- Individuals

- Loans

- Car loan

Auto Loan and other vehicles

I'm looking for a…

Used Vehicle Loan Online TAEG 11.0%

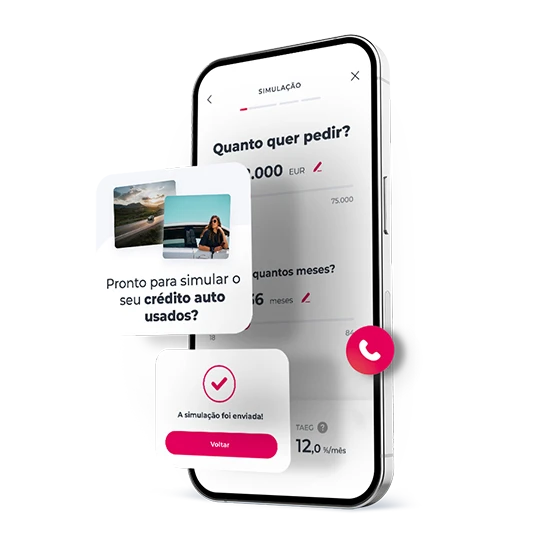

Unlock the road to your used car

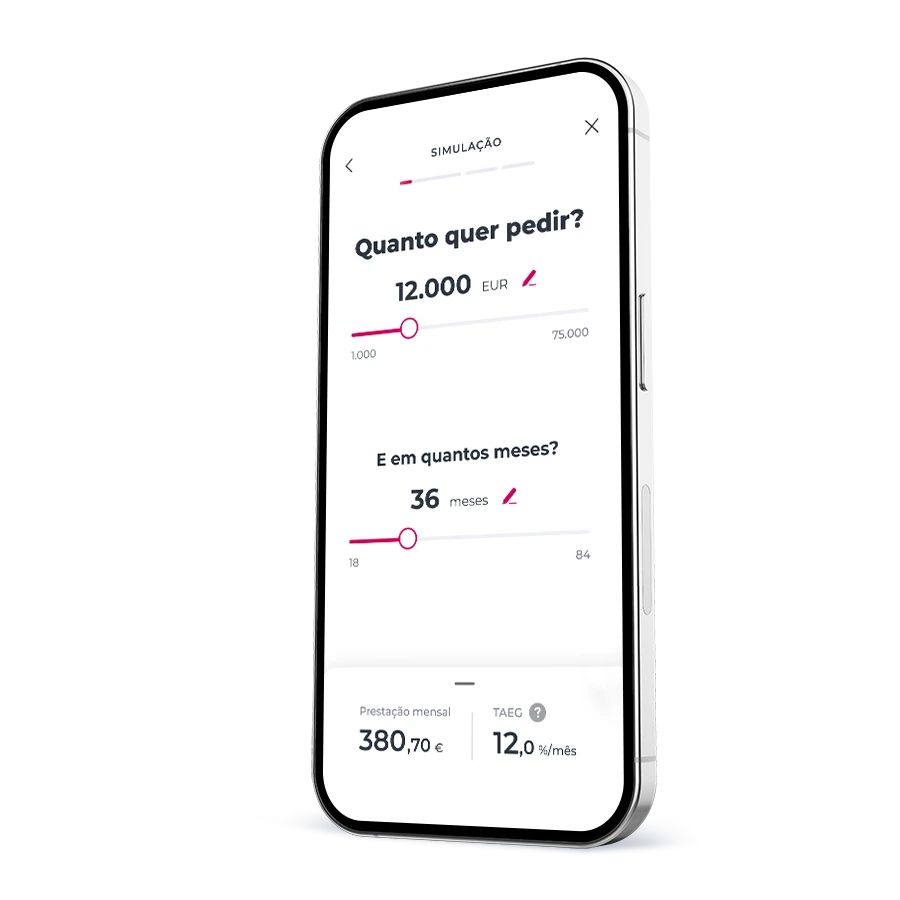

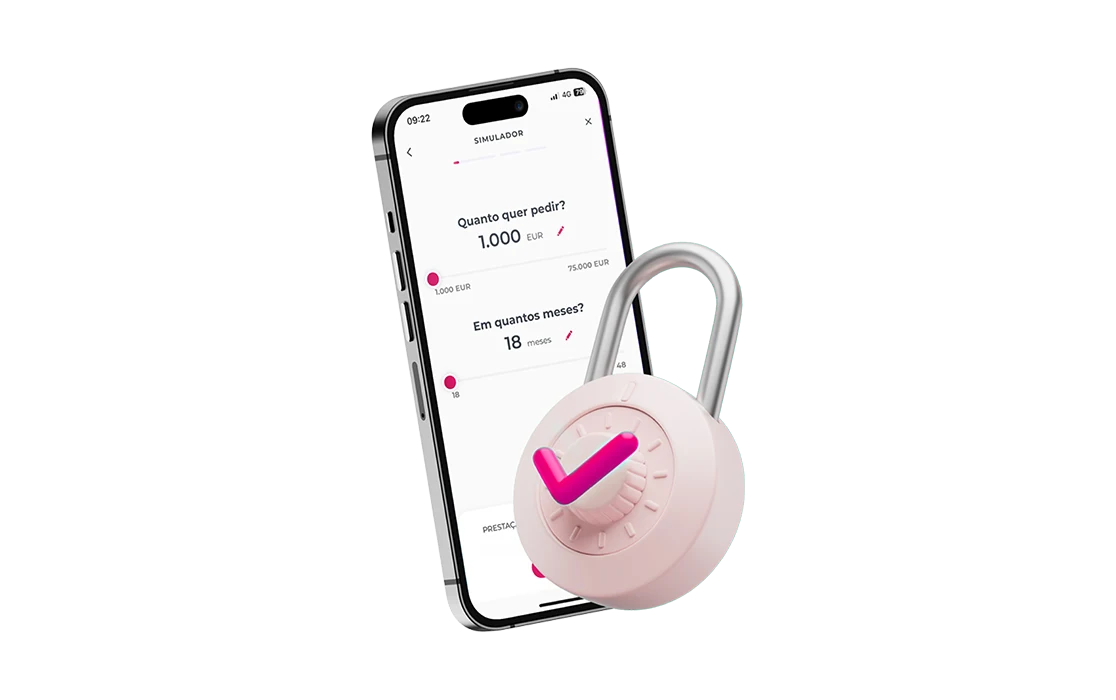

100% online

Apply for your loan online with no paperwork

Between 24 and 84 months

Between 24 and 84 months without down payment

100% online

Apply for your loan online with no paperwork

Between 24 and 84 months

Between 24 and 84 months without down payment

Used Vehicle Loan Online TAEG 11.0%

Unlock the road to your used car

100% online

Between 24 and 84 months

New vehicle loan TAEG 9.2%

Hit the road with a new vehicle

Up to 100% of the purchase amount

Between 24 and 120 months

Used vehicle Loan TAEG 10.2%

Sometimes a used vehicle is the best find

Up to 100% of the purchase amount

Between 24 and 120 months

Leasing (Used Cars) TAEG 6.3%

Your used car with lower rates

Flexible conditions

Between 12 and 84 months

Leasing (New Cars) TAEG 5.0%

Your new car with lower rates

Flexible conditions

Between 12 and 120 months

Renting

Get a new car without having to buy it

Fixed rent

Services included

Compare cards

Insurance, responsability, and more

We're here to help with your loan

We ensure your monthly loan payments

New

With the Personal Loan Life Insurance

Learn what happens in case of credit agreement default

New

Learn how the financial follow-up works

New

With the Móbis Car Insurance

Want to apply for a car loan?

Before making a decision...

Frequently asked questions

Questions? We'll help

The minimum is €3,000 and the maximum is €25,000.

The minimum is €3,000 and the maximum is €25,000.

