- Individuals

- Loans

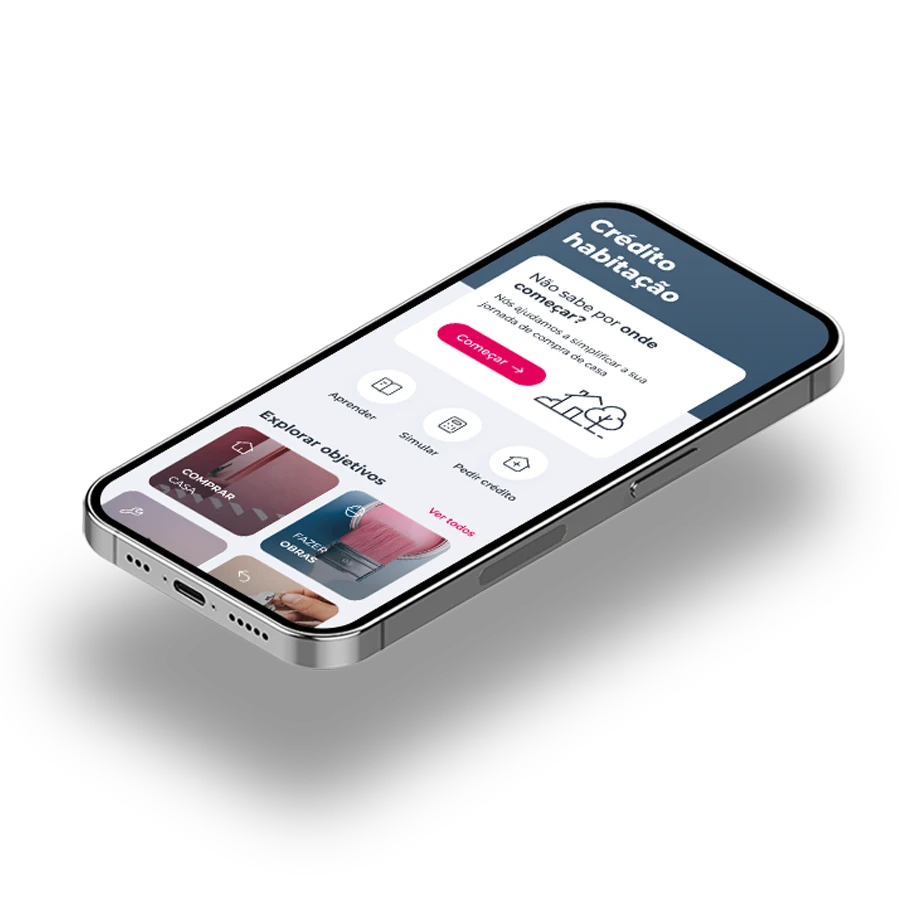

- Mortgage loan

- Young adults

Mortgage Solutions for Young People

State Guarantee for Young People Under 35

State Personal Guarantee

Don’t miss out!

With State Personal Guarantee, Millennium can lend up to 100% of the property value (the State guarantee cannot exceed 15% of the original contracted principal amount).

With State Personal Guarantee, Millennium can lend up to 100% of the property value (the State guarantee cannot exceed 15% of the original contracted principal amount).

*Access conditions

Everything you need to know

State Guarantee

Features

Fist Home Tax Exemptions

Grab this opportunity

Get The Best Of Both Worlds

Up to 100% financing plus exemptions from IMT and Stamp Duty

Learn about tax benefitsFist Home Tax Exemptions

Grab this opportunity

Get The Best Of Both Worlds

Up to 100% financing plus exemptions from IMT and Stamp Duty

Learn about tax benefitsFrequently asked questions

Questions? We'll help

The State Guarantee is valid for 10 years from the date of the loan but ends earlier if the loan holders fulfill all obligations in contracts with a term shorter than 10 years.

The State Guarantee is valid for 10 years from the date of the loan but ends earlier if the loan holders fulfill all obligations in contracts with a term shorter than 10 years.

Borrowers must provide the following documents when applying for a loan:

- Tax residence certificate issued by the Portuguese Tax Authority;

- Borrowers with IRS declaration: Access key to the IRS Settlement Note, or;

- Borrowers without IRS declaration with declared income to Social Security - Certificate of exemption from IRS submission + Social Security statement of declared income for the last 3 months, or;

- Borrowers without IRS declaration and recipients of social benefits: Certificate of exemption from IRS submission + Social Security statement showing the monthly value and type of social benefits received;

- Certificate of no tax debts issued by the Portuguese Tax Authority;

- Certificate of no debts to Social Security;

- Negative property registry certificate issued by the Portuguese Tax Authority;

- Certificate of No Debt from the Tax Authority;

- Certificate of No Debt from Social Security;

- Borrower's Declaration confirming that the financing will be used for the intended purpose, that the borrower has never benefited from the State Guarantee for this purpose, and that the acquired property will remain dedicated to its intended use during the Guarantee period.

