- Individuals

- Insurance

- HOMIN home multi-risk

HOMIN home insurance

Complete protection for your home

Guaranteed protection Home insurance that protects your property and belongings, offering a variety of innovative assistance services.

Senior assistance We help fill out your tax return, deliver groceries to your door, and provide transportation for medical appointments.

Home services by the technician are limited to 10 hours per year. Grocery deliveries are available once a month, and transportation for medical appointments is offered up to twice a year, with a maximum distance of 50 km from your residence.

Electrical assistance If you experience issues with your home's electrical system, we’ll arrange repairs and cover the costs, including the technician's travel and labor.

The coverage for electrical system repairs, including labor and parts, is limited to €250 per claim, with a maximum of 2 claims per year. A €20 copayment applies per claim.

All the benefits

What’s included?

IT assistance Having issues with your computer, tablet, or smartphone? We offer phone support and can send a technician to your home to help.

The phone support line assists with installation, configuration, and software downloads, limited to 5 requests per year. Home technician visits are capped at 2 requests per year. Equipment repairs are covered up to €200 per claim, with a maximum of 2 claims annually and a €25 deductible per claim.

Flexible insurance For homeowners, tenants, or landlords.

Domestic emergency We provide services for issues with your water heater or boiler, interior pipes, ducts, or leaking faucets.

The coverage for repairing external fixed plumbing elements, plumbing systems, and water heaters/boilers is limited to €200 per claim, with a maximum of 3 claims per year. A €20 copayment applies per claim.

All the benefits

What’s included?

Guaranteed protection Home insurance that protects your property and belongings, offering a variety of innovative assistance services.

Senior assistance We help fill out your tax return, deliver groceries to your door, and provide transportation for medical appointments.

Home services by the technician are limited to 10 hours per year. Grocery deliveries are available once a month, and transportation for medical appointments is offered up to twice a year, with a maximum distance of 50 km from your residence.

Electrical assistance If you experience issues with your home's electrical system, we’ll arrange repairs and cover the costs, including the technician's travel and labor.

The coverage for electrical system repairs, including labor and parts, is limited to €250 per claim, with a maximum of 2 claims per year. A €20 copayment applies per claim.

IT assistance Having issues with your computer, tablet, or smartphone? We offer phone support and can send a technician to your home to help.

The phone support line assists with installation, configuration, and software downloads, limited to 5 requests per year. Home technician visits are capped at 2 requests per year. Equipment repairs are covered up to €200 per claim, with a maximum of 2 claims annually and a €25 deductible per claim.

Flexible insurance For homeowners, tenants, or landlords.

Domestic emergency We provide services for issues with your water heater or boiler, interior pipes, ducts, or leaking faucets.

The coverage for repairing external fixed plumbing elements, plumbing systems, and water heaters/boilers is limited to €200 per claim, with a maximum of 3 claims per year. A €20 copayment applies per claim.

All the benefits

What’s included?

Guaranteed protection Home insurance that protects your property and belongings, offering a variety of innovative assistance services.

Senior assistance We help fill out your tax return, deliver groceries to your door, and provide transportation for medical appointments.

Home services by the technician are limited to 10 hours per year. Grocery deliveries are available once a month, and transportation for medical appointments is offered up to twice a year, with a maximum distance of 50 km from your residence.

Electrical assistance If you experience issues with your home's electrical system, we’ll arrange repairs and cover the costs, including the technician's travel and labor.

The coverage for electrical system repairs, including labor and parts, is limited to €250 per claim, with a maximum of 2 claims per year. A €20 copayment applies per claim.

IT assistance Having issues with your computer, tablet, or smartphone? We offer phone support and can send a technician to your home to help.

The phone support line assists with installation, configuration, and software downloads, limited to 5 requests per year. Home technician visits are capped at 2 requests per year. Equipment repairs are covered up to €200 per claim, with a maximum of 2 claims annually and a €25 deductible per claim.

