- Individuals

- Investments

- Unit Linked

- Reforma Ativa PPR 2 Série

Reforma Ativa PPR 2.ª Série

From €30 with tax benefits up to €400/year

Benefits

Why invest in this retirement plan?

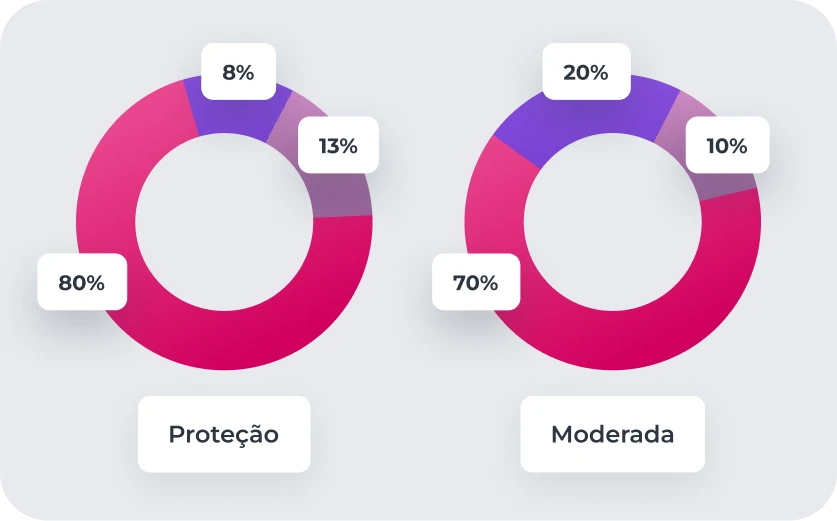

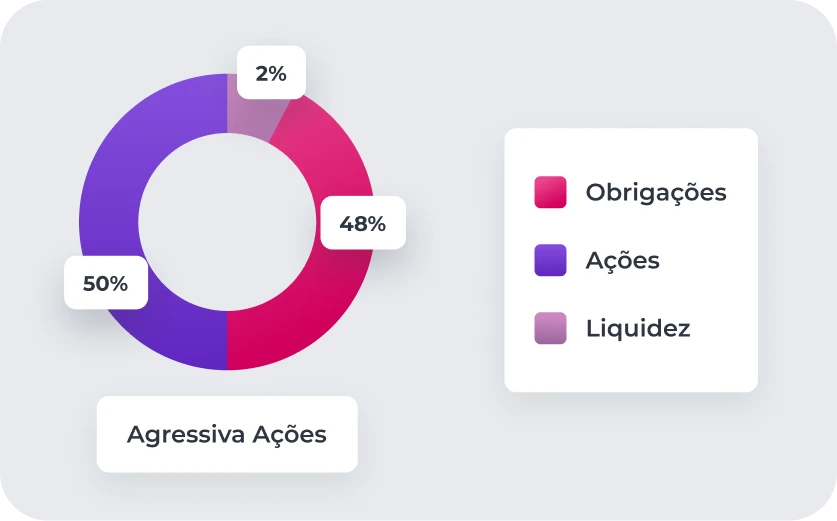

Allocation strategies

Invest with one of these strategies

Investment options