Borrowers must provide the following documents when applying for a loan:

- Tax residence certificate issued by the Portuguese Tax Authority;

- Borrowers with IRS declaration: Access key to the IRS Settlement Note, or;

- Borrowers without IRS declaration with declared income to Social Security - Certificate of exemption from IRS submission + Social Security statement of declared income for the last 3 months, or;

- Borrowers without IRS declaration and recipients of social benefits: Certificate of exemption from IRS submission + Social Security statement showing the monthly value and type of social benefits received;

- Certificate of no tax debts issued by the Portuguese Tax Authority;

- Certificate of no debts to Social Security;

- Negative property registry certificate issued by the Portuguese Tax Authority;

- Certificate of No Debt from the Tax Authority;

- Certificate of No Debt from Social Security;

- Borrower's Declaration confirming that the financing will be used for the intended purpose, that the borrower has never benefited from the State Guarantee for this purpose, and that the acquired property will remain dedicated to its intended use during the Guarantee period.

Loans for construction, renovations, and financial leasing agreements are excluded from this State support.

Loans for construction, renovations, and financial leasing agreements are excluded from this State support.

No, it also applies to loans that partially finance the transaction value, provided the percentage is proportionally adjusted when the Bank finances less than 100%, as long as it exceeds 85% of the transaction value.

No, it also applies to loans that partially finance the transaction value, provided the percentage is proportionally adjusted when the Bank finances less than 100%, as long as it exceeds 85% of the transaction value.

The transaction value is the lower amount between the purchase price and the appraisal value of the urban property or autonomous unit of an urban property at the time the loan is contracted. This value is determined under Article 18 of Decree-Law No. 74-A/2017, of June 23, and must be accepted by the lender.

The transaction value is the lower amount between the purchase price and the appraisal value of the urban property or autonomous unit of an urban property at the time the loan is contracted. This value is determined under Article 18 of Decree-Law No. 74-A/2017, of June 23, and must be accepted by the lender.

Frequently asked questions

Questions? We'll help

The State Guarantee is valid for 10 years from the date of the loan but ends earlier if the loan holders fulfill all obligations in contracts with a term shorter than 10 years.

The State Guarantee is valid for 10 years from the date of the loan but ends earlier if the loan holders fulfill all obligations in contracts with a term shorter than 10 years.

Borrowers must provide the following documents when applying for a loan:

- Tax residence certificate issued by the Portuguese Tax Authority;

- Borrowers with IRS declaration: Access key to the IRS Settlement Note, or;

- Borrowers without IRS declaration with declared income to Social Security - Certificate of exemption from IRS submission + Social Security statement of declared income for the last 3 months, or;

- Borrowers without IRS declaration and recipients of social benefits: Certificate of exemption from IRS submission + Social Security statement showing the monthly value and type of social benefits received;

- Certificate of no tax debts issued by the Portuguese Tax Authority;

- Certificate of no debts to Social Security;

- Negative property registry certificate issued by the Portuguese Tax Authority;

- Certificate of No Debt from the Tax Authority;

- Certificate of No Debt from Social Security;

- Borrower's Declaration confirming that the financing will be used for the intended purpose, that the borrower has never benefited from the State Guarantee for this purpose, and that the acquired property will remain dedicated to its intended use during the Guarantee period.

Borrowers must provide the following documents when applying for a loan:

- Tax residence certificate issued by the Portuguese Tax Authority;

- Borrowers with IRS declaration: Access key to the IRS Settlement Note, or;

- Borrowers without IRS declaration with declared income to Social Security - Certificate of exemption from IRS submission + Social Security statement of declared income for the last 3 months, or;

- Borrowers without IRS declaration and recipients of social benefits: Certificate of exemption from IRS submission + Social Security statement showing the monthly value and type of social benefits received;

- Certificate of no tax debts issued by the Portuguese Tax Authority;

- Certificate of no debts to Social Security;

- Negative property registry certificate issued by the Portuguese Tax Authority;

- Certificate of No Debt from the Tax Authority;

- Certificate of No Debt from Social Security;

- Borrower's Declaration confirming that the financing will be used for the intended purpose, that the borrower has never benefited from the State Guarantee for this purpose, and that the acquired property will remain dedicated to its intended use during the Guarantee period.

Loans for construction, renovations, and financial leasing agreements are excluded from this State support.

Loans for construction, renovations, and financial leasing agreements are excluded from this State support.

No, it also applies to loans that partially finance the transaction value, provided the percentage is proportionally adjusted when the Bank finances less than 100%, as long as it exceeds 85% of the transaction value.

No, it also applies to loans that partially finance the transaction value, provided the percentage is proportionally adjusted when the Bank finances less than 100%, as long as it exceeds 85% of the transaction value.

The transaction value is the lower amount between the purchase price and the appraisal value of the urban property or autonomous unit of an urban property at the time the loan is contracted. This value is determined under Article 18 of Decree-Law No. 74-A/2017, of June 23, and must be accepted by the lender.

The transaction value is the lower amount between the purchase price and the appraisal value of the urban property or autonomous unit of an urban property at the time the loan is contracted. This value is determined under Article 18 of Decree-Law No. 74-A/2017, of June 23, and must be accepted by the lender.

Need help?

We are here for you

Need help?

Need help?

Looking for a branch?

Looking for a branch?

Need to call us?

Need to call us?