- Individuals

- Insurance

Homin Home Insurance

Prepare for shaky times

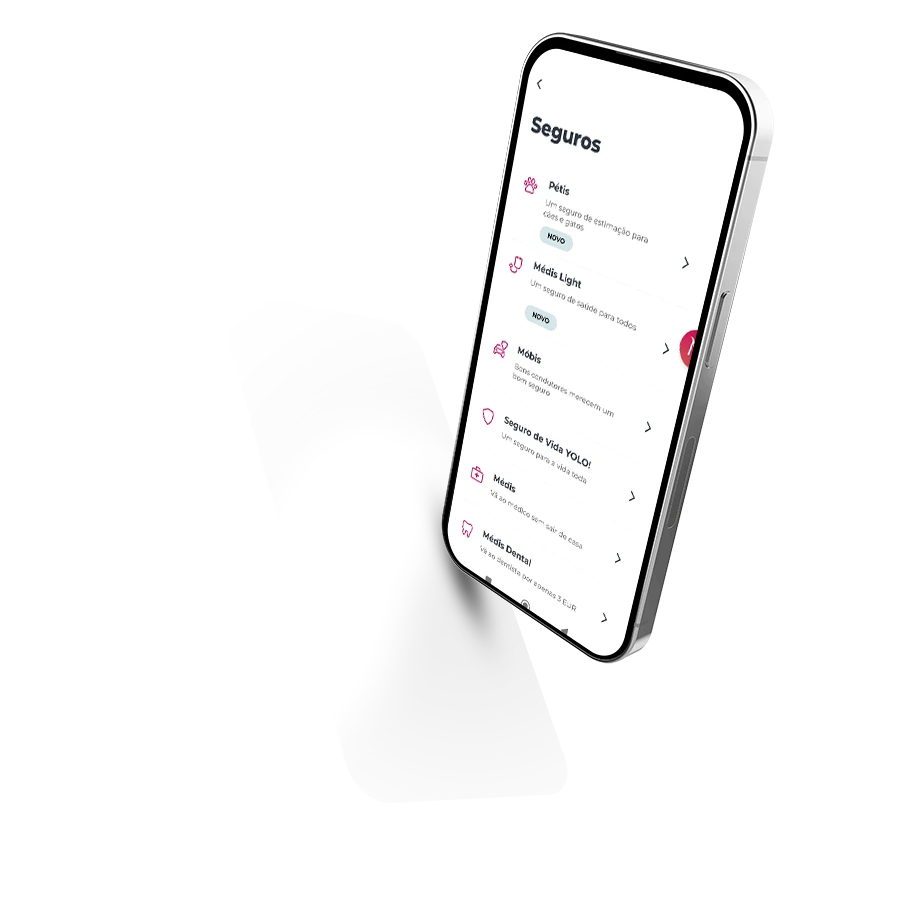

Our insurances

I want protection...

