- Individuals

- Retirement

Retirement

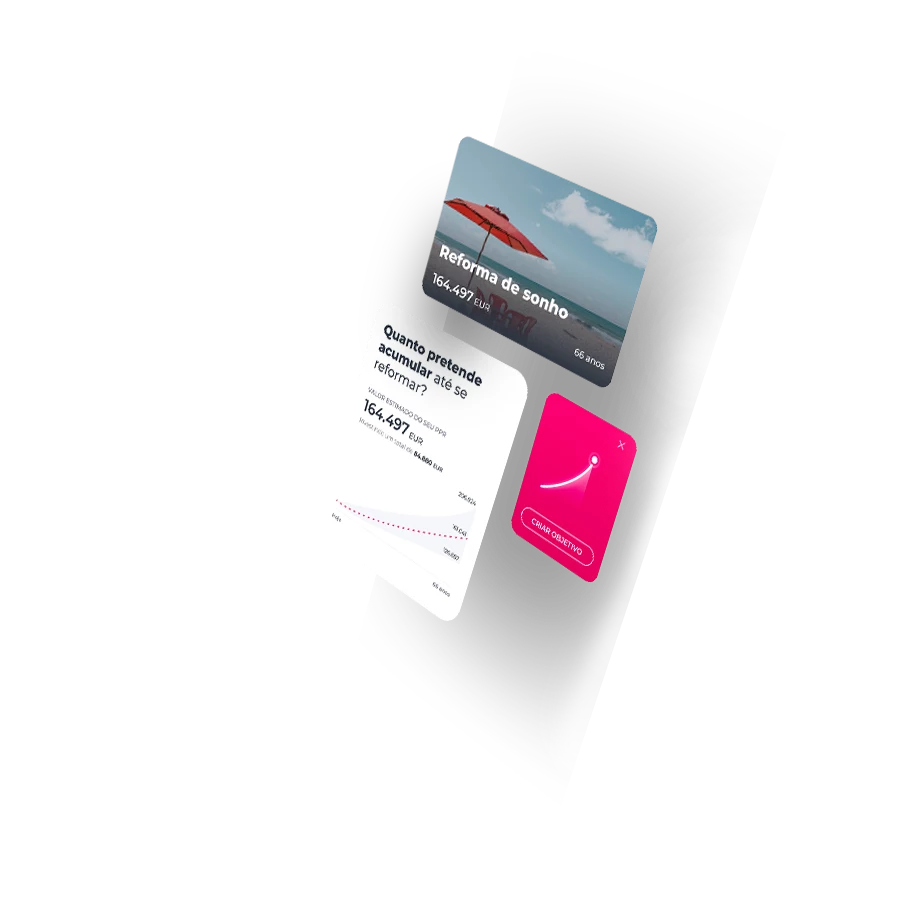

Start planning now…

Reforma Ativa 2ª Série

To secure a future of new passions and adventures

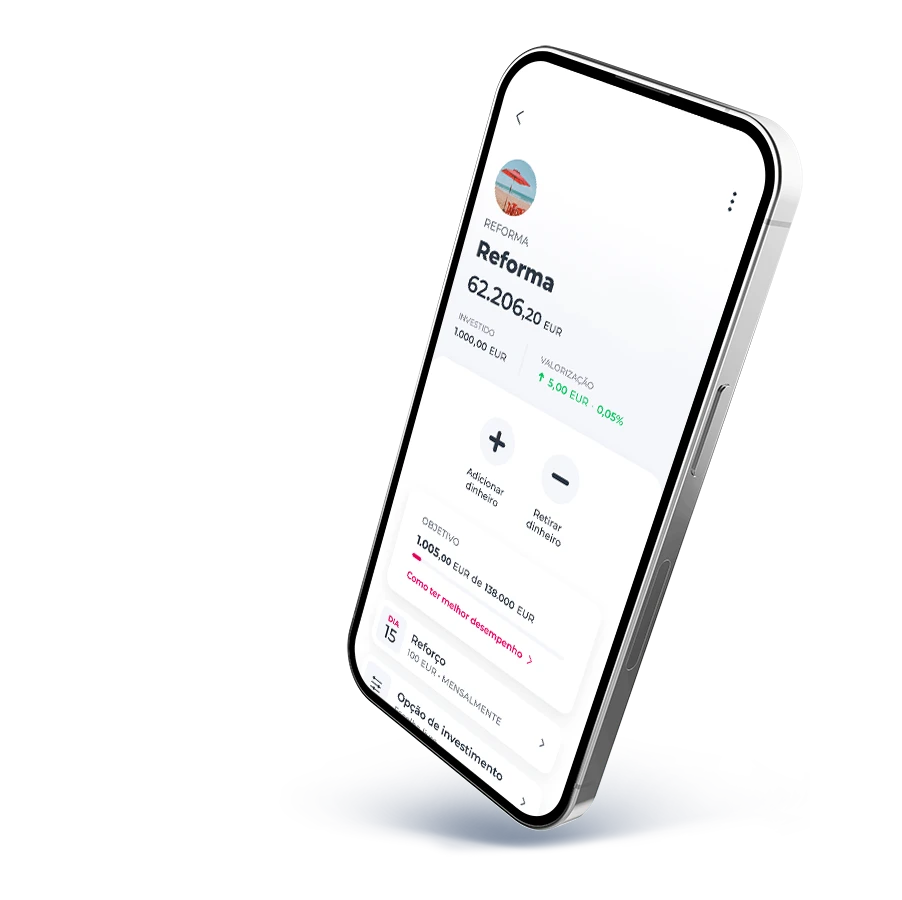

Invest in a digital insurance managed by specialists

Invest in a digital insurance managed by specialists

Tax benefits up to €400

Tax benefits up to €400

Invest in a digital insurance managed by specialists

Invest in a digital insurance managed by specialists

Tax benefits up to €400

Tax benefits up to €400

Reforma Ativa 2ª Série

To secure a future of new passions and adventures

Invest in a digital insurance managed by specialists

Tax benefits up to €400

IMGA Crescimento PPR

For those who prefer to start young

Tax benefits up to €400

Up to 100% in stocks

IMGA Poupança PPR

For those who are more conservative

Tax benefits up to €400

Long-term solution

IMGA investimento PPR

For those who prefer risk

Tax benefits up to €400

Early repayment

Mais rendimento flexível

Boost your retirement savings

Monthly income

Professional management

Compare cards

Greater flexibility

Discover how retirement plans work

Frequently asked questions

Questions? We'll help

A retirement plan is a long-term savings product intended to supplement the government-provided retirement pension. Usually, you contribute periodically or sporadically throughout your working years, and these funds are invested until redemption. Notably, one of the primary advantages setting retirement plans apart from other financial products is the inclusion of tax benefits.

A retirement plan is a long-term savings product intended to supplement the government-provided retirement pension. Usually, you contribute periodically or sporadically throughout your working years, and these funds are invested until redemption. Notably, one of the primary advantages setting retirement plans apart from other financial products is the inclusion of tax benefits.

One of the primary benefits of retirement plans is the opportunity for substantial IRS deductions, which can potentially reach up to €400 per year, depending on your age. This 20% tax benefit is tied to your income and allowable taxable deductions, ensuring that deductions within categories such as health, education, and more adhere to specific limits based on your income bracket.

To calculate your annual benefit, refer to the previous year's IRS assessment note, assuming your expenditure and income remain unchanged. Deduct eligible expenses from your taxable income, and the remaining amount can be allocated for contributions to your retirement plan.

One of the primary benefits of retirement plans is the opportunity for substantial IRS deductions, which can potentially reach up to €400 per year, depending on your age. This 20% tax benefit is tied to your income and allowable taxable deductions, ensuring that deductions within categories such as health, education, and more adhere to specific limits based on your income bracket.

To calculate your annual benefit, refer to the previous year's IRS assessment note, assuming your expenditure and income remain unchanged. Deduct eligible expenses from your taxable income, and the remaining amount can be allocated for contributions to your retirement plan.

