- Individuals

- Loans

- Personal loan

- Online

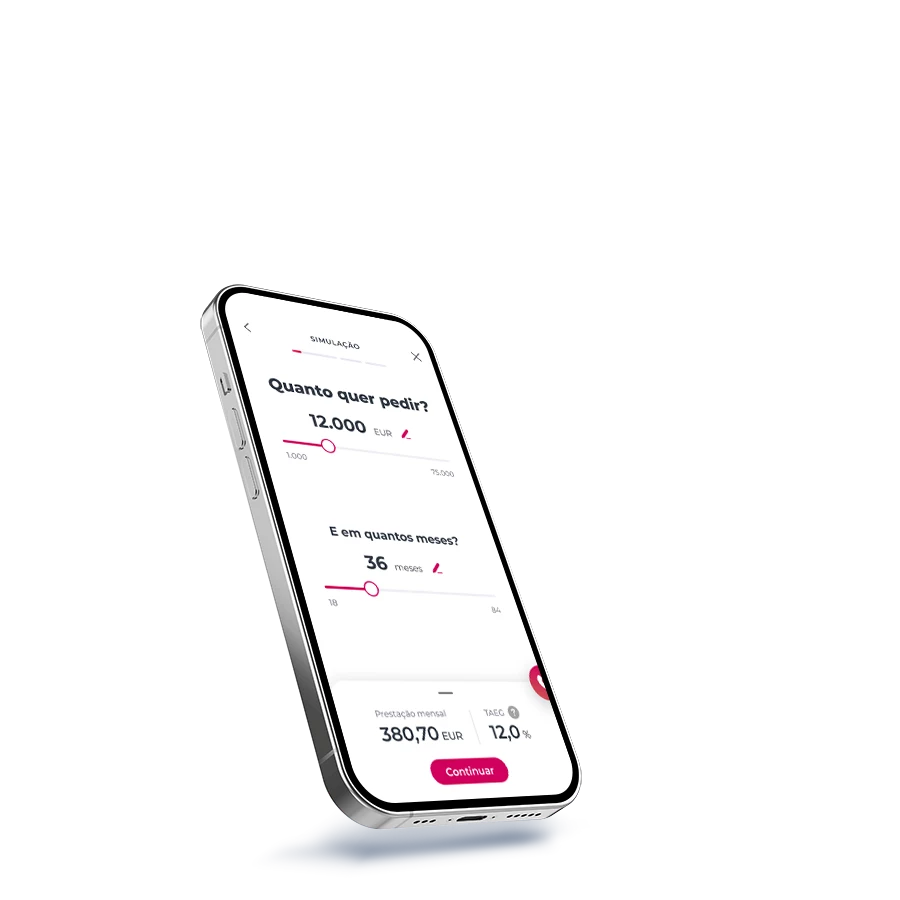

- Calculator

Calculate Online Personal Loan

Don't leave your 2026 plans for 2027

Main benefits

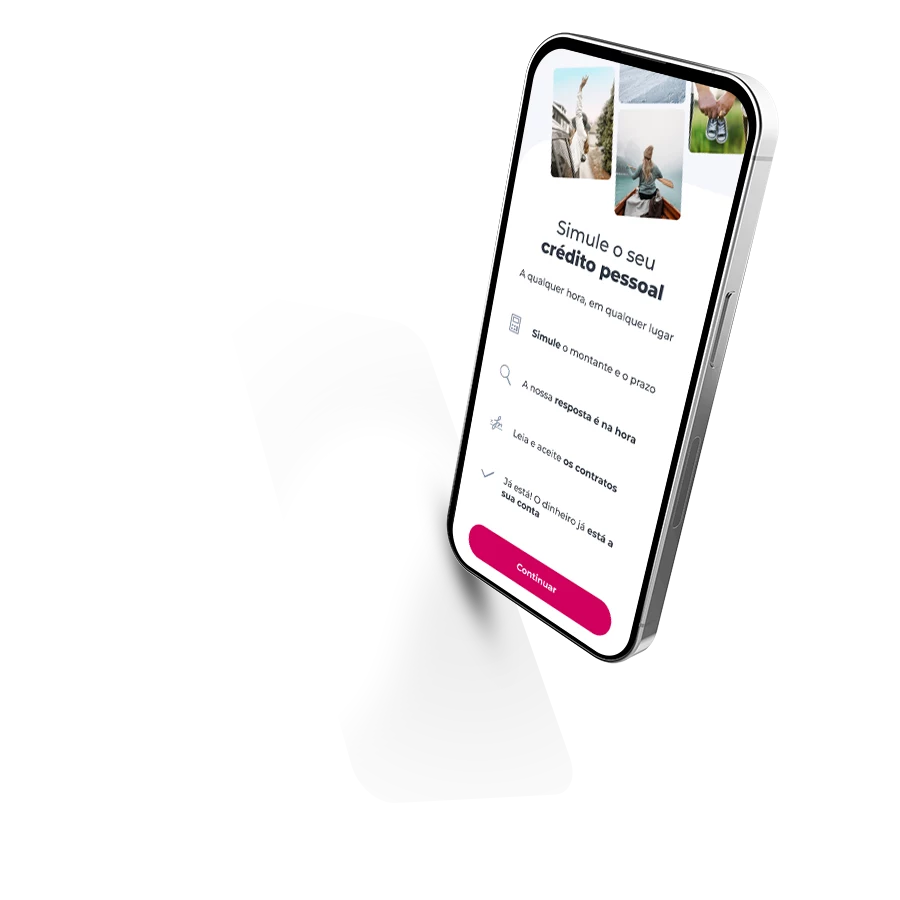

Here’s how it works

Money in your account

If your loan is approved, the money is deposited into your account immediately.

Money in your account

If your loan is approved, the money is deposited into your account immediately.

Instant decision

Get an instant response up to €25,000. No waiting, no bureaucracy.

Instant decision

Get an instant response up to €25,000. No waiting, no bureaucracy.

Instant decision

Get an instant response up to €25,000. No waiting, no bureaucracy.

Instant decision

Get an instant response up to €25,000. No waiting, no bureaucracy.

Money in your account

If your loan is approved, the money is deposited into your account immediately.

Money in your account

If your loan is approved, the money is deposited into your account immediately.

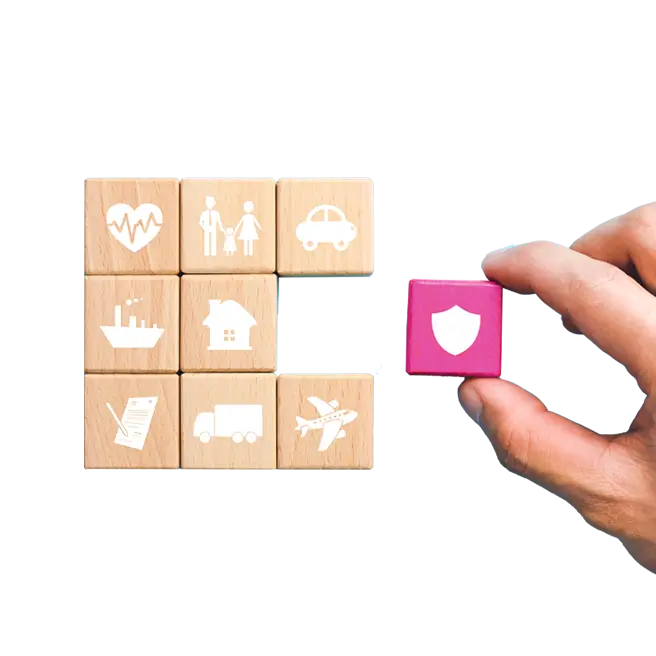

Personal loan add-ons

So you don't have to worry

80% of our Customers take out life insurance

New

We ensure your monthly loan payments

How to apply for an Online Personal Loan

It's simple and quick

How to apply for an Online Personal Loan

It's simple and quick

Apply for a personal loan

Before making a decision…

Frequently asked questions

Questions? We’ll help

Before applying for a loan, you should:

- Assess the need for the expense you are going to have.

- Consider the amount of the new loan together with your household's monthly income and expenses and make sure that the loan will not compromise your budget.

- Obtain all the information you consider relevant to making an informed decision before signing the contract.

- Read the pre-contractual information and the contract carefully and pay attention to the particular conditions of the loan, namely the amount, term, installments and rates.

Before applying for a loan, you should:

- Assess the need for the expense you are going to have.

- Consider the amount of the new loan together with your household's monthly income and expenses and make sure that the loan will not compromise your budget.

- Obtain all the information you consider relevant to making an informed decision before signing the contract.

- Read the pre-contractual information and the contract carefully and pay attention to the particular conditions of the loan, namely the amount, term, installments and rates.

When applying for a personal loan, the following documents may be requested:

- Last 3 payslips

- Latest tax return (with the applicant’s taxpayer number and validation code)

- ID documents of all parties involved (if the application is made at a branch)

- Certificate of regularized social contributions (mandatory for loans over €50,000)

- Additional documents depending on the purpose of the loan:

- Education - proof of enrollment/registration (showing the institution, course duration, and cost) and of the costs related to the course.

