- Individuals

- Investments

Investments

There’s a world of investments to discover

Articles, tips and a lot more

Everything you need to invest

Articles, tips and a lot more

Everything you need to invest

Explore our offer

Find your best investment fit

Millennium certificates

ETF

Structured deposits

Retirement plans

Stocks

Warrants

Financial insurance

Investment funds

Bonds

Explore our offer

Find your best investment fit

Retirement plans

Millennium certificates

ETF

Structured deposits

Stocks

Investment funds

Warrants

Financial insurance

Bonds

Explore our offer

Find your best investment fit

Millennium certificates

Retirement plans

Investment funds

ETF

Structured deposits

Stocks

Warrants

Financial insurance

Bonds

MTrader

Stock market trading in your hands

MTraderMTrader

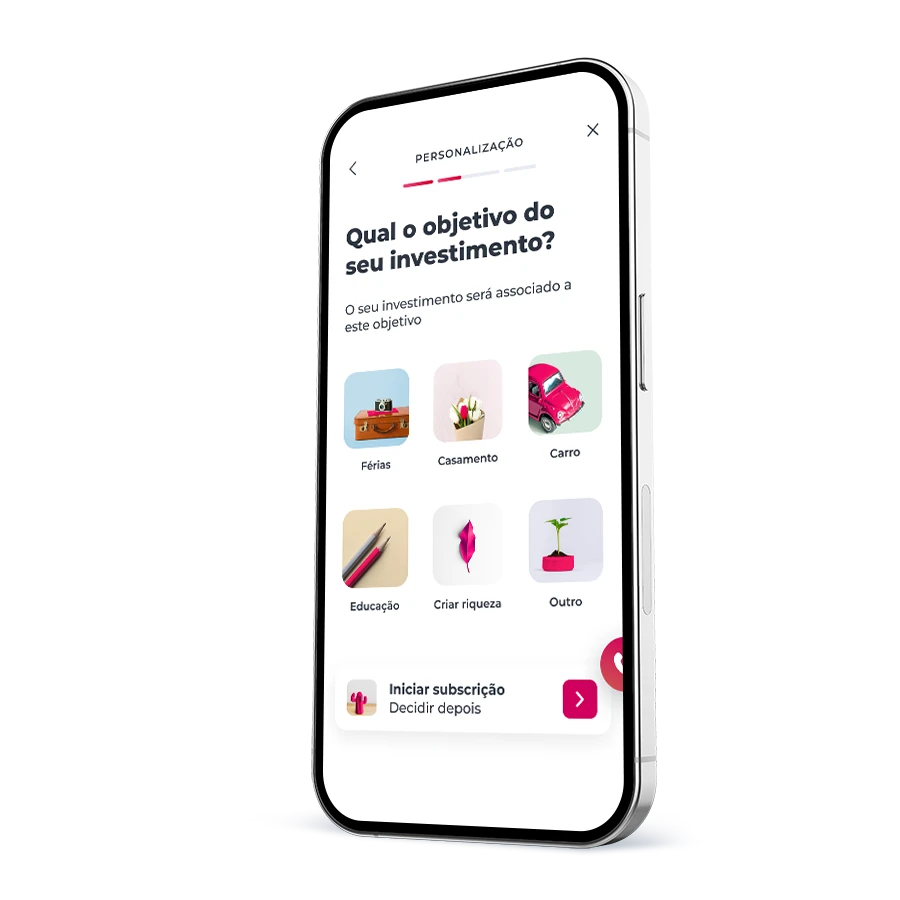

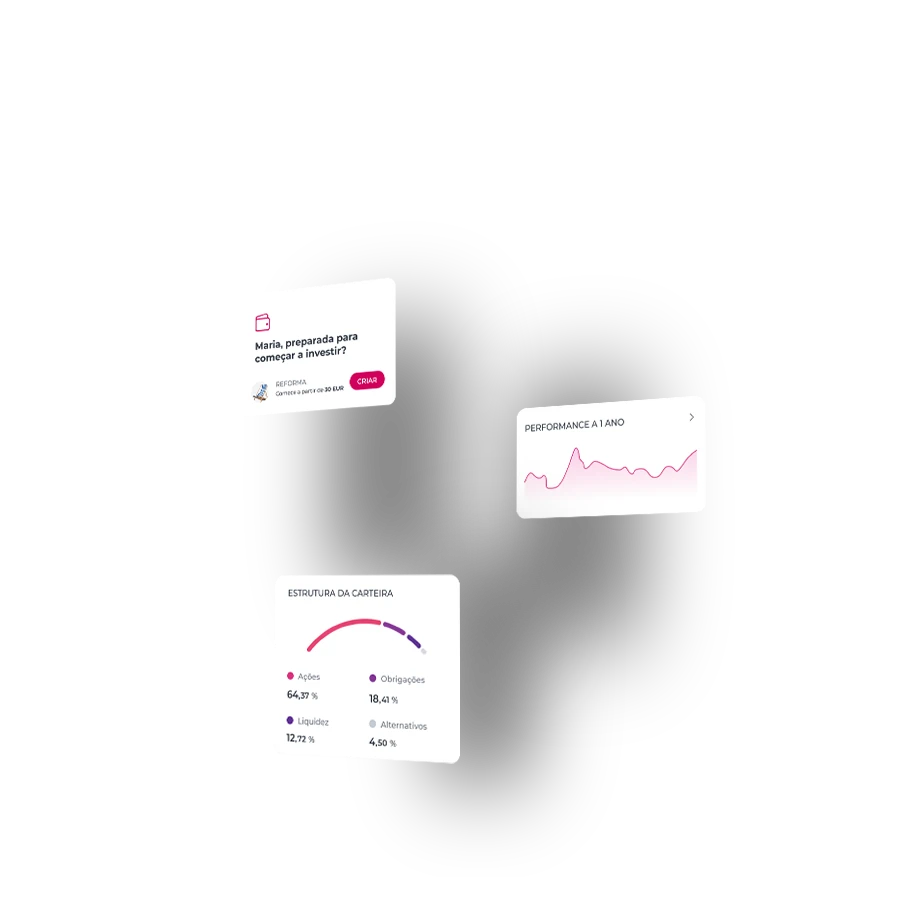

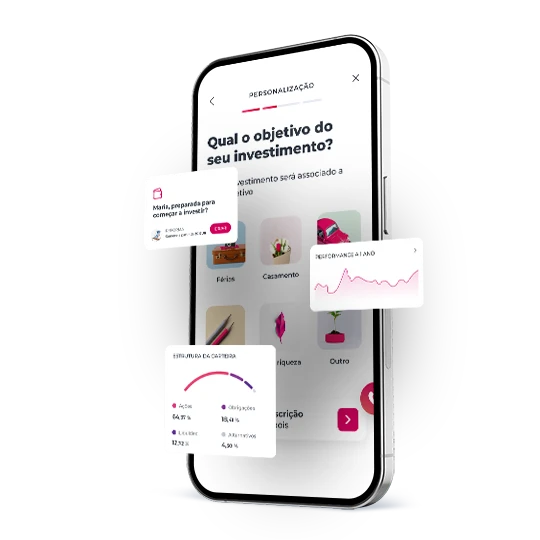

Easy Invest

Invest on auto-pilot with the Millennium App

Easy InvestEasy Invest

Explore our offer

Find your best investment fit

ETF

Retirement plans

Investment funds

Financial insurance

Warrants

Stocks

Millennium certificates

Bonds

Explore our offer

Find your best investment fit

Investment funds

ETF

Retirement plans

Financial insurance

Warrants

Millennium certificates

Stocks

Bonds

Explore our offer

Find your best investment fit

ETF

Investment funds

Millennium certificates

Retirement plans

Financial insurance

Warrants

Stocks

Bonds

MTrader

Stock market trading in your hands

MTraderMTrader

Easy Invest

Invest on auto-pilot with the Millennium App

Easy InvestEasy Invest

Articles, tips and a lot more

Everything you need to invest

Articles, tips and a lot more

Everything you need to invest

Explore our offer

Find your best investment fit

Millennium certificates

ETF

Stocks

Financial insurance

Warrants

Retirement plans

Investment funds

Bonds

Explore our offer

Find your best investment fit

Stocks

Millennium certificates

ETF

Financial insurance

Warrants

Investment funds

Retirement plans

Bonds

Explore our offer

Find your best investment fit

Millennium certificates

Stocks

Investment funds

ETF

Financial insurance

Warrants

Retirement plans

Bonds

MTrader

Stock market trading in your hands

MTraderMTrader

Easy Invest

Invest on auto-pilot with the Millennium App

Easy InvestEasy Invest

Articles, tips and a lot more

Everything you need to invest

Articles, tips and a lot more

Everything you need to invest

I need a...

Investment manager

I need a...