Tailored to your needs

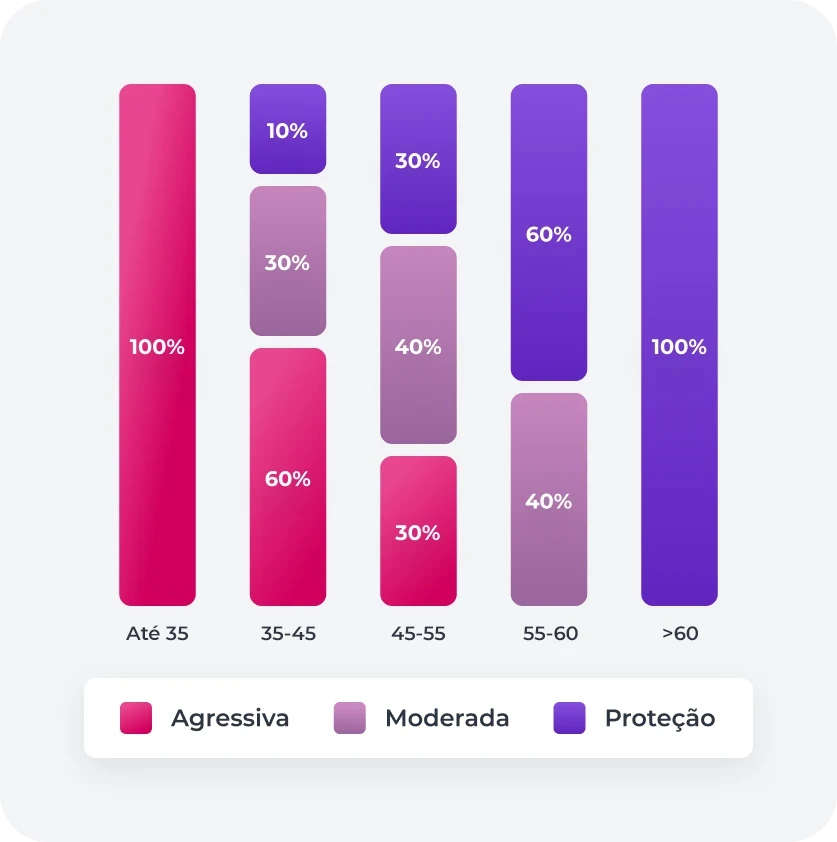

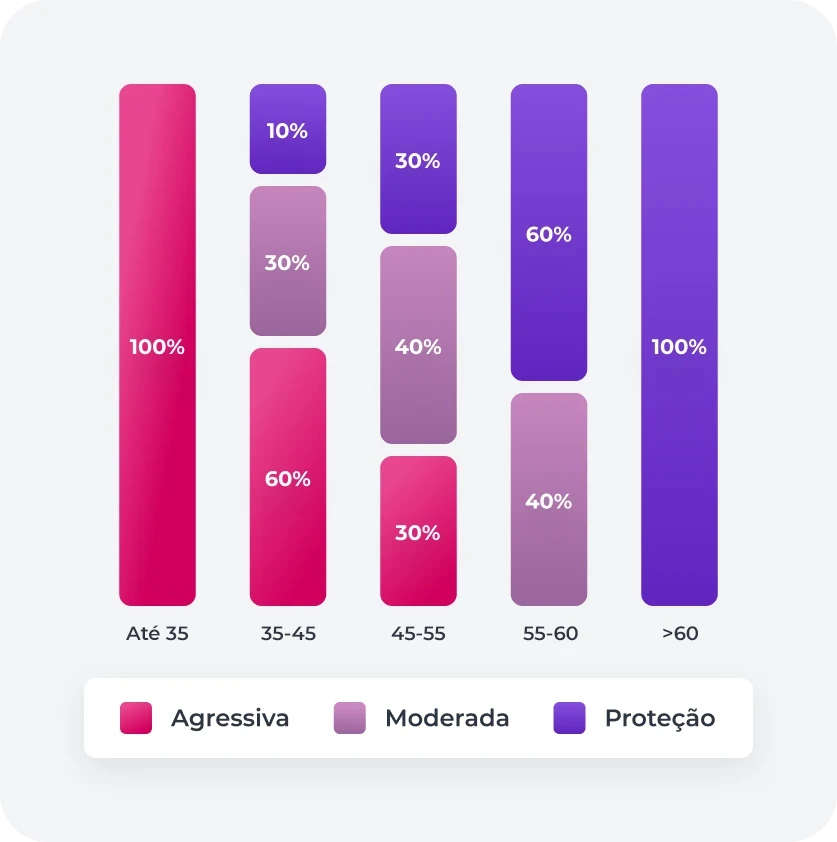

Life cycle

Managed according to your age

Our experts allocate deliveries to each of the strategies according to your age. Up to the age of 35, the strategies with the highest risk are chosen. And as time goes by, deliveries are assigned to the strategies with less risk.