Terms vary between 12 and 48 months for amounts up to €3,000 and between 12 and 84 months for amounts over €3,000.

Terms vary between 12 and 48 months for amounts up to €3,000 and between 12 and 84 months for amounts over €3,000.

Yes, early repayment can be arranged with a notice period of 30 days. There's a fee associated with early repayment, and it's calculated as outlined below:

Option a) - If the period between early repayment and the contract's stipulated expiry date is more than one year, the fee is 0.5% of the advanced capital amount.

Option b) - If the period between early repayment and the contract's stipulated expiry date is one year or less, the fee is 0.25% of the advanced capital amount.

Option c) - The fee under options (a) and (b) won't exceed the interest amount payable under the contract during the period from early repayment until the scheduled end of the contract's fixed-rate period, if applicable.

Yes, early repayment can be arranged with a notice period of 30 days. There's a fee associated with early repayment, and it's calculated as outlined below:

Option a) - If the period between early repayment and the contract's stipulated expiry date is more than one year, the fee is 0.5% of the advanced capital amount.

Option b) - If the period between early repayment and the contract's stipulated expiry date is one year or less, the fee is 0.25% of the advanced capital amount.

Option c) - The fee under options (a) and (b) won't exceed the interest amount payable under the contract during the period from early repayment until the scheduled end of the contract's fixed-rate period, if applicable.

Yes, Stamp Duty applies on the opening of the loan, on the interest and on the associated fees (e.g. Formalization fee).

Yes, Stamp Duty applies on the opening of the loan, on the interest and on the associated fees (e.g. Formalization fee).

These are capital and interest payments that remain the same throughout the term of the loan, assuming that there are no changes in the interest rate or the capital owed during the term.

These are capital and interest payments that remain the same throughout the term of the loan, assuming that there are no changes in the interest rate or the capital owed during the term.

Frequently asked questions

Questions? We'll help

The minimum is €3,000 and the maximum is €25,000.

The minimum is €3,000 and the maximum is €25,000.

Terms vary between 12 and 48 months for amounts up to €3,000 and between 12 and 84 months for amounts over €3,000.

Terms vary between 12 and 48 months for amounts up to €3,000 and between 12 and 84 months for amounts over €3,000.

Yes, early repayment can be arranged with a notice period of 30 days. There's a fee associated with early repayment, and it's calculated as outlined below:

Option a) - If the period between early repayment and the contract's stipulated expiry date is more than one year, the fee is 0.5% of the advanced capital amount.

Option b) - If the period between early repayment and the contract's stipulated expiry date is one year or less, the fee is 0.25% of the advanced capital amount.

Option c) - The fee under options (a) and (b) won't exceed the interest amount payable under the contract during the period from early repayment until the scheduled end of the contract's fixed-rate period, if applicable.

Yes, early repayment can be arranged with a notice period of 30 days. There's a fee associated with early repayment, and it's calculated as outlined below:

Option a) - If the period between early repayment and the contract's stipulated expiry date is more than one year, the fee is 0.5% of the advanced capital amount.

Option b) - If the period between early repayment and the contract's stipulated expiry date is one year or less, the fee is 0.25% of the advanced capital amount.

Option c) - The fee under options (a) and (b) won't exceed the interest amount payable under the contract during the period from early repayment until the scheduled end of the contract's fixed-rate period, if applicable.

Yes, Stamp Duty applies on the opening of the loan, on the interest and on the associated fees (e.g. Formalization fee).

Yes, Stamp Duty applies on the opening of the loan, on the interest and on the associated fees (e.g. Formalization fee).

These are capital and interest payments that remain the same throughout the term of the loan, assuming that there are no changes in the interest rate or the capital owed during the term.

These are capital and interest payments that remain the same throughout the term of the loan, assuming that there are no changes in the interest rate or the capital owed during the term.

Need help?

We are here for you

Need help?

Need help?

Looking for a branch?

Looking for a branch?

Need to call us?

Need to call us?