- Individuals

- Savings

Savings

I want a savings account...

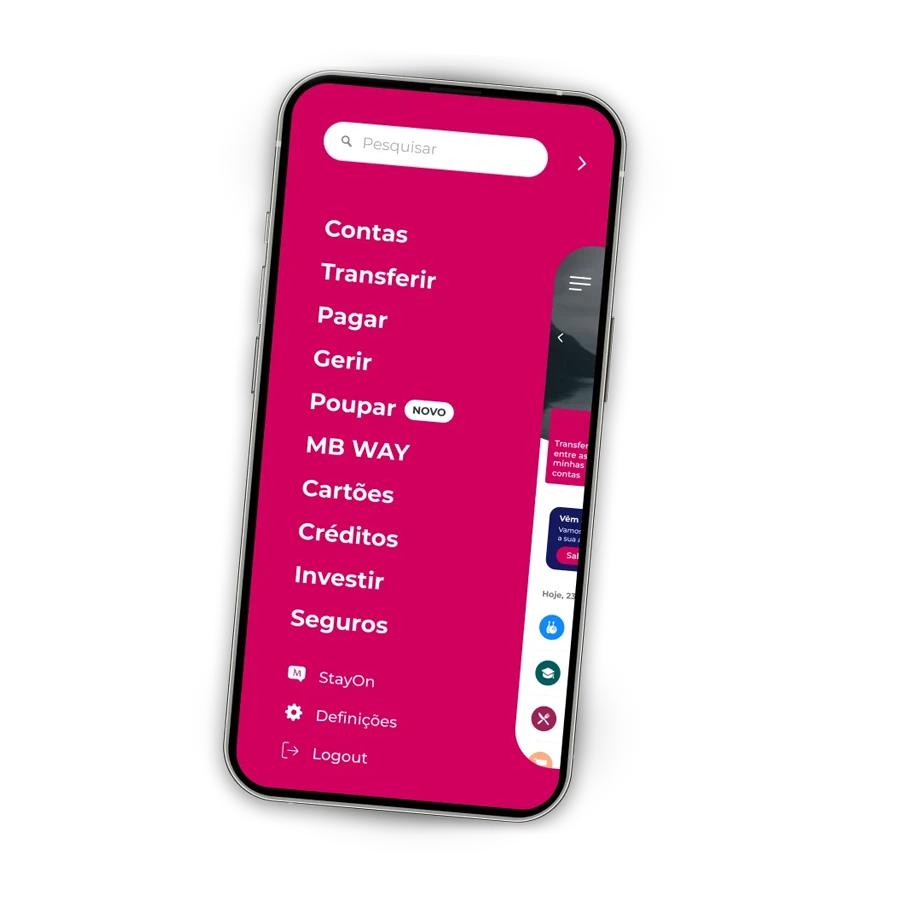

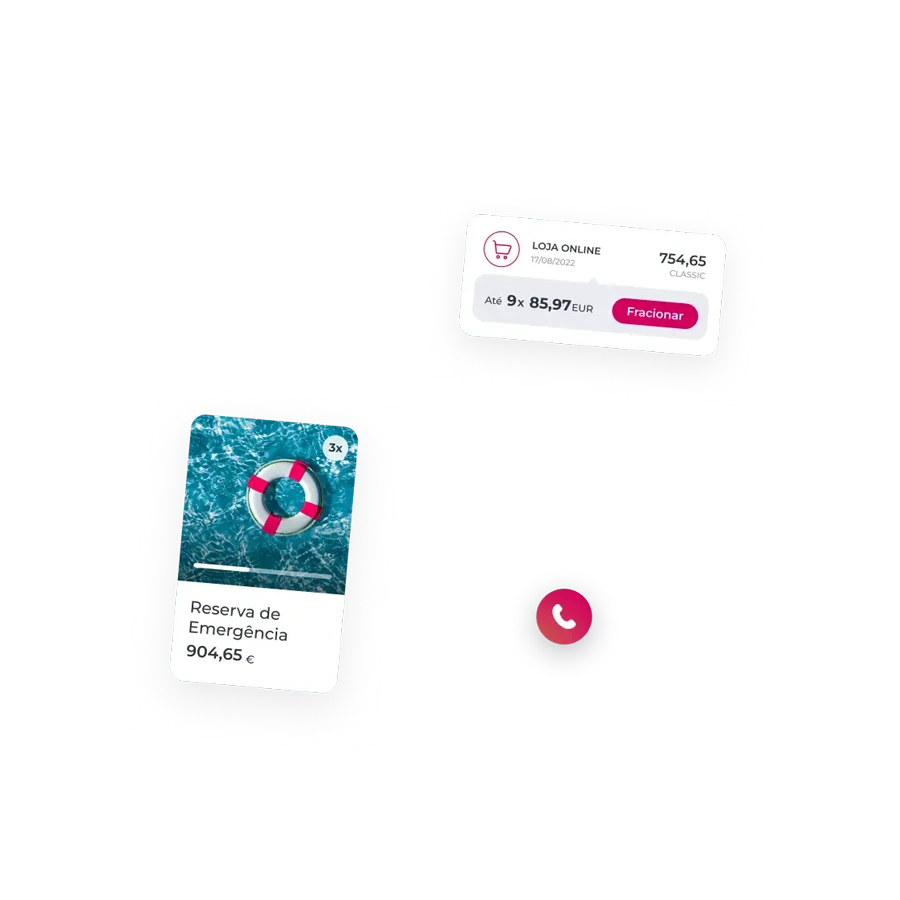

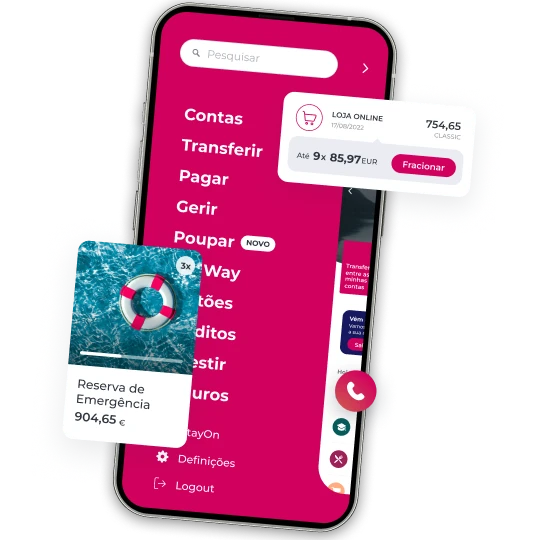

App deposit

Save on the app with a minimum of €500

TANB: 1.05% to 1.50%

TANB: 1.05% to 1.50%

Amount €500 to €500,000

Amount €500 to €500,000

TANB: 1.05% to 1.50%

TANB: 1.05% to 1.50%

Amount €500 to €500,000

Amount €500 to €500,000

App deposit

Save on the app with a minimum of €500

TANB: 1.05% to 1.50%

Amount €500 to €500,000

Net Millennium Flexível

Flexible savings

TANB: 0.65% to 0.90%

Amount: €250 to €500,000

Poupança Ordenado

Save with a 1.50% rate

TANB: 1.50%

Minimum amount: €25

Poupança Aforro

Save from €25

TANB: 0.70% avg.

Without mandatory distributions

Poupança Reforço Frequente

Save from €100 with monthly interest

TANB: 1.25%

Top up from €100

Poupança Reforço Prestige

Save from €250

TANB: 1.40%

Top up from €250

Poupança Let’s GO!

Do you have kids under 17?

TANB: 1.75%

Top up from €25

Compare cards

Frequently asked questions

Questions? We'll help

You can open your savings in the app or on the website.

In the app go to For you > Save > Savings

On the website, in Savings and Investments > Term Applications > Our solutions > Discover all our savings > Then just choose the one that suits you best.

You can open your savings in the app or on the website.

In the app go to For you > Save > Savings

On the website, in Savings and Investments > Term Applications > Our solutions > Discover all our savings > Then just choose the one that suits you best.

Early withdrawal is possible for all of our savings options, except for the Apprazo deposit. However, please note that all accounts are subject to early withdrawal penalties.

Early withdrawal is possible for all of our savings options, except for the Apprazo deposit. However, please note that all accounts are subject to early withdrawal penalties.

The tax regime associated with savings is 28% (19,6% in the case of deposit income earned by residents of the Autonomous Region of the Azores and the Autonomous Region of Madeira)

The tax regime associated with savings is 28% (19,6% in the case of deposit income earned by residents of the Autonomous Region of the Azores and the Autonomous Region of Madeira)

The interest is deposited into the designated current account.

The interest is deposited into the designated current account.

The Deposit Guarantee Fund is a public entity with its own autonomy.

It is based in Lisbon and operates alongside the Bank of Portugal. Its role is to guarantee the repayment of deposits held at participating credit institutions if those deposits become unavailable. The Fund follows the rules set out in Articles 154 to 173 of the General Regime of Credit Institutions and Financial Companies, as well as all other applicable legislation.