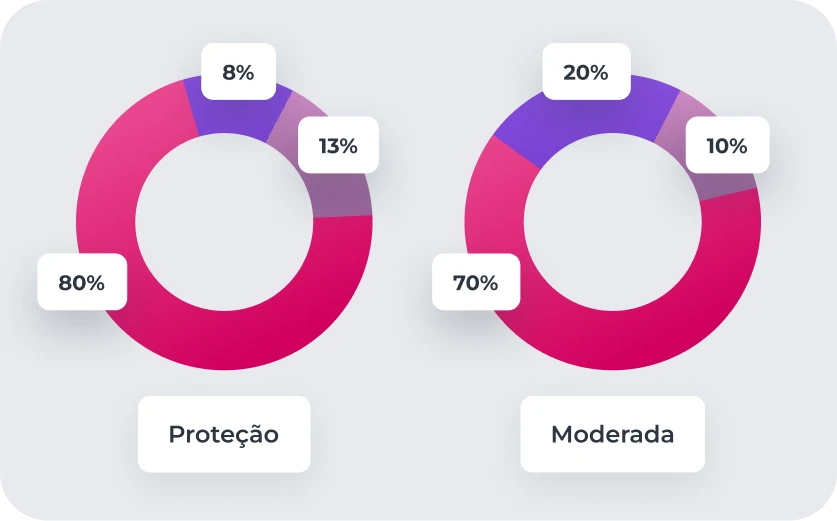

Free choice

Decide how to distribute the deliveries

Choose the distribution of deliveries to each of the different strategies, according to your investment preferences. You can choose more than one strategy, allocating partial amounts of your delivery to different strategies.

Fees and charges

Now on to the math

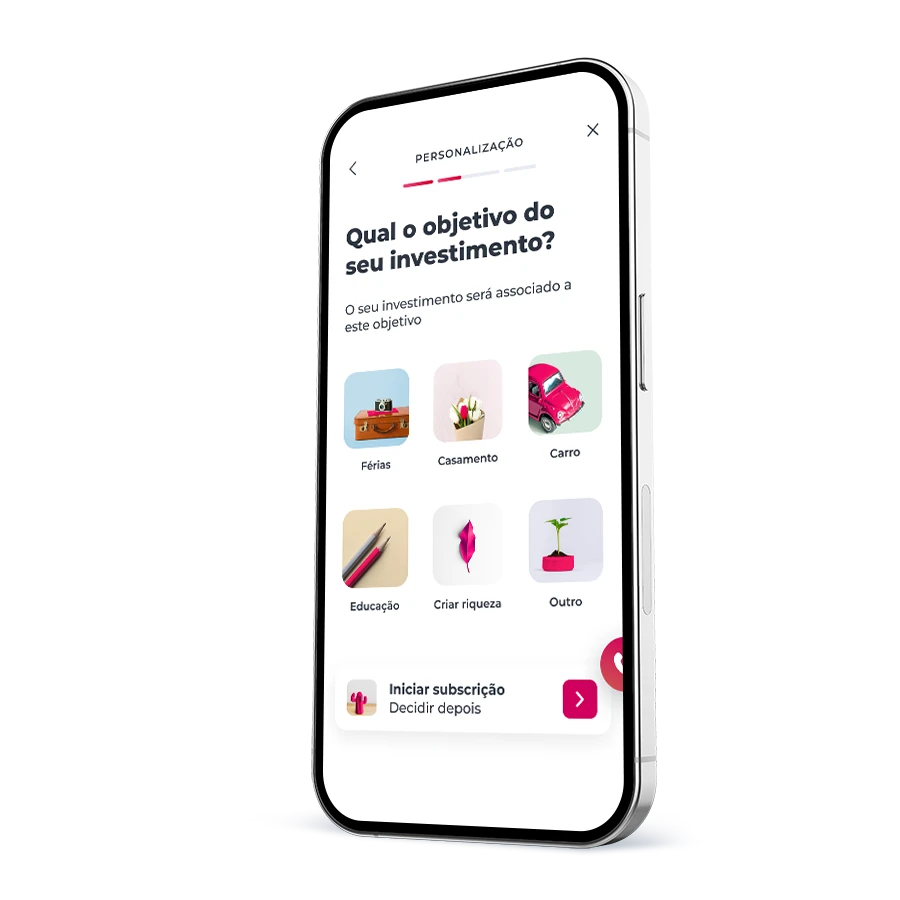

1, 2, 3 and that’s it!