Flexible insurance For homeowners, tenants, or landlords.

Domestic emergency We provide services for issues with your water heater or boiler, interior pipes, ducts, or leaking faucets.

The coverage for repairing external fixed plumbing elements, plumbing systems, and water heaters/boilers is limited to €200 per claim, with a maximum of 3 claims per year. A €20 copayment applies per claim.

HOMIN options

Choose your level of protection…

Coverage

Coverage and amounts

Coverage

Base

Regular

Premium

Coverage

Fire

Base

Insured capital property;

Contents without deductible

Regular

Insured capital property;

Contents without deductible

Premium

Insured capital property;

Contents without deductible

Coverage

Storms

Base

Insured capital property;

Contents deductible €150

Regular

Insured capital property;

Contents selected deductible

Premium

Insured capital property;

Contents selected deductible

Coverage

Floods

Base

(Optional)

Insured capital property;

Contents deductible €150

Regular

Insured capital property;

Contents selected deductible

Premium

Insured capital property;

Contents selected deductible

Coverage

Water damage

Base

Insured capital property;

Contents deductible €150

Regular

Insured capital property;

Contents selected deductible

Premium

Insured capital property;

Contents selected deductible

Coverage

Search and repair for faults

Base

2.5% of the capital, max. €2,500 for property;

Contents without deductible

Regular

2.5% of the capital, max. €2,500 for property;

Contents without deductible

Premium

2.5% of the capital, max. €5,000 for property;

Contents without deductible

Coverage

Land subsidence

Base

Insured capital property;

Contents deductible €150

Regular

Insured capital property;

Contents selected deductible

Premium

Insured capital property;

Contents selected deductible

Coverage

Theft and burglary

Base

−

Regular

Insured capital property;

Contents selected deductible

Premium

Insured capital property;

Contents selected deductible

Coverage

Aircraft crash

Base

−

Regular

Insured capital property;

Contents selected deductible

Premium

Insured capital property;

Contents selected deductible

Coverage

Collision/impact from land vehicles

Base

−

Regular

Insured capital property;

Contents selected deductible

Premium

Insured capital property;

Contents selected deductible

Coverage

Oil spill

Base

−

Regular

Insured capital property;

Contents selected deductible

Premium

Insured capital property;

Contents selected deductible

Coverage

Strikes

Base

−

Regular

Insured capital property;

Contents selected deductible

Premium

Insured capital property;

Contents selected deductible

Coverage

Glass breakage

Base

−

Regular

2% of the insured capital, max. €500 for property;

Contents without deductible

Premium

2% of the insured capital, max. €1,000 for property;

Contents without deductible

Coverage

Breakage or falling of antennas

Base

−

Regular

1% of the insured capital, max. €1,000 for property;

Contents without deductible

Premium

1% of the insured capital, max. €1,000 for property;

Contents without deductible

Coverage

Breakage or fall of solar panels

Base

−

Regular

1% of the insured capital, max. €10,000 for property;

Contents without deductible

Premium

1% of the insured capital, max. €10,000 for property;

Contents without deductible

Coverage

Demolition and debris removal

Base

−

Regular

10% of the insured capital value property;

Contents without deductible

Premium

10% of the insured capital value property;

Contents without deductible

Coverage

Content storage

Base

−

Regular

5% of the capital, max. €750/month;

Contents without deductible

Premium

5% of the capital, max. €750/month;

Contents without deductible

Coverage

Loss of housing

Base

−

Regular

5% of the capital, up to €750/month;

Contents without deductible

Premium

5% of the capital, up to €750/month;

Contents without deductible

Coverage

Temporary move

Base

−

Regular

5% of the capital, max. €750/month;

Contents without deductible

Premium

5% of the capital, max. €750/month;

Contents without deductible

Coverage

Liability owner or occupant

Base

€100,000 for property;

Contents without deductible

Regular

€150,000 for property;

Contents without deductible

Premium

€250,000 for property;