- Works/renovations -works estimate + proof of property ownership (Land Registry Certificate and Property Tax Record).

- Sustainable buildings – proof of eligible expenses.

- Automobile – proof of vehicle purchase (mandatory for terms over 84 months).

When applying for a personal loan, the following documents may be requested:

- Last 3 payslips

- Latest tax return (with the applicant’s taxpayer number and validation code)

- ID documents of all parties involved (if the application is made at a branch)

- Certificate of regularized social contributions (mandatory for loans over €50,000)

- Additional documents depending on the purpose of the loan:

- Education - proof of enrollment/registration (showing the institution, course duration, and cost) and of the costs related to the course.

- Works/renovations -works estimate + proof of property ownership (Land Registry Certificate and Property Tax Record).

- Sustainable buildings – proof of eligible expenses.

- Automobile – proof of vehicle purchase (mandatory for terms over 84 months).

The Nominal Annual Rate is the interest rate, expressed as a fixed or variable percentage, that is applied annually to the used loan amount.

The Nominal Annual Rate is the interest rate, expressed as a fixed or variable percentage, that is applied annually to the used loan amount.

The Annual Percentage Rate of Charge is the total cost of the loan to the consumer (as an annual percentage of the loan amount). It includes the loan and interest payments, as well as other mandatory charges (taxes, fees and interest).

The Annual Percentage Rate of Charge is the total cost of the loan to the consumer (as an annual percentage of the loan amount). It includes the loan and interest payments, as well as other mandatory charges (taxes, fees and interest).

It's the total amount you will pay for the loan, including the financed amount, interest, fees, taxes and charges.

It's the total amount you will pay for the loan, including the financed amount, interest, fees, taxes and charges.

You can apply for a loan anywhere, at any time. In these cases, the loan application is analyzed online. If approved, the personal loan is taken out online and the amount requested will be credited to the current account. Valid for clients with a risk profile suitable for the product. Decision subject to credit analysis.

You can apply for a loan anywhere, at any time. In these cases, the loan application is analyzed online. If approved, the personal loan is taken out online and the amount requested will be credited to the current account. Valid for clients with a risk profile suitable for the product. Decision subject to credit analysis.

No, you don’t need to open an account. You can pay your installments from an account with another Bank via direct debit. If you don’t have an account with us yet, schedule a call to apply for your loan.

No, you don’t need to open an account. You can pay your installments from an account with another Bank via direct debit. If you don’t have an account with us yet, schedule a call to apply for your loan.

Frequently asked questions

Questions? We’ll help

Before applying for a loan, you should:

- Assess the need for the expense you are going to have.

- Consider the amount of the new loan together with your household's monthly income and expenses and make sure that the loan will not compromise your budget.

- Obtain all the information you consider relevant to making an informed decision before signing the contract.

- Read the pre-contractual information and the contract carefully and pay attention to the particular conditions of the loan, namely the amount, term, installments and rates.

Before applying for a loan, you should:

- Assess the need for the expense you are going to have.

- Consider the amount of the new loan together with your household's monthly income and expenses and make sure that the loan will not compromise your budget.

- Obtain all the information you consider relevant to making an informed decision before signing the contract.

- Read the pre-contractual information and the contract carefully and pay attention to the particular conditions of the loan, namely the amount, term, installments and rates.

When applying for a personal loan, the following documents may be requested:

- Last 3 payslips

- Latest tax return (with the applicant’s taxpayer number and validation code)

- ID documents of all parties involved (if the application is made at a branch)

- Certificate of regularized social contributions (mandatory for loans over €50,000)

- Additional documents depending on the purpose of the loan:

- Education - proof of enrollment/registration (showing the institution, course duration, and cost) and of the costs related to the course.

- Works/renovations -works estimate + proof of property ownership (Land Registry Certificate and Property Tax Record).

- Sustainable buildings – proof of eligible expenses.

- Automobile – proof of vehicle purchase (mandatory for terms over 84 months).

When applying for a personal loan, the following documents may be requested:

- Last 3 payslips

- Latest tax return (with the applicant’s taxpayer number and validation code)

- ID documents of all parties involved (if the application is made at a branch)

- Certificate of regularized social contributions (mandatory for loans over €50,000)

- Additional documents depending on the purpose of the loan:

- Education - proof of enrollment/registration (showing the institution, course duration, and cost) and of the costs related to the course.

