- Individuals

- Young people

Young People

If you're under 30, this is your space

Our solutions

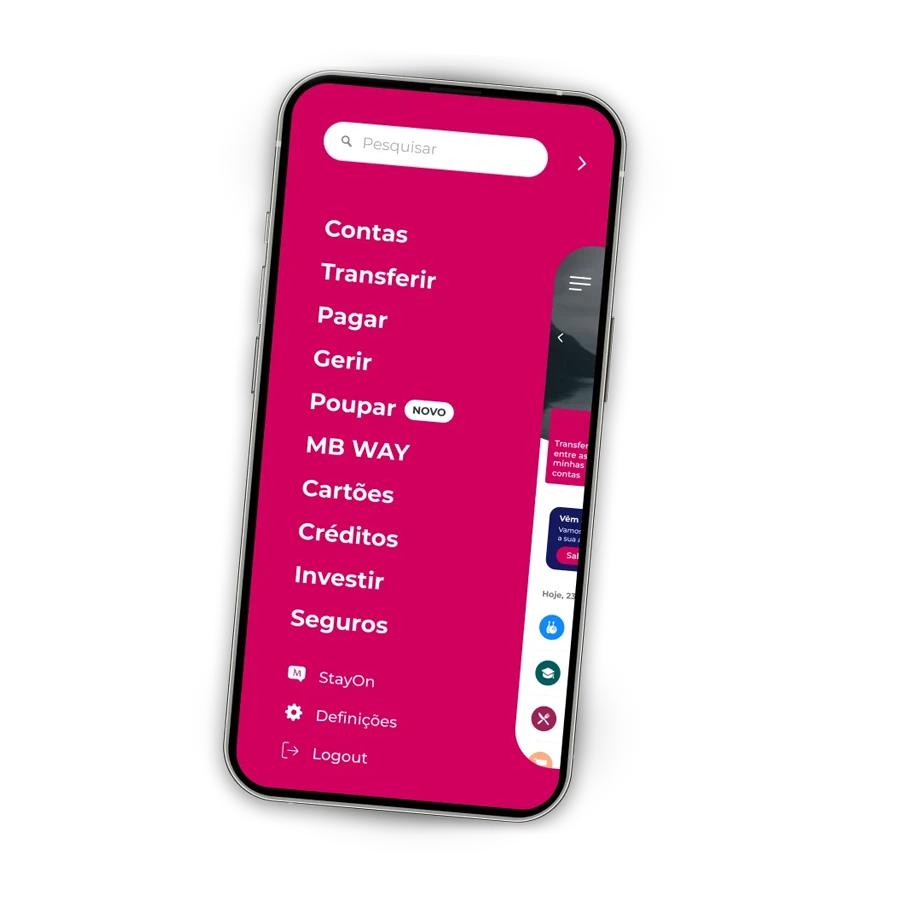

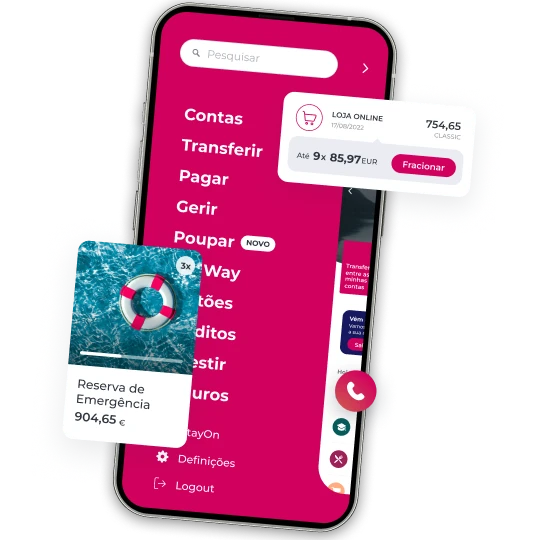

Your cool start to banking

For university students

For university students

Ever heard about Unni?

From 18 to 30 years old

From 18 to 30 years old

Kickstart your financial journey with Millennium

For minors

For minors

Big solutions for little ones

If You’re Young

What are you waiting for?

State Personal Guarantee

IMT And Stamp Duty Exemption

Frequently asked questions

Questions? We'll help

You can open an account through our app, website, or at a branch.

You can open an account through our app, website, or at a branch.

The required documents are:

- Account Opening Proposal*

- Customer File and Signature Sheet*

- Citizen Card or original Identity Card or Personal Card (only if you do not have ID); or Taxpayer Card

- Proof of address (to prove tax address: water or electricity receipt, or other supporting document). This document must not be older than 12 months

- Proof of employment and professional entity (professional card, salary slip or any other supporting document).

*You can download these documents from our website or ask for them at a branch.

The required documents are:

- Account Opening Proposal*

- Customer File and Signature Sheet*

- Citizen Card or original Identity Card or Personal Card (only if you do not have ID); or Taxpayer Card

- Proof of address (to prove tax address: water or electricity receipt, or other supporting document). This document must not be older than 12 months

- Proof of employment and professional entity (professional card, salary slip or any other supporting document).

*You can download these documents from our website or ask for them at a branch.

Depending on your profile and age, we offer various options:

- Millennium Account

- Millennium Start Account

- Basic Account

- Minimum Banking Services Account

In addition, the Millennium Account can be enhanced with additional solutions that offer a range of advantages:

- Cliente Frequente

- Prestige Program

- Prestige Direct Start and Family

- Millennium GO!

