- Individuals

- Investments

- Unit Linked

Financial Insurances

Explore our financial insurance options

Reforma Ativa PPR 2.ª Série

From €30

Invest in an insurance managed by specialists

Invest in an insurance managed by specialists

Enjoy up to €400 on tax benefits

Enjoy up to €400 on tax benefits

Invest in an insurance managed by specialists

Invest in an insurance managed by specialists

Enjoy up to €400 on tax benefits

Enjoy up to €400 on tax benefits

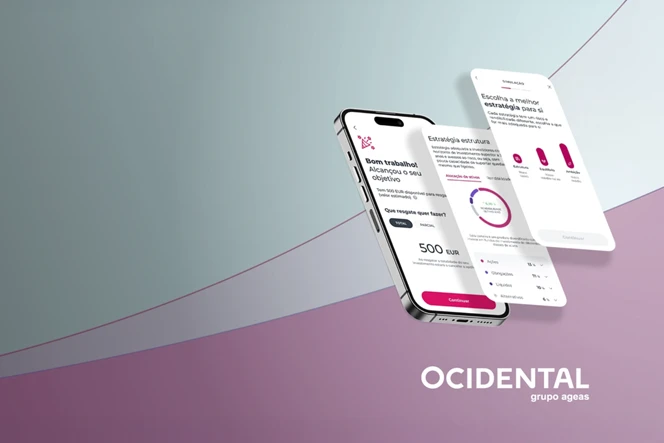

Seguro Investidor Global 2.ª Série

Invest with 5 investment strategies

Risk Life Insurance

Tax benefits

Easy Invest

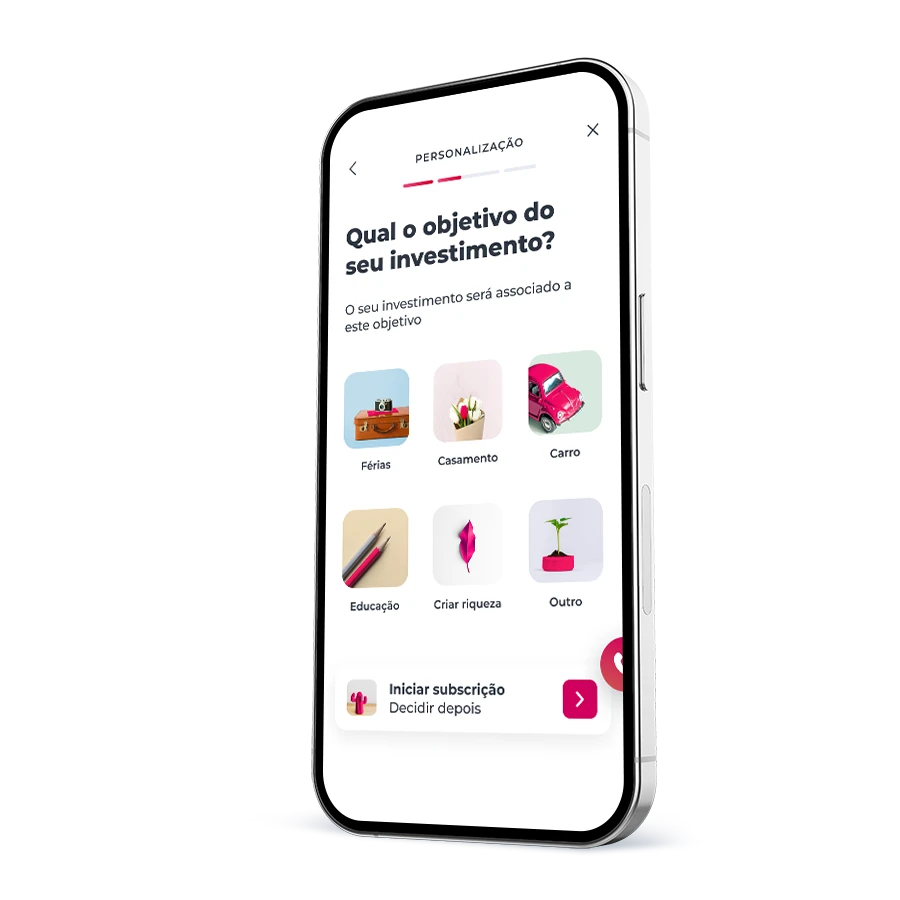

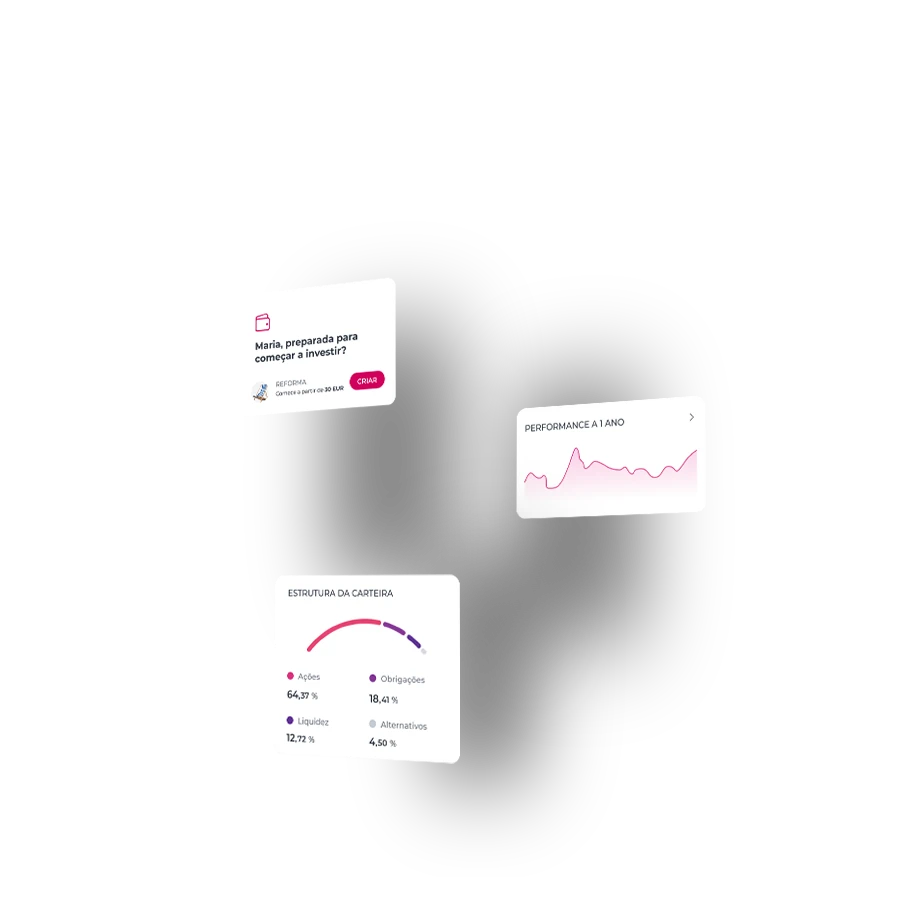

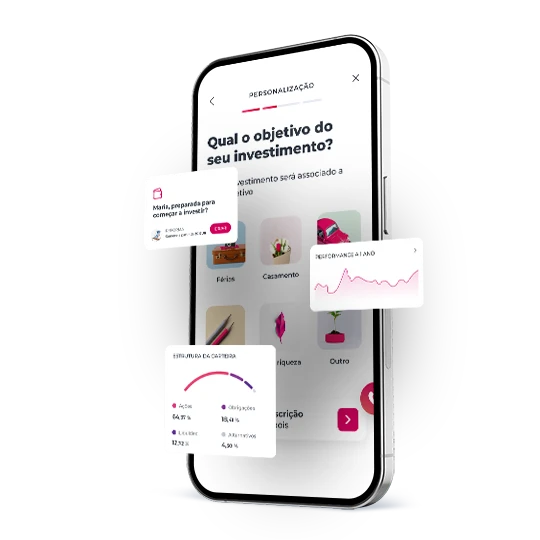

Invest on auto-pilot with the

3 strategies

Tax benefits

Compare cards

How does financial insurance work?

Insurance products linked to funds, expertly managed for customized and flexible investment solutions.

Invest in 4 steps!

It’s that easy!

Invest in 4 steps!

It’s that easy!

Articles, tips and a lot more

Insurance investment essentials

Articles, tips and a lot more

Insurance investment essentials

Related topics

Some more investment picks...

Frequently asked questions

Questions? We'll help

Financial insurance includes life insurance, categorized into two types: capitalization insurance and unit-linked insurance.

Financial insurance includes life insurance, categorized into two types: capitalization insurance and unit-linked insurance.

- They allow a programmed, flexible and personalized savings, starting from low amounts, with a medium / long term investment horizon;

- They are a diversified investment of savings in autonomous investment funds, with different investment styles, thus adapting to different investor profiles and different market moments;

- No guaranteed minimum return, no guarantee of the capital invested, the investment risk is borne by the policyholder.