Contents without deductible

Coverage

Liability tenant

Base

€100,000 applicable as a tenant;

Contents without deductible

Regular

€150,000 applicable as a tenant;

Contents without deductible

Premium

€250,000 applicable as a tenant;

Contents without deductible

Coverage

Legal expenses resulting from liability Owner/Occupant

Base

−

Regular

Costs: €2,500;

Fees: €1,500 for property;

Contents without deductible

Premium

Costs: €2,500;

Fees: €1,500 for property;

Contents without deductible

Coverage

Legal expenses resulting from liability Tenant

Base

−

Regular

Costs: €2,500;

Fees: €1,500;

Applicable as a tenant;

Contents without deductible

Premium

Costs: €2,500;

Fees: €1,500;

Applicable as a tenant;

Contents without deductible

Coverage

Domestic personal risks Death or permanent invalidity

Base

−

Regular

25% of the contents capital, max. €7,500;

Contents without deductible

Premium

25% of the contents capital, max. €7,500;

Contents without deductible

Coverage

Domestic personal risks Medical expenses

Base

−

Regular

2.5% of the contents capital, max. €1,250;

Contents without deductible

Premium

2.5% of the contents capital, max. €1,250;

Contents without deductible

Coverage

Home personal risks Funeral allowance

Base

−

Regular

5% of the contents capital, max. €1,250;

Contents without deductible

Premium

5% of the contents capital, max. €1,250;

Contents without deductible

Coverage

Home assistance

Base

−

Regular

View General Conditions

Contents without deductible

Premium

View General Conditions

Contents without deductible

Coverage

Aesthetic damages

Base

−

Regular

Maximum of €2,500;

Property without deductible

Premium

Maximum of €5,000;

Property without deductible

Coverage

Acts of vandalism and intentional damage

Base

−

Regular

Insured capital property;

Contents selected deductible

Premium

Insured capital property;

Contents selected deductible

Coverage

Damage to the landlord's property

Base

−

Regular

Maximum of €7,500;

Applicable as a tenant;

Contents without deductible

Premium

Maximum of €7,500;

Applicable as a tenant;

Contents without deductible

Coverage

Accidental damage

Base

−

Regular

−

Premium

€1,000 / 2 claims per year;

Contents €200

Coverage

Domestic emergency

Base

−

Regular

View General Conditions

Applicable as a tenant - Contents

Premium

Coverage

Seismic events

Base

(Optional)

Insured capital property;

Contents 5% deductible

Regular

(Optional)

Insured capital property;

Contents 5% deductible

Premium

Insured capital property;

Contents 5% deductible

Coverage

Electrical risks

Base

(Optional)

Equity capital: property;

Contents 10%, min. €150.00

Regular

(Optional)

Equity capital: property;

Contents 10%, min. €150.00

Premium

Equity capital: property;

Contents 10%, min. €150.00

Coverage

Damage to gardens and plantations

Base

−

Regular

−

Premium

(Optional)

Insured capital property;

No deductible

Coverage

Loss of income

Base

−

Regular

The declared amount for this coverage, max. €7,500;

Applicable in the capacity of landlord - Property;

No deductible

Premium

The declared amount for this coverage, max. €7,500;

Applicable in the capacity of landlord - Property;

No deductible

Coverage

Vehicles in garage

Base

−

Regular

(Optional)

Own capital;

Contents selected deductible

Premium

(Optional)

Own capital;

Contents selected deductible

Coverage

Extension of warranty for appliances

Base

(Optional)

View General Conditions

Contents

Regular

(Optional)

View General Conditions

Contents

Premium

View General Conditions

Contents

Coverage

Liability swimming pools

Base

−

Regular

−

Premium

(Optional)

€250,000

Property

No deductible

Coverage

Damage to walls and fences

Base

(Optional)

Up to 10% of the property value;

Selected deductible

Regular

(Optional)

Up to 10% of the property value;

Selected deductible

Premium

(Optional)

Up to 10% of the property value;

