- Individuals

- Accounts

- Current account

- Minimum Banking Services account

Minimum Banking Services Account

For those looking for minimum services at a reduced cost

Branch only

Quick access to your account

View more

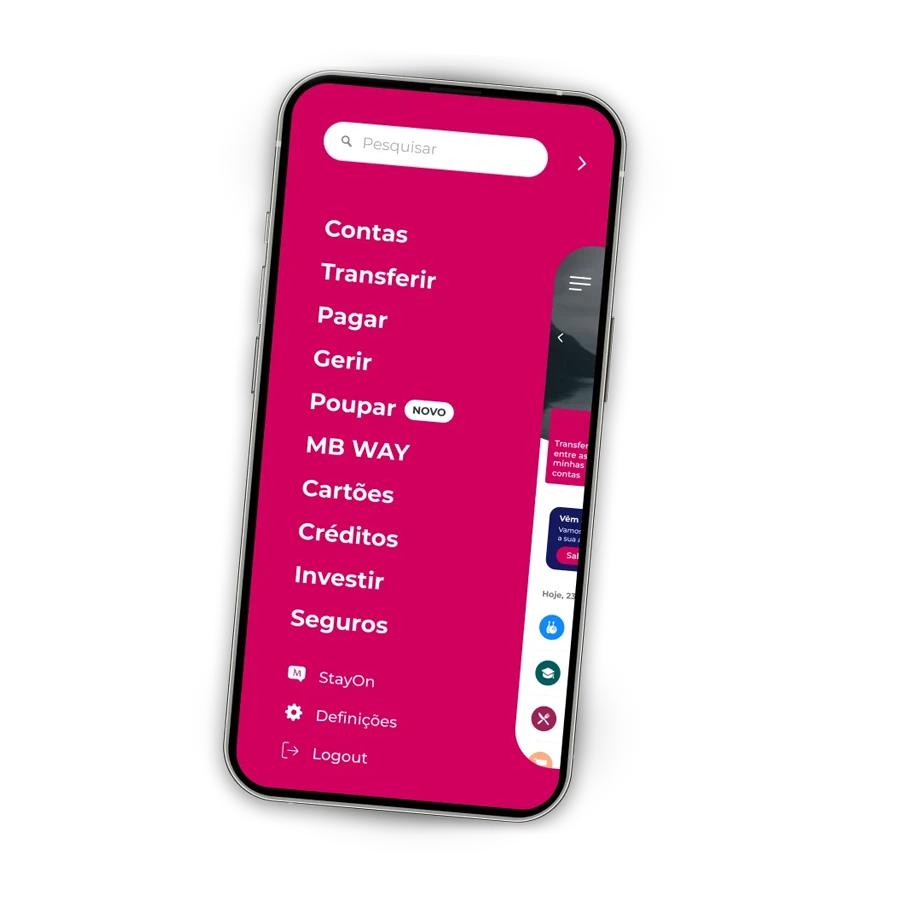

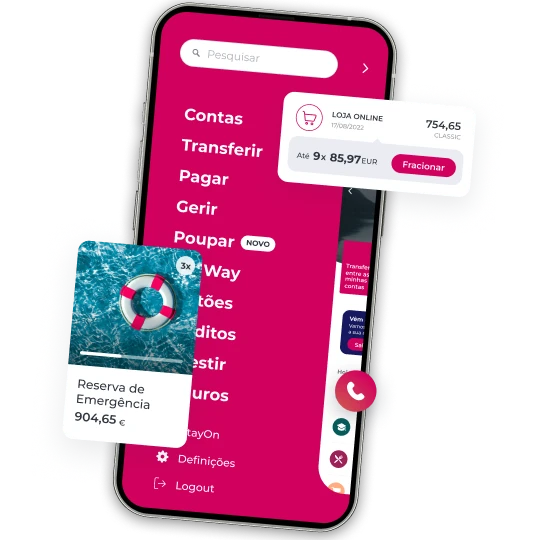

Through the ATM, app, website, and Millennium branches.

