made using MB Way and digital wallet top-ups do not qualify for cashback.

This campaign can be combined with other ongoing credit card acquisition campaigns.

The preferential conditions of the Plano Mais Colaborador are subject to quarterly review and modification, in accordance with the information available under Accounts > Work > Plano Mais Colaborador. This does not preclude Millennium bcp from reviewing the plan whenever there are changes in general market conditions, the Bank's pricing policy, or any legal or regulatory provisions to which the Bank is subject.

The Bank reserves the right to withdraw the Plano Mais Colaborador, which will result in the termination of the associated preferential product conditions for all beneficiaries, without prejudice to the effects of preferential conditions applied before that date. Discounts on the current Price List are not cumulative with any other preferential conditions in effect.

A salary is considered domiciled when it is a bank transfer credit of at least €350, properly coded at the source with the ISO code "SALA", into a current account held by the customer at Millennium bcp.