- Individuals

- Investments

- Certificates

Millennium bcp Certificates

Access world markets with a single exchange order

Benefits

Why invest in certificates?

Millennium certificates

Explore our certificates…

Investment plan

Investment Plan in Certificates

Invest in Millennium Certificates with a scheduled plan

Stocks and commodity Indexes

Stocks and commodity Indexes

Investment opportunities in the world’s major markets

Allocation strategies

Allocation strategies

Have a strategy for your investment portfolio

Indexes with ESG criteria

Indexes with ESG criteria

Build your balanced portfolio

Invest in 4 steps!

It's that easy!

Invest in 4 steps!

It's that easy!

Articles, tips and more

Your roadmap to certificate investing

Articles, tips and more

Your roadmap to certificate investing

Frequently asked questions

Questions? We'll help

Certificates are securities issued by Millennium bcp that track the performance of underlying assets, denominated in euros. They are listed on Euronext Paris, where they can be traded, with Millennium bcp responsible for providing liquidity.

The broad range of certificates allows for building a diversified portfolio, with exposure to stocks, bonds, and commodities, as well as implementing pre-defined allocation strategies for equity and bond markets.

Certificates are securities issued by Millennium bcp that track the performance of underlying assets, denominated in euros. They are listed on Euronext Paris, where they can be traded, with Millennium bcp responsible for providing liquidity.

The broad range of certificates allows for building a diversified portfolio, with exposure to stocks, bonds, and commodities, as well as implementing pre-defined allocation strategies for equity and bond markets.

TThere is no minimum investment amount. You can start investing in certificates by purchasing a single certificate, the value of which depends on its market price.

TThere is no minimum investment amount. You can start investing in certificates by purchasing a single certificate, the value of which depends on its market price.

The price of the certificate reflects the performance of the underlying asset, minus the Management Fee (where applicable). All factors that influence the price of the underlying asset also affect the price of the certificate. These factors can include economic indicators, company results, news indicating political stability or instability, or prospects of economic acceleration or slowdown, such as a global pandemic.

The price of the certificate reflects the performance of the underlying asset, minus the Management Fee (where applicable). All factors that influence the price of the underlying asset also affect the price of the certificate. These factors can include economic indicators, company results, news indicating political stability or instability, or prospects of economic acceleration or slowdown, such as a global pandemic.

Equity indices: track the performance of a diversified and liquid reference stock index. These indices can be global or regional.

Allocation strategies: track the performance of diversified and liquid reference indices of bonds and stocks, with various risk profiles available corresponding to different allocations between these two asset classes.

Commodities: track the performance of commodities, such as gold.

Equity indices: track the performance of a diversified and liquid reference stock index. These indices can be global or regional.

Allocation strategies: track the performance of diversified and liquid reference indices of bonds and stocks, with various risk profiles available corresponding to different allocations between these two asset classes.

Commodities: track the performance of commodities, such as gold.

Frequently asked questions

Questions? We'll help

Certificates are securities issued by Millennium bcp that track the performance of underlying assets, denominated in euros. They are listed on Euronext Paris, where they can be traded, with Millennium bcp responsible for providing liquidity.

The broad range of certificates allows for building a diversified portfolio, with exposure to stocks, bonds, and commodities, as well as implementing pre-defined allocation strategies for equity and bond markets.

Certificates are securities issued by Millennium bcp that track the performance of underlying assets, denominated in euros. They are listed on Euronext Paris, where they can be traded, with Millennium bcp responsible for providing liquidity.

The broad range of certificates allows for building a diversified portfolio, with exposure to stocks, bonds, and commodities, as well as implementing pre-defined allocation strategies for equity and bond markets.

TThere is no minimum investment amount. You can start investing in certificates by purchasing a single certificate, the value of which depends on its market price.

TThere is no minimum investment amount. You can start investing in certificates by purchasing a single certificate, the value of which depends on its market price.

The price of the certificate reflects the performance of the underlying asset, minus the Management Fee (where applicable). All factors that influence the price of the underlying asset also affect the price of the certificate. These factors can include economic indicators, company results, news indicating political stability or instability, or prospects of economic acceleration or slowdown, such as a global pandemic.

The price of the certificate reflects the performance of the underlying asset, minus the Management Fee (where applicable). All factors that influence the price of the underlying asset also affect the price of the certificate. These factors can include economic indicators, company results, news indicating political stability or instability, or prospects of economic acceleration or slowdown, such as a global pandemic.

Equity indices: track the performance of a diversified and liquid reference stock index. These indices can be global or regional.

Allocation strategies: track the performance of diversified and liquid reference indices of bonds and stocks, with various risk profiles available corresponding to different allocations between these two asset classes.