Selected deductible

Coverage

IT support

Base

−

Regular

(Optional)

View General Conditions

Contents

Premium

View General Conditions

Contents

Coverage

Electrical assistance

Base

−

Regular

(Optional)

View General Conditions

Property

Premium

View General Conditions

Property

Coverage

Senior assistance

Base

−

Regular

(Optional)

View General Conditions

Property or contents

Premium

(Optional)

View General Conditions

Property or contents

The HOMIN insurance premium varies depending on whether you are a property owner, landlord, or tenant. It will also vary based on the quality of your home's construction, the selected package and deductible, and the value of your contents.

Coverage for Seismic Events

1 - SCOPE

a) It guarantees, within the limits stated in the Particular Conditions, damages caused to insured property as a direct result of earthquakes, volcanic eruptions, tsunamis, underground fire, and fire resulting from these phenomena.

b) Events occurring within 72 hours following the verification of the first damage to the insured objects will be considered a single claim.

2 - EXCLUSIONS

The following are excluded from this coverage:

a) Damages already existing at the date of the claim;

b) Damages to buildings recognized as fragile, such as those made of wood or plastic panels, as well as those in which resilient construction materials do not make at least 50% of the structure, and all objects within the buildings as mentioned above;

c) Buildings that are totally or partially vacant and intended for demolition;

d) Losses or damages to insured property if, at the event, the building was already damaged, defective, collapsed, or displaced from its foundations, affecting its overall stability and safety.

3 - DEDUCTIBLE

The deductible specified in the Particular Conditions will always be subtracted from the compensation the insurer is required to pay for each claim.