- They allow a programmed, flexible and personalized savings, starting from low amounts, with a medium / long term investment horizon;

- They are a diversified investment of savings in autonomous investment funds, with different investment styles, thus adapting to different investor profiles and different market moments;

- No guaranteed minimum return, no guarantee of the capital invested, the investment risk is borne by the policyholder.

- They offer structured, adaptable, and tailored savings options, beginning with modest sums, catering to medium to long-term investment objectives.

- Provide capital security, with potential for guaranteed minimum returns depending on the policy.

- In the case of a PPR (Personal Pension Plan), they come with tax advantages such as the potential for deduction from income tax and special early repayment conditions defined by law (DL 158/2002).

- Additionally, they feature reduced income taxation for early repayments as stipulated by law, with rates as low as 8%.

- They offer structured, adaptable, and tailored savings options, beginning with modest sums, catering to medium to long-term investment objectives.

- Provide capital security, with potential for guaranteed minimum returns depending on the policy.

- In the case of a PPR (Personal Pension Plan), they come with tax advantages such as the potential for deduction from income tax and special early repayment conditions defined by law (DL 158/2002).

- Additionally, they feature reduced income taxation for early repayments as stipulated by law, with rates as low as 8%.

Given their typical medium to long-term nature, financial insurances benefit from tax advantages in income taxation, as follows under the IRS (Individual Income Tax):

- 2% upon redemption/maturity after 8 years;

- 4% upon redemption between the 5th and 8th year;

- 28% upon redemption within the first 5 years.

Given their typical medium to long-term nature, financial insurances benefit from tax advantages in income taxation, as follows under the IRS (Individual Income Tax):

- 2% upon redemption/maturity after 8 years;

- 4% upon redemption between the 5th and 8th year;

- 28% upon redemption within the first 5 years.

Frequently asked questions

Questions? We'll help

Financial insurance includes life insurance, categorized into two types: capitalization insurance and unit-linked insurance.

Financial insurance includes life insurance, categorized into two types: capitalization insurance and unit-linked insurance.

- They allow a programmed, flexible and personalized savings, starting from low amounts, with a medium / long term investment horizon;

- They are a diversified investment of savings in autonomous investment funds, with different investment styles, thus adapting to different investor profiles and different market moments;

- No guaranteed minimum return, no guarantee of the capital invested, the investment risk is borne by the policyholder.

- They allow a programmed, flexible and personalized savings, starting from low amounts, with a medium / long term investment horizon;

- They are a diversified investment of savings in autonomous investment funds, with different investment styles, thus adapting to different investor profiles and different market moments;

- No guaranteed minimum return, no guarantee of the capital invested, the investment risk is borne by the policyholder.

- They offer structured, adaptable, and tailored savings options, beginning with modest sums, catering to medium to long-term investment objectives.

- Provide capital security, with potential for guaranteed minimum returns depending on the policy.

- In the case of a PPR (Personal Pension Plan), they come with tax advantages such as the potential for deduction from income tax and special early repayment conditions defined by law (DL 158/2002).

- Additionally, they feature reduced income taxation for early repayments as stipulated by law, with rates as low as 8%.

- They offer structured, adaptable, and tailored savings options, beginning with modest sums, catering to medium to long-term investment objectives.

- Provide capital security, with potential for guaranteed minimum returns depending on the policy.

- In the case of a PPR (Personal Pension Plan), they come with tax advantages such as the potential for deduction from income tax and special early repayment conditions defined by law (DL 158/2002).

- Additionally, they feature reduced income taxation for early repayments as stipulated by law, with rates as low as 8%.

Given their typical medium to long-term nature, financial insurances benefit from tax advantages in income taxation, as follows under the IRS (Individual Income Tax):

- 2% upon redemption/maturity after 8 years;

- 4% upon redemption between the 5th and 8th year;

- 28% upon redemption within the first 5 years.

Given their typical medium to long-term nature, financial insurances benefit from tax advantages in income taxation, as follows under the IRS (Individual Income Tax):

- 2% upon redemption/maturity after 8 years;

- 4% upon redemption between the 5th and 8th year;

- 28% upon redemption within the first 5 years.

Legal documents

Key Investor Information Document

See documentsNeed help?

We are here for you

Need help?

Need help?

Looking for a branch?

Looking for a branch?

Need to call us?

Need to call us?