- Individuals

- Loans

- Mortgage loan

Mortgage loan

I need a mortgage loan...

Mortgage Loan Solutions

Zero has never been worth more

Loan subject to approval

Loan subject to approval

Conditions valid for proposals approved until 31/03/2026, and hired until 30/04/2026

Conditions valid for proposals approved until 31/03/2026, and hired until 30/04/2026

Loan subject to approval

Loan subject to approval

Conditions valid for proposals approved until 31/03/2026, and hired until 30/04/2026

Conditions valid for proposals approved until 31/03/2026, and hired until 30/04/2026

Buy a house

This is your new home,

Fixed rate solutions

Discounts for efficient homes

House renovations

Refurbish your home the way it deserves

Pay less during works

Exclusive partners

Transfer Mortgage Loan

Bring your mortgage to Millennium

Exemption from expenses

Exclusive partners

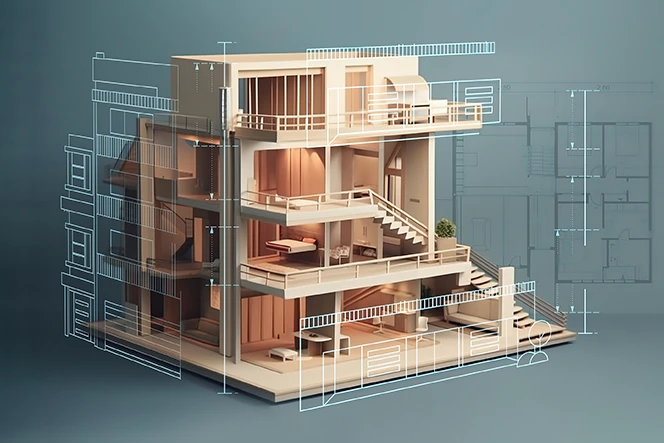

Build a house

Build the home of your dreams

Sustainable loan

Exclusive partners

Different purposes

For other goals you might have

Exclusive partners

Flexibility in the deed

Subsidized Loan for people with disabilities 1.8% TAEG

With subsidized rate

Capital repayment from day one

Life insurance not mandatory

Compare cards

If You’re Young

What are you waiting for?

State Personal Guarantee

IMT And Stamp Duty Exemption

Premium service

No red tape. We take care of everything

Don't waste time, we collect all the necessary documentation

More flexibility to sign the deed, available on weekdays until 10pm and Saturdays from 9am to 12pm

If you can't be present, we can represent you at the signing

Insurance, responsability, and more

Get your mortgage with...

Get discounts and benefits

New

Mortgage at another Bank?

New

Protect your home with HOMIN insurance

New

Discover our offer

With the mortgage life insurance

New

Protect your home with seguro HOMIN

New

We ensure your monthly loan payments

Learn what happens in case of credit agreement default

New

Learn how the Financial Follow Up service works

Awards and Distinctions

Fastest Process, Most Digital Bank, and Best Mortgage Transfer Campaign

Fastest Process

Millennium bcp was distinguished in the 2025 Summer Mortgage Loan Awards by ComparaJá.pt in the “Fastest Process” category, having been the Bank that most streamlined the credit process for Consumers who used ComparaJá’s services. This distinction is only possible thanks to the dedication and professionalism of the extensive team involved in the various stages of the mortgage loan process.

Most Digital Bank

Millennium bcp was distinguished in the 2025 Summer Mortgage Loan Awards by ComparaJá.pt in the “Most Digital Bank” category for offering innovative and practical digital solutions, ensuring an efficient and intuitive online experience throughout the summer. This distinction is only possible thanks to the dedication and professionalism of the extensive team involved in the various stages of the mortgage loan process.

Best Mortgage Transfer Campaign

Millennium bcp was distinguished in the 2025 Summer Mortgage Loan Awards by ComparaJá.pt in the “Best Credit Transfer Campaign” category, having presented the best transfer campaign and achieving the best scores in ComparaJá’s analysis. This distinction is only possible thanks to the dedication and professionalism of the extensive team involved in the various stages of the mortgage loan process.

These awards are the sole responsibility of the entities that granted them.