The Deposit Guarantee Fund is a public entity with its own autonomy.

It is based in Lisbon and operates alongside the Bank of Portugal. Its role is to guarantee the repayment of deposits held at participating credit institutions if those deposits become unavailable. The Fund follows the rules set out in Articles 154 to 173 of the General Regime of Credit Institutions and Financial Companies, as well as all other applicable legislation.

Frequently asked questions

Questions? We'll help

You can open your savings in the app or on the website.

In the app go to For you > Save > Savings

On the website, in Savings and Investments > Term Applications > Our solutions > Discover all our savings > Then just choose the one that suits you best.

You can open your savings in the app or on the website.

In the app go to For you > Save > Savings

On the website, in Savings and Investments > Term Applications > Our solutions > Discover all our savings > Then just choose the one that suits you best.

Early withdrawal is possible for all of our savings options, except for the Apprazo deposit. However, please note that all accounts are subject to early withdrawal penalties.

Early withdrawal is possible for all of our savings options, except for the Apprazo deposit. However, please note that all accounts are subject to early withdrawal penalties.

The tax regime associated with savings is 28% (19,6% in the case of deposit income earned by residents of the Autonomous Region of the Azores and the Autonomous Region of Madeira)

The tax regime associated with savings is 28% (19,6% in the case of deposit income earned by residents of the Autonomous Region of the Azores and the Autonomous Region of Madeira)

The interest is deposited into the designated current account.

The interest is deposited into the designated current account.

The Deposit Guarantee Fund is a public entity with its own autonomy.

It is based in Lisbon and operates alongside the Bank of Portugal. Its role is to guarantee the repayment of deposits held at participating credit institutions if those deposits become unavailable. The Fund follows the rules set out in Articles 154 to 173 of the General Regime of Credit Institutions and Financial Companies, as well as all other applicable legislation.

The Deposit Guarantee Fund is a public entity with its own autonomy.

It is based in Lisbon and operates alongside the Bank of Portugal. Its role is to guarantee the repayment of deposits held at participating credit institutions if those deposits become unavailable. The Fund follows the rules set out in Articles 154 to 173 of the General Regime of Credit Institutions and Financial Companies, as well as all other applicable legislation.

Need help?

We are here for you

Need help?

Need help?

Looking for a branch?

Looking for a branch?

Need to call us?

Need to call us?