Commodities: track the performance of commodities, such as gold.

Equity indices: track the performance of a diversified and liquid reference stock index. These indices can be global or regional.

Allocation strategies: track the performance of diversified and liquid reference indices of bonds and stocks, with various risk profiles available corresponding to different allocations between these two asset classes.

Commodities: track the performance of commodities, such as gold.

Related topics

Some more investment picks...

Legal documents and other information

Documents about Certificates

ConsultCertificates on indexes may prove appropriate for medium and long term investments in the stock markets due to their potential profitability and the diversification that characterize their components. They also enable you to take advantage of short term variations in the quotations of those markets or of other reference assets.

- MSCI WORLD EUR (World) - www.msci.com

- Eurostoxx 50 (Eurozone) - stoxx.com/equity-indices/

- S&P 500 in Euros (United States of America) - www.spindices.com

- NASDAQ-100 in Euros (United States of America) - www.nasdaq.com

- MSCI Emerging Markets EUR (Emerging Markets) - www.msci.com

- IBEX 35 (Spain) - www.bolsasymercados.es

- PSI 20 (Portugal) - www.euronext.com/en/euronext-indices

- CAC 40 (França) - www.euronext.com/en/euronext-indices

- DAX 30 (Germany) - stoxx.com/equity-indices/

Stay up to date on commodity performance

Millennium BCP Certificates allow you to track the performance of commodities.

- Gold in Euros (Commodity) – www.lbma.org.uk ou www.theice.com/index

Certificates on indexes may prove appropriate for medium and long term investments in the stock markets due to their potential profitability and the diversification that characterize their components. They also enable you to take advantage of short term variations in the quotations of those markets or of other reference assets.

- MSCI WORLD EUR (World) - www.msci.com

- Eurostoxx 50 (Eurozone) - stoxx.com/equity-indices/

- S&P 500 in Euros (United States of America) - www.spindices.com

- NASDAQ-100 in Euros (United States of America) - www.nasdaq.com

- MSCI Emerging Markets EUR (Emerging Markets) - www.msci.com

- IBEX 35 (Spain) - www.bolsasymercados.es

- PSI 20 (Portugal) - www.euronext.com/en/euronext-indices

- CAC 40 (França) - www.euronext.com/en/euronext-indices

- DAX 30 (Germany) - stoxx.com/equity-indices/

Stay up to date on commodity performance

Millennium BCP Certificates allow you to track the performance of commodities.

- Gold in Euros (Commodity) – www.lbma.org.uk ou www.theice.com/index

The Certificates Allocation Strategy replicate the profitability, with different allocations, of indexes from the two main financial asset classes, the Stock Market asset class and the Fixed Income asset class, deducting management costs.

The Bloomberg Barclays Euro-Aggregate Corporate Total Return Index is composed by the largest bond issues in Euros from leading companies worldwide, with an Investment Grade (high quality) rating. It is compromised by more than 3100 bond issues, highlighting among the many issuer: BNP, Volkswagen, AT&T, Soc. Gen., Daimler, BMW, Shell, Coca-Cola, Unilever, Bayer and Danone.

The MSCI All Country World Index Net Total Return EUR is a stock index composed by the largest companies worldwide, including 23 developed countries (such as the United States, Japan, the United Kingdom, France, Switzerland and Germany) and 24 emerging countries (namely China, South Korea, Taiwan, India and Brazil). The index has over 3000 firms, for instance: Apple, Johnson & Johnson, Nestlé, Siemens, Bayer, Alibaba and Samsung.

The Certificates Allocation Strategy replicate the profitability, with different allocations, of indexes from the two main financial asset classes, the Stock Market asset class and the Fixed Income asset class, deducting management costs.

The Bloomberg Barclays Euro-Aggregate Corporate Total Return Index is composed by the largest bond issues in Euros from leading companies worldwide, with an Investment Grade (high quality) rating. It is compromised by more than 3100 bond issues, highlighting among the many issuer: BNP, Volkswagen, AT&T, Soc. Gen., Daimler, BMW, Shell, Coca-Cola, Unilever, Bayer and Danone.

The MSCI All Country World Index Net Total Return EUR is a stock index composed by the largest companies worldwide, including 23 developed countries (such as the United States, Japan, the United Kingdom, France, Switzerland and Germany) and 24 emerging countries (namely China, South Korea, Taiwan, India and Brazil). The index has over 3000 firms, for instance: Apple, Johnson & Johnson, Nestlé, Siemens, Bayer, Alibaba and Samsung.