- Millennium GO! Uni

- Mais Portugal (for residents abroad)

These advantages can include a variety of benefits, such as insurance, discounts on partners and exemption from fees for debit and credit cards.

Depending on your profile and age, we offer various options:

- Millennium Account

- Millennium Start Account

- Basic Account

- Minimum Banking Services Account

In addition, the Millennium Account can be enhanced with additional solutions that offer a range of advantages:

- Cliente Frequente

- Prestige Program

- Prestige Direct Start and Family

- Millennium GO!

- Millennium GO! Uni

- Mais Portugal (for residents abroad)

These advantages can include a variety of benefits, such as insurance, discounts on partners and exemption from fees for debit and credit cards.

Now that you’ve reached adulthood, you need to update your account to ensure continued access to all the products and services we offer! You can update it quickly and easily online through our app or, if you prefer, at a Millennium branch. If you update it online, no documents are required — just make sure you have your Digital Mobile Key with an active digital signature.

Now that you’ve reached adulthood, you need to update your account to ensure continued access to all the products and services we offer! You can update it quickly and easily online through our app or, if you prefer, at a Millennium branch. If you update it online, no documents are required — just make sure you have your Digital Mobile Key with an active digital signature.

If you choose to update your account online, no documents are required. You only need to have your Digital Mobile Key with an active digital signature. If you prefer to visit a branch, you’ll need:

- A valid Citizen Card or Passport;

- An updated proof of address (such as a water, electricity, or internet bill);

- Proof of employment or an enrollment certificate (if applicable).

Regardless of how you complete the process, there are no associated costs.

If you choose to update your account online, no documents are required. You only need to have your Digital Mobile Key with an active digital signature. If you prefer to visit a branch, you’ll need:

- A valid Citizen Card or Passport;

- An updated proof of address (such as a water, electricity, or internet bill);

- Proof of employment or an enrollment certificate (if applicable).

Regardless of how you complete the process, there are no associated costs.

Frequently asked questions

Questions? We'll help

You can open an account through our app, website, or at a branch.

You can open an account through our app, website, or at a branch.

The required documents are:

- Account Opening Proposal*

- Customer File and Signature Sheet*

- Citizen Card or original Identity Card or Personal Card (only if you do not have ID); or Taxpayer Card

- Proof of address (to prove tax address: water or electricity receipt, or other supporting document). This document must not be older than 12 months

- Proof of employment and professional entity (professional card, salary slip or any other supporting document).

*You can download these documents from our website or ask for them at a branch.

The required documents are:

- Account Opening Proposal*

- Customer File and Signature Sheet*

- Citizen Card or original Identity Card or Personal Card (only if you do not have ID); or Taxpayer Card

- Proof of address (to prove tax address: water or electricity receipt, or other supporting document). This document must not be older than 12 months

- Proof of employment and professional entity (professional card, salary slip or any other supporting document).

*You can download these documents from our website or ask for them at a branch.

Depending on your profile and age, we offer various options:

- Millennium Account

- Millennium Start Account

- Basic Account

- Minimum Banking Services Account

In addition, the Millennium Account can be enhanced with additional solutions that offer a range of advantages:

- Cliente Frequente

- Prestige Program

- Prestige Direct Start and Family

- Millennium GO!

- Millennium GO! Uni

- Mais Portugal (for residents abroad)

These advantages can include a variety of benefits, such as insurance, discounts on partners and exemption from fees for debit and credit cards.

Depending on your profile and age, we offer various options:

- Millennium Account

- Millennium Start Account

- Basic Account

- Minimum Banking Services Account

In addition, the Millennium Account can be enhanced with additional solutions that offer a range of advantages:

- Cliente Frequente

- Prestige Program

- Prestige Direct Start and Family

- Millennium GO!

- Millennium GO! Uni

- Mais Portugal (for residents abroad)

These advantages can include a variety of benefits, such as insurance, discounts on partners and exemption from fees for debit and credit cards.

Now that you’ve reached adulthood, you need to update your account to ensure continued access to all the products and services we offer! You can update it quickly and easily online through our app or, if you prefer, at a Millennium branch. If you update it online, no documents are required — just make sure you have your Digital Mobile Key with an active digital signature.

Now that you’ve reached adulthood, you need to update your account to ensure continued access to all the products and services we offer! You can update it quickly and easily online through our app or, if you prefer, at a Millennium branch. If you update it online, no documents are required — just make sure you have your Digital Mobile Key with an active digital signature.

If you choose to update your account online, no documents are required. You only need to have your Digital Mobile Key with an active digital signature. If you prefer to visit a branch, you’ll need:

- A valid Citizen Card or Passport;

- An updated proof of address (such as a water, electricity, or internet bill);

- Proof of employment or an enrollment certificate (if applicable).

Regardless of how you complete the process, there are no associated costs.

If you choose to update your account online, no documents are required. You only need to have your Digital Mobile Key with an active digital signature. If you prefer to visit a branch, you’ll need:

- A valid Citizen Card or Passport;

- An updated proof of address (such as a water, electricity, or internet bill);

- Proof of employment or an enrollment certificate (if applicable).

Regardless of how you complete the process, there are no associated costs.

Need help?

We are here for you

Need help?

Need help?

Looking for a branch?

Looking for a branch?

Need to call us?

Need to call us?