Preparing for retirement has never been this easy

1, 2, 3 and that’s it!

Preparing for retirement has never been this easy

Related topics

Other options to prepare your retirement

Legal documents and other information

General documents

Key Investor Information Document

Key Investor Information Document Aggressive Strategy - Stocks

Download

Key Investor Information Document Balanced Strategy

Download

Key Investor Information Document Protection Strategy

DownloadInformation on costs and charges

Information on Costs and Charges Aggressive Strategy - Stocks

Download

Information on Costs and Charges Balanced Strategy

Download

Information on Costs and Charges Protection Strategy

Download- Retirement Option: the Customer may choose the full reimbursement of the policy (the contract ends);

- Programmed Payment Option: the Customer may choose to convert the accumulated capital into partial, programmed/automatic reimbursements paid every month/quarter/six months, with an accumulation effect. This partial automatic redemptions mechanism shall last while there are Accounts Units allocated to the policy and, at the most, until the maturity date. These partial and automatic reimbursements will bear a constant value, to be defined by the Customer, with a minimum of 250,00 €;

- Partial Reimbursement: the Customer may request the partial redemption, under the terms permitted by law.

- Full Reimbursement: the Customer may choose the full reimbursement of the policy (the contract ends);

- Partial Reimbursement: the partial reimbursement of the Account Units is subject to the following conditions:

-The minimum amount for each partial reimbursement is €250.00;

-After the partial reimbursement, the value of the remaining Account Units cannot be less than €250.00.

- retirement due to old age of the insured person;

- long term unemployment of the insured person or of any member of his/her household;

- permanent disability for work of the of the insured person or of any member of his/her household, regardless of the cause;

- serious illness of the insured person or of any member of his/her household;

- the insured person turning 60 years old;

- payment of credits guaranteed by mortgage on the real estate property used as the insured person's own and permanent home.

- When the author of the succession is the insured person, the surviving spouse or other legal heirs, regardless of the couple's marital regime, may request the full return of the savings plan, unless a different solution occurs from the will or from a beneficiary clause in favor of a third party, without prejudice to the observation of the law;

- When the author of the succession was the spouse of the insured person and, due to the couple's property regime, the PPR savings are considered common property, the surviving spouse or the other heirs may demand the reimbursement of the part owned by the deceased.

- €400.00 in case of taxpayers aged under 35 (minimum investment of €2,000.00, per taxpayer);

- €350.00 in case of taxpayers aged between 35 and 50 (minimum investment of €1,750.00 per taxpayer);

- €300.00 in case of taxpayers aged over 50 (minimum investment of €1,500.00 per taxpayer).

|

Taxable Income after applying the divisor of the family quotient (Euros)

|

Limit (Euros)²

|

|---|---|

|

8,059 Euros or less

|

No limit

|

|

Between 8,059 and 80,000 (inclusively)

|

Between 2,500 (applicable to lower incomes) and 1,000 (applicable to higher incomes), with the limit being defined using the following formula:

€1,000 + [(€2,500 - €1,000) X (€80,000 - taxable income) / (€80,000 - €8,059)]

|

|

Above 80,000

|

1,000

|

2 - In households with three or more dependents, the limits are increased by 5% for each dependent or civil sponsor who is not a taxpayer of the IRS.

- as capital (even in case of death): taxable income, composed of the difference between the amount reimbursed and the correspondent deliveries, shall be taxed autonomously by withholding at source a rate of 20%, only applicable to two fifths of its value, which corresponds to an effective rate of 8%.

- and the redemption is made after 8 years of duration of the policy, only two fifths of the income shall be taxed, corresponding to an effective rate of 8.6%;

- and the reimbursement is made between the 5th and 8th year of the duration of the policy, only four fifths of the income shall be taxed, corresponding to a withholding tax rate of 17.2%.

- as a regular payment: if the contract establishes the payment of regular and periodical amounts, the tax regime applied will be the one corresponding to Category H of the Income Tax (pensions), including the rules on withholding tax.

Need help?

We are here for you

Need help?

Need help?

Looking for a branch?

Looking for a branch?

Need to call us?

Need to call us?