Treasury Bond Certificates monitor the performance of the respective bond, including the reinvestment of interest, deducted from the management cost.

The maturity of the Certificates coincides with the maturity of the OT. If you keep the Certificates until the end of the term, you will receive the performance of the underlying asset, considering a final price of 100, corresponding to the reimbursement value of the obligation, plus the accumulated reinvested coupons and deducted from the management cost. Therefore, the profitability of your investment will correspond to the interest rate implicit in the OT (yield to maturity) deducted from the management cost.

The Certificates are listed on the stock exchange, at Euronext Paris, where Millennium bcp provides liquidity. Therefore, if you want to complete your investment before the end of the product's term, you can sell your Certificates in advance with an Exchange order, with a return depending on the Certificate's sales price, which will depend on the OT price on the market.

Treasury Bond Certificates monitor the performance of the respective bond, including the reinvestment of interest, deducted from the management cost.

The maturity of the Certificates coincides with the maturity of the OT. If you keep the Certificates until the end of the term, you will receive the performance of the underlying asset, considering a final price of 100, corresponding to the reimbursement value of the obligation, plus the accumulated reinvested coupons and deducted from the management cost. Therefore, the profitability of your investment will correspond to the interest rate implicit in the OT (yield to maturity) deducted from the management cost.

The Certificates are listed on the stock exchange, at Euronext Paris, where Millennium bcp provides liquidity. Therefore, if you want to complete your investment before the end of the product's term, you can sell your Certificates in advance with an Exchange order, with a return depending on the Certificate's sales price, which will depend on the OT price on the market.