With the exception of retirement plans featuring guaranteed capital, all other plans carry some level of risk.

With the exception of retirement plans featuring guaranteed capital, all other plans carry some level of risk.

Retirement plans with guaranteed capital eliminate the risk of capital loss. Upon redeeming your plan, your initial investment is fully ensured, safeguarding your capital. However, these plans typically yield lower returns.

Conversely, retirement plans without guaranteed capital carry the risk of capital devaluation, potentially resulting in a redemption amount less than your initial investment. Longer investment periods can help mitigate this risk, as short-term fluctuations have less impact. Opting for plans without capital guarantees can offer higher returns but comes with increased risk.

Retirement plans with guaranteed capital eliminate the risk of capital loss. Upon redeeming your plan, your initial investment is fully ensured, safeguarding your capital. However, these plans typically yield lower returns.

Conversely, retirement plans without guaranteed capital carry the risk of capital devaluation, potentially resulting in a redemption amount less than your initial investment. Longer investment periods can help mitigate this risk, as short-term fluctuations have less impact. Opting for plans without capital guarantees can offer higher returns but comes with increased risk.

Frequently asked questions

Questions? We'll help

A retirement plan is a long-term savings product intended to supplement the government-provided retirement pension. Usually, you contribute periodically or sporadically throughout your working years, and these funds are invested until redemption. Notably, one of the primary advantages setting retirement plans apart from other financial products is the inclusion of tax benefits.

A retirement plan is a long-term savings product intended to supplement the government-provided retirement pension. Usually, you contribute periodically or sporadically throughout your working years, and these funds are invested until redemption. Notably, one of the primary advantages setting retirement plans apart from other financial products is the inclusion of tax benefits.

One of the primary benefits of retirement plans is the opportunity for substantial IRS deductions, which can potentially reach up to €400 per year, depending on your age. This 20% tax benefit is tied to your income and allowable taxable deductions, ensuring that deductions within categories such as health, education, and more adhere to specific limits based on your income bracket.

To calculate your annual benefit, refer to the previous year's IRS assessment note, assuming your expenditure and income remain unchanged. Deduct eligible expenses from your taxable income, and the remaining amount can be allocated for contributions to your retirement plan.

One of the primary benefits of retirement plans is the opportunity for substantial IRS deductions, which can potentially reach up to €400 per year, depending on your age. This 20% tax benefit is tied to your income and allowable taxable deductions, ensuring that deductions within categories such as health, education, and more adhere to specific limits based on your income bracket.

To calculate your annual benefit, refer to the previous year's IRS assessment note, assuming your expenditure and income remain unchanged. Deduct eligible expenses from your taxable income, and the remaining amount can be allocated for contributions to your retirement plan.

With the exception of retirement plans featuring guaranteed capital, all other plans carry some level of risk.

With the exception of retirement plans featuring guaranteed capital, all other plans carry some level of risk.

Retirement plans with guaranteed capital eliminate the risk of capital loss. Upon redeeming your plan, your initial investment is fully ensured, safeguarding your capital. However, these plans typically yield lower returns.

Conversely, retirement plans without guaranteed capital carry the risk of capital devaluation, potentially resulting in a redemption amount less than your initial investment. Longer investment periods can help mitigate this risk, as short-term fluctuations have less impact. Opting for plans without capital guarantees can offer higher returns but comes with increased risk.

Retirement plans with guaranteed capital eliminate the risk of capital loss. Upon redeeming your plan, your initial investment is fully ensured, safeguarding your capital. However, these plans typically yield lower returns.

Conversely, retirement plans without guaranteed capital carry the risk of capital devaluation, potentially resulting in a redemption amount less than your initial investment. Longer investment periods can help mitigate this risk, as short-term fluctuations have less impact. Opting for plans without capital guarantees can offer higher returns but comes with increased risk.

Need help?

We are here for you

Need help?

Need help?

Looking for a branch?

Looking for a branch?

Need to call us?

Need to call us?