Investment manager

Frequently asked questions

Questions? We'll help

The investor profile is a combination of characteristics, financial goals, risk tolerance, and knowledge of an investor. It is an assessment to understand the behavior and preferences of an investor in order to make more suitable investment decisions.

The investor profile is a combination of characteristics, financial goals, risk tolerance, and knowledge of an investor. It is an assessment to understand the behavior and preferences of an investor in order to make more suitable investment decisions.

Risk refers to the potential for an investment to not meet the investor's expectations or goals. High-risk investments are more prone to financial losses. These investments are often associated with variable income and may not provide guarantees of returns or capital preservation.

Risk refers to the potential for an investment to not meet the investor's expectations or goals. High-risk investments are more prone to financial losses. These investments are often associated with variable income and may not provide guarantees of returns or capital preservation.

Liquidity refers to the ease and speed at which an investment can be converted into cash without significant loss in value. Highly liquid investments, such as stocks traded on the stock market, can be easily bought or sold, allowing investors to access their funds quickly.

Profitability refers to the financial gain, usually as a percentage, that an investor earns on their invested capital. It measures the returns generated by an investment over a specific period and is influenced by various factors, including market conditions, economic conditions, the quality of investment management, and the associated risks.

Liquidity refers to the ease and speed at which an investment can be converted into cash without significant loss in value. Highly liquid investments, such as stocks traded on the stock market, can be easily bought or sold, allowing investors to access their funds quickly.

Profitability refers to the financial gain, usually as a percentage, that an investor earns on their invested capital. It measures the returns generated by an investment over a specific period and is influenced by various factors, including market conditions, economic conditions, the quality of investment management, and the associated risks.

The portfolio is built and managed according to the investor's goals and strategy. Diversification of securities is one of the most effective ways to achieve a balance between risk and profitability.

The portfolio is built and managed according to the investor's goals and strategy. Diversification of securities is one of the most effective ways to achieve a balance between risk and profitability.

You need to complete the questionnaire to be able to invest. This allows us to prevent you from buying a product that you do not understand or are unaware of its associated risks.

You need to complete the questionnaire to be able to invest. This allows us to prevent you from buying a product that you do not understand or are unaware of its associated risks.

Frequently asked questions

Questions? We'll help

The investor profile is a combination of characteristics, financial goals, risk tolerance, and knowledge of an investor. It is an assessment to understand the behavior and preferences of an investor in order to make more suitable investment decisions.

The investor profile is a combination of characteristics, financial goals, risk tolerance, and knowledge of an investor. It is an assessment to understand the behavior and preferences of an investor in order to make more suitable investment decisions.

Risk refers to the potential for an investment to not meet the investor's expectations or goals. High-risk investments are more prone to financial losses. These investments are often associated with variable income and may not provide guarantees of returns or capital preservation.

Risk refers to the potential for an investment to not meet the investor's expectations or goals. High-risk investments are more prone to financial losses. These investments are often associated with variable income and may not provide guarantees of returns or capital preservation.

Liquidity refers to the ease and speed at which an investment can be converted into cash without significant loss in value. Highly liquid investments, such as stocks traded on the stock market, can be easily bought or sold, allowing investors to access their funds quickly.

Profitability refers to the financial gain, usually as a percentage, that an investor earns on their invested capital. It measures the returns generated by an investment over a specific period and is influenced by various factors, including market conditions, economic conditions, the quality of investment management, and the associated risks.

Liquidity refers to the ease and speed at which an investment can be converted into cash without significant loss in value. Highly liquid investments, such as stocks traded on the stock market, can be easily bought or sold, allowing investors to access their funds quickly.

Profitability refers to the financial gain, usually as a percentage, that an investor earns on their invested capital. It measures the returns generated by an investment over a specific period and is influenced by various factors, including market conditions, economic conditions, the quality of investment management, and the associated risks.

The portfolio is built and managed according to the investor's goals and strategy. Diversification of securities is one of the most effective ways to achieve a balance between risk and profitability.

The portfolio is built and managed according to the investor's goals and strategy. Diversification of securities is one of the most effective ways to achieve a balance between risk and profitability.

You need to complete the questionnaire to be able to invest. This allows us to prevent you from buying a product that you do not understand or are unaware of its associated risks.

You need to complete the questionnaire to be able to invest. This allows us to prevent you from buying a product that you do not understand or are unaware of its associated risks.

Need help?

We are here for you

Need help?

Need help?

Looking for a branch?

Looking for a branch?

Need to call us?

Need to call us?