Awards and Distinctions

Fastest Process, Most Digital Bank, and Best Mortgage Transfer Campaign

Fastest Process

Millennium bcp was distinguished in the 2025 Summer Mortgage Loan Awards by ComparaJá.pt in the “Fastest Process” category, having been the Bank that most streamlined the credit process for Consumers who used ComparaJá’s services. This distinction is only possible thanks to the dedication and professionalism of the extensive team involved in the various stages of the mortgage loan process.

Most Digital Bank

Millennium bcp was distinguished in the 2025 Summer Mortgage Loan Awards by ComparaJá.pt in the “Most Digital Bank” category for offering innovative and practical digital solutions, ensuring an efficient and intuitive online experience throughout the summer. This distinction is only possible thanks to the dedication and professionalism of the extensive team involved in the various stages of the mortgage loan process.

Best Mortgage Transfer Campaign

Millennium bcp was distinguished in the 2025 Summer Mortgage Loan Awards by ComparaJá.pt in the “Best Credit Transfer Campaign” category, having presented the best transfer campaign and achieving the best scores in ComparaJá’s analysis. This distinction is only possible thanks to the dedication and professionalism of the extensive team involved in the various stages of the mortgage loan process.

These awards are the sole responsibility of the entities that granted them.

Want to apply for a mortgage loan?

Before you make a decision...

IMT and Stamp Duty exemption

Buy your first home with tax benefits

IMT and Stamp Duty exemption

Buy your first home with tax benefits

Frequently asked questions

Questions? We'll help

Millennium provides a loan for a maximum percentage of either the house's purchase price or its appraised value, depending on whichever is lower. The difference between the loan amount and the purchase price is called equity and is paid by you. The maximum term of the loan varies according to the age of the older holder. For example, if you are under 30 years old, the maximum term is 40 years. Between the ages of 31 and 34, the maximum term will be 37 years. From the age of 35, the maximum term will be 35 years, provided that none of the holders exceeds the age of 72 at the end of the loan. The longer the term, the lower your monthly payment (as long as the rest of the conditions remain unchanged).

Millennium provides a loan for a maximum percentage of either the house's purchase price or its appraised value, depending on whichever is lower. The difference between the loan amount and the purchase price is called equity and is paid by you. The maximum term of the loan varies according to the age of the older holder. For example, if you are under 30 years old, the maximum term is 40 years. Between the ages of 31 and 34, the maximum term will be 37 years. From the age of 35, the maximum term will be 35 years, provided that none of the holders exceeds the age of 72 at the end of the loan. The longer the term, the lower your monthly payment (as long as the rest of the conditions remain unchanged).

You can decrease the spread by choosing and regularly using additional products or services (optional associated sales). For instance, things like having your salary deposited, using a credit card, or getting loan-related insurance can help lower the spread.

You can decrease the spread by choosing and regularly using additional products or services (optional associated sales). For instance, things like having your salary deposited, using a credit card, or getting loan-related insurance can help lower the spread.

The spread is the additional interest rate set by Millennium. It’s added to the index (monthly average of the 3, 6 or 12 month Euribor) to obtain the nominal annual interest rate (TAN).

The spread is the additional interest rate set by Millennium. It’s added to the index (monthly average of the 3, 6 or 12 month Euribor) to obtain the nominal annual interest rate (TAN).

The European Standard Information Sheet is a document provided by Millennium containing detailed information on all the variables and the particular conditions of your loan.

This document helps you compare offers from different banks, making it easier to decide responsibly before finalizing the loan agreement.

The European Standard Information Sheet is a document provided by Millennium containing detailed information on all the variables and the particular conditions of your loan.

This document helps you compare offers from different banks, making it easier to decide responsibly before finalizing the loan agreement.

The primary house documents necessary for obtaining a mortgage loan include:

- Permanent Certificate

- Caderneta Predial (Property Tax Document)

- Dimensioned Plan

- Energy Certificate

Additionally, a usage license might be necessary.

Depending on the loan type, there might be additional documents requested as well.

The primary house documents necessary for obtaining a mortgage loan include:

- Permanent Certificate

- Caderneta Predial (Property Tax Document)

- Dimensioned Plan

- Energy Certificate

Additionally, a usage license might be necessary.

Depending on the loan type, there might be additional documents requested as well.

The insurances required for mortgage loans are life insurance and home insurance. However, it's not mandatory to purchase these insurances from the bank providing the loan.