Health insurance

Insurance for all ages and preferences, always putting your health first

Online Doctor, available 24/7

Médis Network, with more than 13,000 doctors and 8,000 health clinics

Móbis car insurance

Tailored to you and your car

Travel assistance

3 levels of protection to choose from

Life insurance

To live with peace of mind

Options for all ages, from 18 to 75 years old

Adapted to the various stages of your life

FROM

1.25

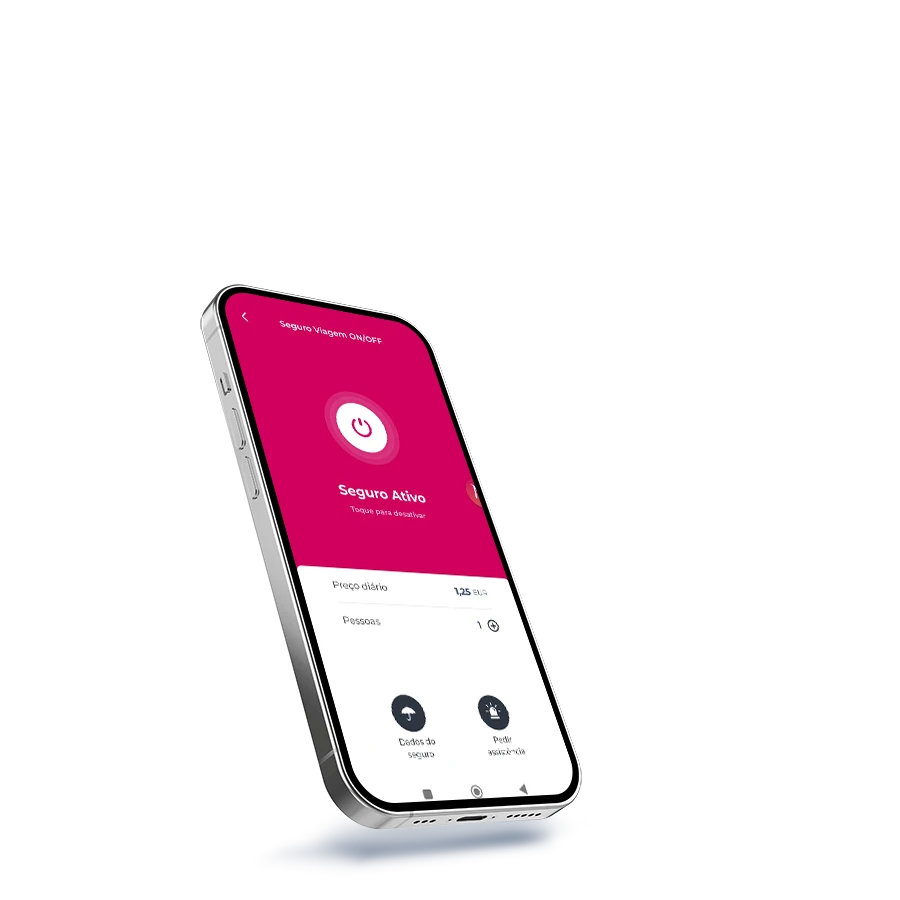

Travel insurance

Stay safe while you travel

ON/OFF insurance, from €1.25/day, valid abroad

Travel Protection, with coverage in Portugal and abroad

Personal accidents insurance

To stay protected every day

Volta insurance: subscriptions for ages 0 to 69

Volta 55+ insurance for those over 55 years old

HOMIN home insurance

Protect your home with complete coverage

Seismic coverage

3 packages with different levels of protection to choose from

Pétis pet insurance

Protection for your furry friend

Veterinary and medication care

You can choose your vet or any vet in Portugal

Domestic Workers Protection

A work accident insurance that protects those who care for your home

Ensures compensation payment to the worker

Access to hospitals, clinics, doctors, and a lot more

Payment Protection Insurance

Ensure your payments

For personal loans, mortgage and salary

Easy to subscribe

Repatriation Insurance De Cá para Lá

Transport or repatriation in case of an accident, serious illness, or death

Capital of €30,000

Can include other household members

Frequently asked questions

Questions? We'll help

The primary insured individual is typically the insurance holder. If the policyholder is also covered by the insurance, they serve as both the policyholder and the insured holder.

The primary insured individual is typically the insurance holder. If the policyholder is also covered by the insurance, they serve as both the policyholder and the insured holder.

The policyholder is the person who takes out the policy and is responsible for payment. They may or may not be insured.

The policyholder is the person who takes out the policy and is responsible for payment. They may or may not be insured.

This is the time you have to wait to use your insurance coverage. It does not apply in the event of an accident.

This is the time you have to wait to use your insurance coverage. It does not apply in the event of an accident.

Frequently asked questions

Questions? We'll help

The primary insured individual is typically the insurance holder. If the policyholder is also covered by the insurance, they serve as both the policyholder and the insured holder.

The primary insured individual is typically the insurance holder. If the policyholder is also covered by the insurance, they serve as both the policyholder and the insured holder.

The policyholder is the person who takes out the policy and is responsible for payment. They may or may not be insured.

The policyholder is the person who takes out the policy and is responsible for payment. They may or may not be insured.

This is the time you have to wait to use your insurance coverage. It does not apply in the event of an accident.

This is the time you have to wait to use your insurance coverage. It does not apply in the event of an accident.

Legal documents and other information

Policy for the Treatment of Insurance Holders, Insured Persons, Beneficiaries, or Injured Third Parties

DownloadNeed help?

We are here for you

Need help?

Need help?

Looking for a branch?

Looking for a branch?

Need to call us?

Need to call us?