- Works/renovations -works estimate + proof of property ownership (Land Registry Certificate and Property Tax Record).

- Sustainable buildings – proof of eligible expenses.

- Automobile – proof of vehicle purchase (mandatory for terms over 84 months).

The Nominal Annual Rate is the interest rate, expressed as a fixed or variable percentage, that is applied annually to the used loan amount.

The Nominal Annual Rate is the interest rate, expressed as a fixed or variable percentage, that is applied annually to the used loan amount.

The Annual Percentage Rate of Charge is the total cost of the loan to the consumer (as an annual percentage of the loan amount). It includes the loan and interest payments, as well as other mandatory charges (taxes, fees and interest).

The Annual Percentage Rate of Charge is the total cost of the loan to the consumer (as an annual percentage of the loan amount). It includes the loan and interest payments, as well as other mandatory charges (taxes, fees and interest).

It's the total amount you will pay for the loan, including the financed amount, interest, fees, taxes and charges.

It's the total amount you will pay for the loan, including the financed amount, interest, fees, taxes and charges.

You can apply for a loan anywhere, at any time. In these cases, the loan application is analyzed online. If approved, the personal loan is taken out online and the amount requested will be credited to the current account. Valid for clients with a risk profile suitable for the product. Decision subject to credit analysis.

You can apply for a loan anywhere, at any time. In these cases, the loan application is analyzed online. If approved, the personal loan is taken out online and the amount requested will be credited to the current account. Valid for clients with a risk profile suitable for the product. Decision subject to credit analysis.

No, you don’t need to open an account. You can pay your installments from an account with another Bank via direct debit. If you don’t have an account with us yet, schedule a call to apply for your loan.

No, you don’t need to open an account. You can pay your installments from an account with another Bank via direct debit. If you don’t have an account with us yet, schedule a call to apply for your loan.

How it works

To receive your salary with Millennium, go to the “For You” menu, select “Salary”, and then “Receive Salary.”

- In the Millennium app or website, when you apply for a Personal Loan up to €25,000, you’ll find an option to reduce your interest rate.

- Make sure this option is selected to benefit from the reduced rate.

- Remember, you must receive (or start receiving) your salary with Millennium*.

- You have 3 months to start receiving your salary with Millennium.

After that, to keep your reduced rate, you must continue to have your salary paid into Millennium. This condition is reviewed every six months. If not met, the standard loan rate will apply.

*Includes salaries and pensions. Also valid for clients receiving deposits or transfers into the current account linked to the Online Personal Loan, for a minimum amount of €500/month.

How it works

To receive your salary with Millennium, go to the “For You” menu, select “Salary”, and then “Receive Salary.”

- In the Millennium app or website, when you apply for a Personal Loan up to €25,000, you’ll find an option to reduce your interest rate.

- Make sure this option is selected to benefit from the reduced rate.

- Remember, you must receive (or start receiving) your salary with Millennium*.

- You have 3 months to start receiving your salary with Millennium.

After that, to keep your reduced rate, you must continue to have your salary paid into Millennium. This condition is reviewed every six months. If not met, the standard loan rate will apply.

*Includes salaries and pensions. Also valid for clients receiving deposits or transfers into the current account linked to the Online Personal Loan, for a minimum amount of €500/month.

- In the Millennium app or website, when you apply for a Personal Loan up to €25,000, you’ll find an option to reduce your interest rate.

Make sure this option is selected to benefit from the reduced rate - Remember, you must receive (or start receiving) your salary with Millennium*

- You have 3 months to start receiving your salary with Millennium. After that, to keep your reduced rate, you must continue to have your salary paid into Millennium. This condition is reviewed every six months. If not met, the standard loan rate will apply

*Includes salaries and pensions. Also valid for clients receiving deposits or transfers into the current account linked to the Online Personal Loan, for a minimum amount of €500/month.

- In the Millennium app or website, when you apply for a Personal Loan up to €25,000, you’ll find an option to reduce your interest rate.

Make sure this option is selected to benefit from the reduced rate - Remember, you must receive (or start receiving) your salary with Millennium*

- You have 3 months to start receiving your salary with Millennium. After that, to keep your reduced rate, you must continue to have your salary paid into Millennium. This condition is reviewed every six months. If not met, the standard loan rate will apply

*Includes salaries and pensions. Also valid for clients receiving deposits or transfers into the current account linked to the Online Personal Loan, for a minimum amount of €500/month.

Need help?

We are here for you

Need help?

Need help?

Looking for a branch?

Looking for a branch?

Need to call us?

Need to call us?