The insurances required for mortgage loans are life insurance and home insurance. However, it's not mandatory to purchase these insurances from the bank providing the loan.

Frequently asked questions

Questions? We'll help

Millennium provides a loan for a maximum percentage of either the house's purchase price or its appraised value, depending on whichever is lower. The difference between the loan amount and the purchase price is called equity and is paid by you. The maximum term of the loan varies according to the age of the older holder. For example, if you are under 30 years old, the maximum term is 40 years. Between the ages of 31 and 34, the maximum term will be 37 years. From the age of 35, the maximum term will be 35 years, provided that none of the holders exceeds the age of 72 at the end of the loan. The longer the term, the lower your monthly payment (as long as the rest of the conditions remain unchanged).

Millennium provides a loan for a maximum percentage of either the house's purchase price or its appraised value, depending on whichever is lower. The difference between the loan amount and the purchase price is called equity and is paid by you. The maximum term of the loan varies according to the age of the older holder. For example, if you are under 30 years old, the maximum term is 40 years. Between the ages of 31 and 34, the maximum term will be 37 years. From the age of 35, the maximum term will be 35 years, provided that none of the holders exceeds the age of 72 at the end of the loan. The longer the term, the lower your monthly payment (as long as the rest of the conditions remain unchanged).

You can decrease the spread by choosing and regularly using additional products or services (optional associated sales). For instance, things like having your salary deposited, using a credit card, or getting loan-related insurance can help lower the spread.

You can decrease the spread by choosing and regularly using additional products or services (optional associated sales). For instance, things like having your salary deposited, using a credit card, or getting loan-related insurance can help lower the spread.

The spread is the additional interest rate set by Millennium. It’s added to the index (monthly average of the 3, 6 or 12 month Euribor) to obtain the nominal annual interest rate (TAN).

The spread is the additional interest rate set by Millennium. It’s added to the index (monthly average of the 3, 6 or 12 month Euribor) to obtain the nominal annual interest rate (TAN).

The European Standard Information Sheet is a document provided by Millennium containing detailed information on all the variables and the particular conditions of your loan.

This document helps you compare offers from different banks, making it easier to decide responsibly before finalizing the loan agreement.

The European Standard Information Sheet is a document provided by Millennium containing detailed information on all the variables and the particular conditions of your loan.

This document helps you compare offers from different banks, making it easier to decide responsibly before finalizing the loan agreement.

The primary house documents necessary for obtaining a mortgage loan include:

- Permanent Certificate

- Caderneta Predial (Property Tax Document)

- Dimensioned Plan

- Energy Certificate

Additionally, a usage license might be necessary.

Depending on the loan type, there might be additional documents requested as well.

The primary house documents necessary for obtaining a mortgage loan include:

- Permanent Certificate

- Caderneta Predial (Property Tax Document)

- Dimensioned Plan

- Energy Certificate

Additionally, a usage license might be necessary.

Depending on the loan type, there might be additional documents requested as well.

The insurances required for mortgage loans are life insurance and home insurance. However, it's not mandatory to purchase these insurances from the bank providing the loan.

The insurances required for mortgage loans are life insurance and home insurance. However, it's not mandatory to purchase these insurances from the bank providing the loan.

Legal documents and other Information

General Pre-Contractual Information

Download-

Dossier Fee €290 + ST

-

Setup Fee €200 + ST

-

Valuation Fee €230 + ST

- Get salary paid at Millennium bcp's account associated with the loan;

- Fulfil three of the five following requirements/products/services:

-

- Credit card with a minimum monthly usage of €100 in payments for purchases and services (with semi-annual monitoring of the accumulated value) - TAEG 15.7%²;

- Personal loan or Vehicle loan with a minimum outstanding balance of €1,000;

- Setting up direct debits for 2 monthly bills (electricity, water, gas, communications);

- Life insurance associated with the loan at Ocidental Vida³;

- Home Insurance associated with the credit, sold by Ageas Portugal under the Ocidental brand³.

The credit is granted by Banco Comercial Português S.A., without credit intermediation, and is guaranteed by a property mortgage. The granting of credit is subject to the macroprudential rules of the Bank of Portugal. The interest rate applied (TAN) can assume negative values depending on the evolution of the respective index.

Need help?

We are here for you

Need help?

Need help?

Looking for a branch?

Looking for a branch?

Need to call us?

Need to call us?