Fixed annual fee that allows deposits, withdrawals, payments of goods and services and direct debits.

All the benefits

What’s included?

Intra-bank transfers free of charge through the app or website

View more

If you want to transfer to an account at another bank, you can do so free of charge at an ATM. In the app or website, you have a limit of 48 interbank transfers per year.

1 debit card for one account holder

View more

With contactless technology, enabling hassle-free payments without the need to insert your card into the reader.

All the benefits

What’s included?

Quick access to your account

View more

Through the ATM, app, website, and Millennium branches.

Fixed annual fee that allows deposits, withdrawals, payments of goods and services and direct debits.

Intra-bank transfers free of charge through the app or website

View more

If you want to transfer to an account at another bank, you can do so free of charge at an ATM. In the app or website, you have a limit of 48 interbank transfers per year.

1 debit card for one account holder

View more

With contactless technology, enabling hassle-free payments without the need to insert your card into the reader.

All the benefits

What’s included?

Quick access to your account

View more

Through the ATM, app, website, and Millennium branches.

Fixed annual fee that allows deposits, withdrawals, payments of goods and services and direct debits.

Intra-bank transfers free of charge through the app or website

View more

If you want to transfer to an account at another bank, you can do so free of charge at an ATM. In the app or website, you have a limit of 48 interbank transfers per year.

1 debit card for one account holder

View more

With contactless technology, enabling hassle-free payments without the need to insert your card into the reader.

Monthly charges

This is how much you'll pay

Account maintenance fee

€ 0.34/month

€ 0.34/month

The Minimum Banking Services Account has a fixed annual fee of €4.20, which is charged monthly at the beginning of the following month to which it refers for €0.34. Stamp Duty of €0.01 is added monthly.

The amounts charged as costs, fees, charges or expenses will not exceed the equivalent of 1% of the social support index each year.

The amounts charged as costs, fees, charges or expenses will not exceed the equivalent of 1% of the social support index each year.

How it works

Your account conditions

You can have multiple account holders

You can’t have other current accounts in Portugal, with a few exceptions

Accounts and solutions

Want a more complete account? We've got it

Millennium account + Cliente Frequente

Millennium account + Cliente Frequente

An account with benefits for everyday life

An account with benefits for everyday life

Millennium Account + Prestige Direto

Millennium Account + Prestige Direto

A complete digital solution of products and services

A complete digital solution of products and services

Millennium Account + Programa Prestige

Millennium Account + Programa Prestige

Experience personalized financial management

Experience personalized financial management

Millennium Account + GO!

Millennium Account + GO!

Advantages for those between 18 and 30

Advantages for those between 18 and 30

Millennium account + GO! Universitário

Millennium account + GO! Universitário

If you're a college student this account is for you

If you're a college student this account is for you

Millennium account + Cliente Frequente

Millennium account + Cliente Frequente

An account with benefits for everyday life

An account with benefits for everyday life

Millennium Account + Prestige Direto

Millennium Account + Prestige Direto

A complete digital solution of products and services

A complete digital solution of products and services

Millennium Account + Programa Prestige

Millennium Account + Programa Prestige

Experience personalized financial management

Experience personalized financial management

Millennium Account + GO!

Millennium Account + GO!

Advantages for those between 18 and 30

Advantages for those between 18 and 30

Millennium account + GO! Universitário

Millennium account + GO! Universitário

If you're a college student this account is for you

If you're a college student this account is for you

1,2,3 and that’s it!

Opening an account is easy

Go to a Millennium branch

Go to a Millennium branch

and hand in the necessary documents from all the account holders.

and hand in the necessary documents from all the account holders.

Read and sign the documents

Read and sign the documents

to confirm the account opening request.

to confirm the account opening request.

And that's it!

And that's it!

What do you need?

What do you need?