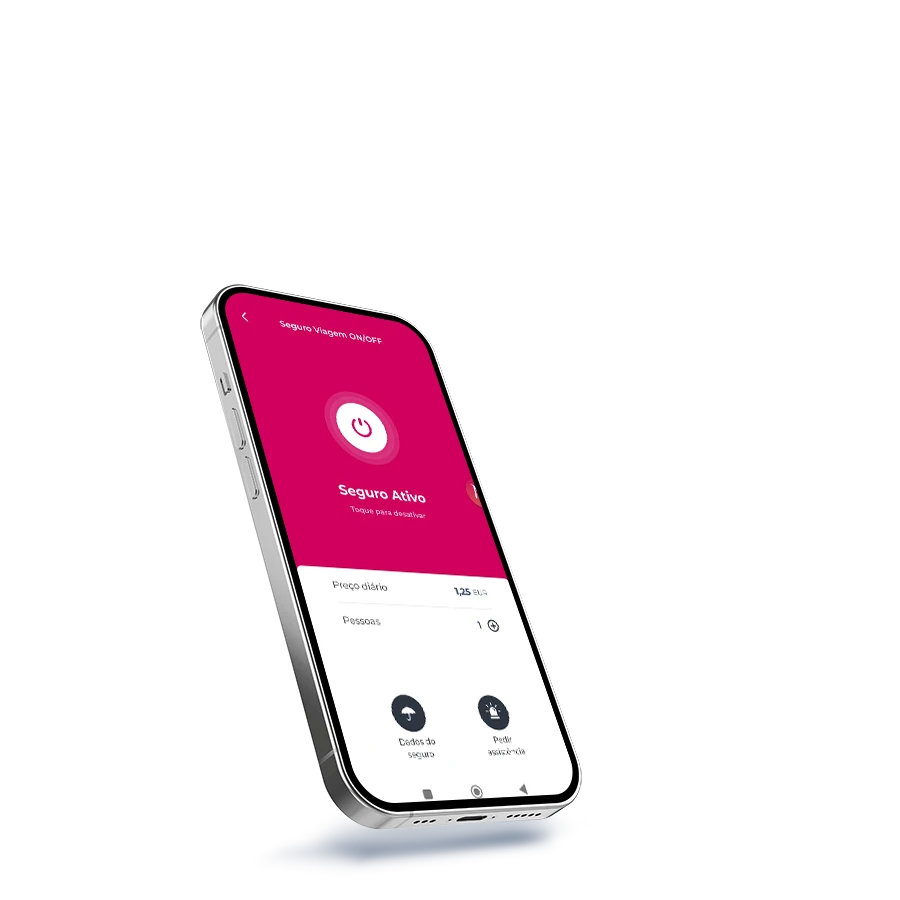

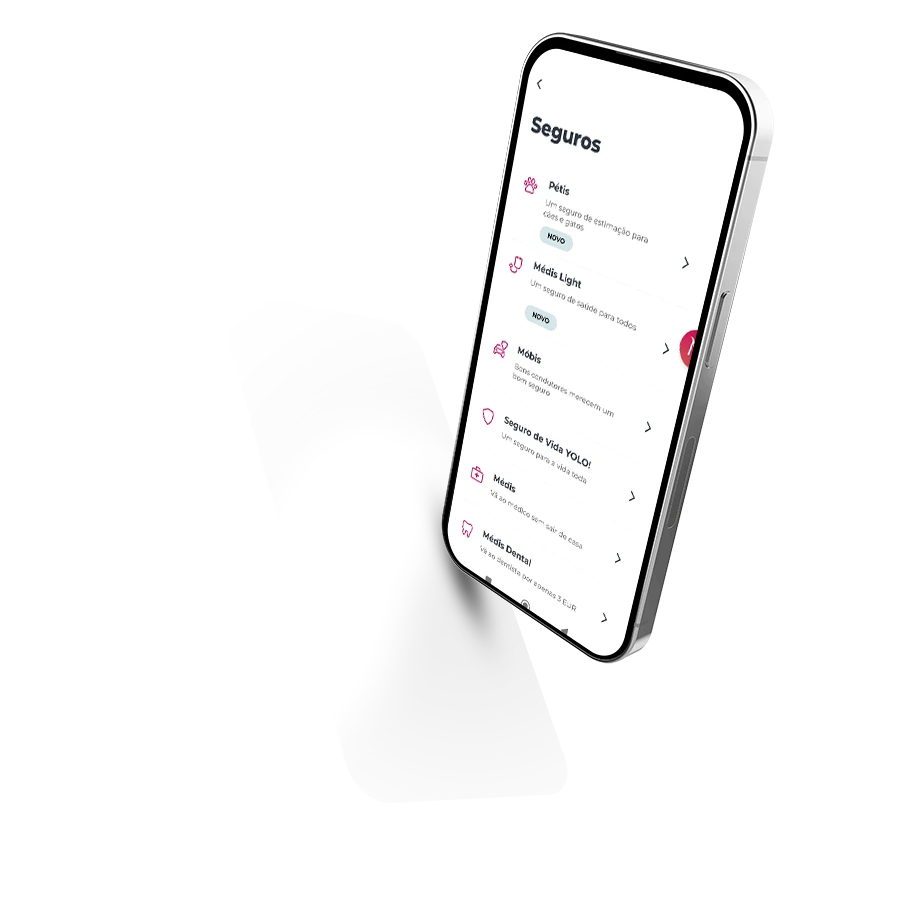

Subscribe and report a claim

It’s quick and easy

Subscribe and report a claim

It’s quick and easy

Frequently asked questions

Questions? We’ll help

Insuring your contents protects your belongings from risks like theft, burglary, flooding, fires, and other unforeseen incidents.

Insuring your contents protects your belongings from risks like theft, burglary, flooding, fires, and other unforeseen incidents.

The contents of a home refer to all the belongings inside, divided into standard contents and special items.

Standard contents include items owned by the policyholder, such as furniture, appliances (both built-in and non-built-in), dishes, crockery, clothes, decorations, and electronic devices.

Special items refer to high-value goods like jewelry, precious materials, antiques, artwork, coin collections, or other items valued over €1,000.