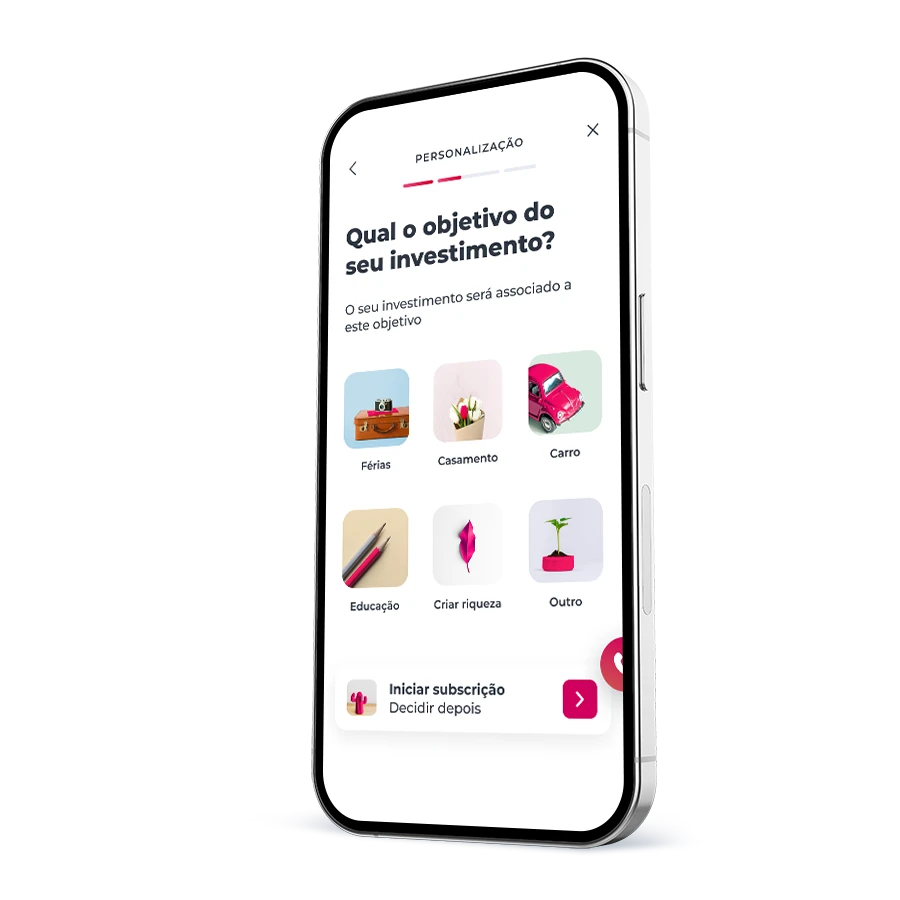

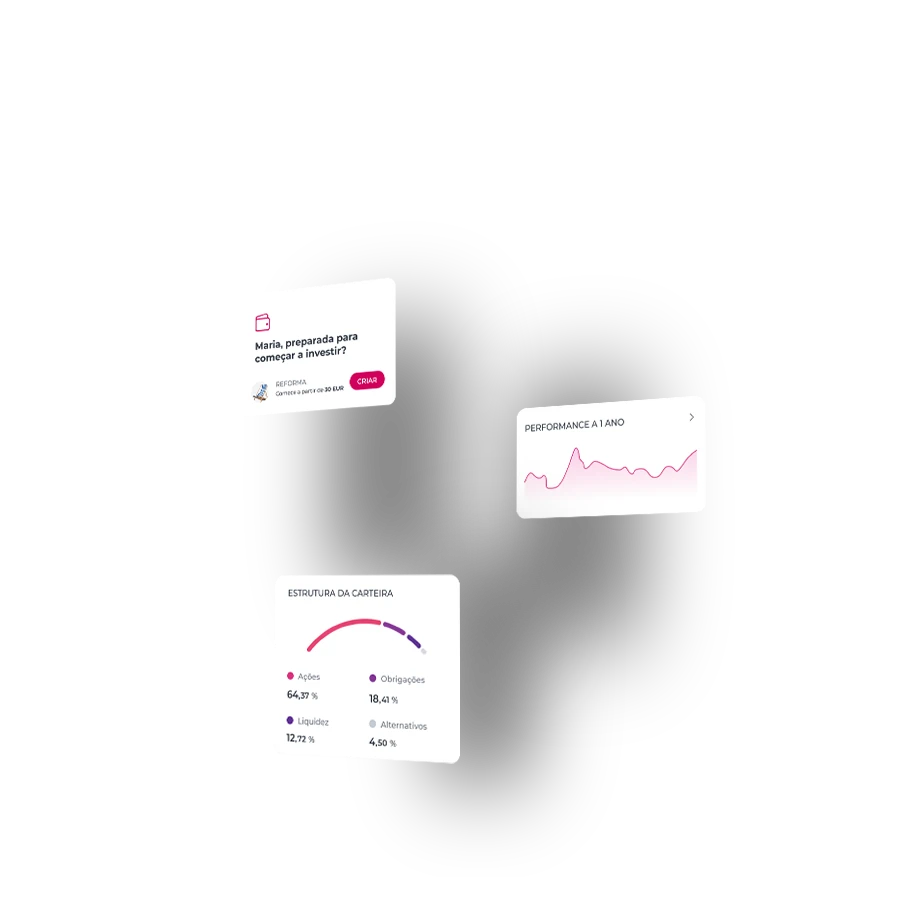

The Investment Plan in Certificates allows you to invest in Millennium bcp Certificates (Certificates on Stock Indices, Allocation Strategy Certificates, and Certificates on Gold) starting with small amounts, on a monthly basis, and with no fees on contributions. It is a regular, scheduled investment designed for the medium to long term.

The wide range of Millennium bcp Certificates provides access to major global stock indices, bonds, and commodities such as gold.

You can subscribe via the Investment Hub in the Millennium App. To set up the plan, simply choose the Certificate, define the monthly contribution amount, and select the day of the month for the order to be executed.

The Investment Plan in Certificates allows you to invest in Millennium bcp Certificates (Certificates on Stock Indices, Allocation Strategy Certificates, and Certificates on Gold) starting with small amounts, on a monthly basis, and with no fees on contributions. It is a regular, scheduled investment designed for the medium to long term.

The wide range of Millennium bcp Certificates provides access to major global stock indices, bonds, and commodities such as gold.

You can subscribe via the Investment Hub in the Millennium App. To set up the plan, simply choose the Certificate, define the monthly contribution amount, and select the day of the month for the order to be executed.

Certificates on indexes with ESG criteria allow medium- and long-term investment in equity indexes weighted according to Environmental, Social, and Governance (ESG) principles.

- MSCI WORLD SELECTION (Global) - www.msci.com

- S&P 500 SCORED & SCREENED (United States of America) - www.spindices.com

- MSCI EMERGING MARKETS SELECTION (Emerging Markets) - www.msci.com

- EURO STOXX 50 ESG (Eurozone) - stoxx.com/equity-indices/

Certificates on indexes with ESG criteria allow medium- and long-term investment in equity indexes weighted according to Environmental, Social, and Governance (ESG) principles.

- MSCI WORLD SELECTION (Global) - www.msci.com

- S&P 500 SCORED & SCREENED (United States of America) - www.spindices.com

- MSCI EMERGING MARKETS SELECTION (Emerging Markets) - www.msci.com

- EURO STOXX 50 ESG (Eurozone) - stoxx.com/equity-indices/

Need help?

We are here for you

Need help?

Need help?

Looking for a branch?

Looking for a branch?

Need to call us?

Need to call us?