To be at least 18 years old

To be at least 18 years old

To have a Citizen Card or Residency Authorization Card

To have a Citizen Card or Residency Authorization Card

Not having other current accounts

Not having other current accounts

To present the proof of employment and address (if applicable)

To present the proof of employment and address (if applicable)

1,2,3 and that’s it!

Opening an account is easy

Go to a Millennium branch

Go to a Millennium branch

and hand in the necessary documents from all the account holders.

and hand in the necessary documents from all the account holders.

Read and sign the documents

Read and sign the documents

to confirm the account opening request.

to confirm the account opening request.

And that's it!

And that's it!

What do you need?

What do you need?

To be at least 18 years old

To be at least 18 years old

To have a Citizen Card or Residency Authorization Card

To have a Citizen Card or Residency Authorization Card

Not having other current accounts

Not having other current accounts

To present the proof of employment and address (if applicable)

To present the proof of employment and address (if applicable)

Exceptions

An individual who holds other demand deposit accounts may hold a minimum banking services account with a person over 65 years of age or with a degree of permanent disability of 60% or more who does not hold other accounts.

An individual who holds a minimum banking services account with a person aged 65 years or older or with a degree of permanent disability of 60% or more may access a minimum banking services account individually if he or she has no other current accounts.

A customer who has been notified that his or her current deposit account will be closed may apply to open a minimum banking services account.

Exceptions

An individual who holds other demand deposit accounts may hold a minimum banking services account with a person over 65 years of age or with a degree of permanent disability of 60% or more who does not hold other accounts.

An individual who holds a minimum banking services account with a person aged 65 years or older or with a degree of permanent disability of 60% or more may access a minimum banking services account individually if he or she has no other current accounts.

A customer who has been notified that his or her current deposit account will be closed may apply to open a minimum banking services account.

Other banking services

Customers accessing the minimum banking services may contract other banking products or services not included in the set of minimum services, namely time deposits, savings accounts, interbank transfers (SEPA+ credit transfers and/or SEPA+ standing orders) carried out through the branches of credit institutions or through homebanking or through the institution's own apps (in this case, only if they exceed 48 operations per calendar year), or through payment applications operated by third parties (in this case, only if they exceed five operations per month, or if they are for an amount greater than 30 euros) or for accounts opened at institutions located outside the European Union, credit products, among others.

The products or services contracted that are not part of the minimum banking services are subject to the commissions and expenses provided for in the Bank's price list.

Minimum banking services accounts cannot have a negative balance. It is not allowed to contract overdraft facilities, nor is it tacitly allowed to move the account beyond its balance (credit overdraft) to Customers who access the minimum banking services. The prohibition on overdrafts does not apply to debit card transactions, in which case credit institutions may allow the minimum banking services account to be moved beyond its balance for certain debit card payments (e.g. toll payments).

Closing

Millennium bcp may close your minimum banking services account immediately if you:

- Have deliberately used the account for purposes contrary to law;

- Have provided incorrect information to obtain the minimum banking services account, when not fulfilling the respective access requirements.

Millennium bcp may close the minimum banking services account, effective 60 days after the closure communication, in the following situations:

- The minimum banking services account has not been operated (debit or credit) for at least 24 consecutive months;

- The Customer is no longer legally resident in the European Union;

- The Customer holds another demand deposit account with a credit institution in Portugal, which allows him/her to use the products and services included in the minimum banking services.

Account modification

If you already hold a sight deposit account, you may, at no cost, convert the sight deposit account directly into a minimum banking services account, or close the account and open a minimum banking services account at another credit institution.

Need help?

We are here for you

Need help?

Need help?

Here you can find the answer to all your questions

Here you can find the answer to all your questions

Looking for a branch?

Looking for a branch?

Find the nearest branch

Find the nearest branch

Need to call us?

Need to call us?

Call whenever you need to

Call whenever you need to

Need help?

Here you can find the answer to all your questions

Here you can find the answer to all your questions

Looking for a branch?

Find the nearest branch

Find the nearest branch

Need to call us?

Call whenever you need to

Call whenever you need to