If the policyholder doesn't specify special items, their total value in the event of a claim is limited to 20% of the total contents value, up to a maximum of €7,500, with a limit of €1,000 per item.

The contents of a home refer to all the belongings inside, divided into standard contents and special items.

Standard contents include items owned by the policyholder, such as furniture, appliances (both built-in and non-built-in), dishes, crockery, clothes, decorations, and electronic devices.

Special items refer to high-value goods like jewelry, precious materials, antiques, artwork, coin collections, or other items valued over €1,000.

If the policyholder doesn't specify special items, their total value in the event of a claim is limited to 20% of the total contents value, up to a maximum of €7,500, with a limit of €1,000 per item.

The insured amount should reflect the market value of the building's reconstruction cost, considering factors such as the type of construction and any other elements that may influence the value. For the contents, the insured amount should correspond to the total value of each item as if it were new.

The insured amount should reflect the market value of the building's reconstruction cost, considering factors such as the type of construction and any other elements that may influence the value. For the contents, the insured amount should correspond to the total value of each item as if it were new.

Special items are valuables that require extra attention due to their characteristics, such as gold, jewelry, furs, collectibles, video cameras, artwork, antiques, or other items valued over €1,000.

These items must be listed and specified in the insurance proposal or provided through a separate list.

Special items are valuables that require extra attention due to their characteristics, such as gold, jewelry, furs, collectibles, video cameras, artwork, antiques, or other items valued over €1,000.

These items must be listed and specified in the insurance proposal or provided through a separate list.

Yes, depending on the coverage, you can choose from different deductible options.

Yes, depending on the coverage, you can choose from different deductible options.

Frequently asked questions

Questions? We’ll help

Insuring your contents protects your belongings from risks like theft, burglary, flooding, fires, and other unforeseen incidents.

Insuring your contents protects your belongings from risks like theft, burglary, flooding, fires, and other unforeseen incidents.

The contents of a home refer to all the belongings inside, divided into standard contents and special items.

Standard contents include items owned by the policyholder, such as furniture, appliances (both built-in and non-built-in), dishes, crockery, clothes, decorations, and electronic devices.

Special items refer to high-value goods like jewelry, precious materials, antiques, artwork, coin collections, or other items valued over €1,000.

If the policyholder doesn't specify special items, their total value in the event of a claim is limited to 20% of the total contents value, up to a maximum of €7,500, with a limit of €1,000 per item.

The contents of a home refer to all the belongings inside, divided into standard contents and special items.

Standard contents include items owned by the policyholder, such as furniture, appliances (both built-in and non-built-in), dishes, crockery, clothes, decorations, and electronic devices.

Special items refer to high-value goods like jewelry, precious materials, antiques, artwork, coin collections, or other items valued over €1,000.

If the policyholder doesn't specify special items, their total value in the event of a claim is limited to 20% of the total contents value, up to a maximum of €7,500, with a limit of €1,000 per item.

The insured amount should reflect the market value of the building's reconstruction cost, considering factors such as the type of construction and any other elements that may influence the value. For the contents, the insured amount should correspond to the total value of each item as if it were new.

The insured amount should reflect the market value of the building's reconstruction cost, considering factors such as the type of construction and any other elements that may influence the value. For the contents, the insured amount should correspond to the total value of each item as if it were new.

Special items are valuables that require extra attention due to their characteristics, such as gold, jewelry, furs, collectibles, video cameras, artwork, antiques, or other items valued over €1,000.

These items must be listed and specified in the insurance proposal or provided through a separate list.

Special items are valuables that require extra attention due to their characteristics, such as gold, jewelry, furs, collectibles, video cameras, artwork, antiques, or other items valued over €1,000.

These items must be listed and specified in the insurance proposal or provided through a separate list.

Yes, depending on the coverage, you can choose from different deductible options.

Yes, depending on the coverage, you can choose from different deductible options.

Need help?

We are here for you

Need help?

Need help?

Looking for a branch?

Looking for a branch?

Need to call us?

Need to call us?