- Individuals

- Investments

- Stocks

Stocks

Invest in your preferred companies spanning from the USA to Europe

Benefits

Why invest in stocks?

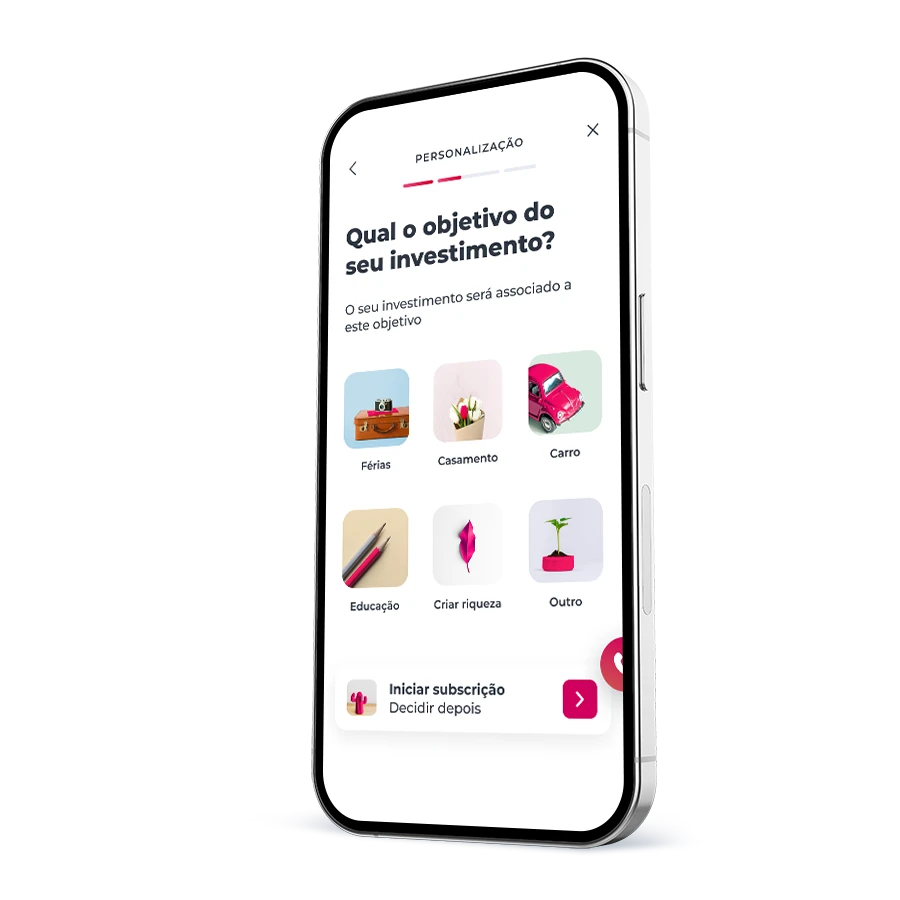

Stocks adapted to your investor profile

Invest in 4 steps!

It’s that easy!

Invest in 4 steps!

It’s that easy!

Articles, tips and a lot more

Everything you need to invest

Articles, tips and a lot more

Everything you need to invest

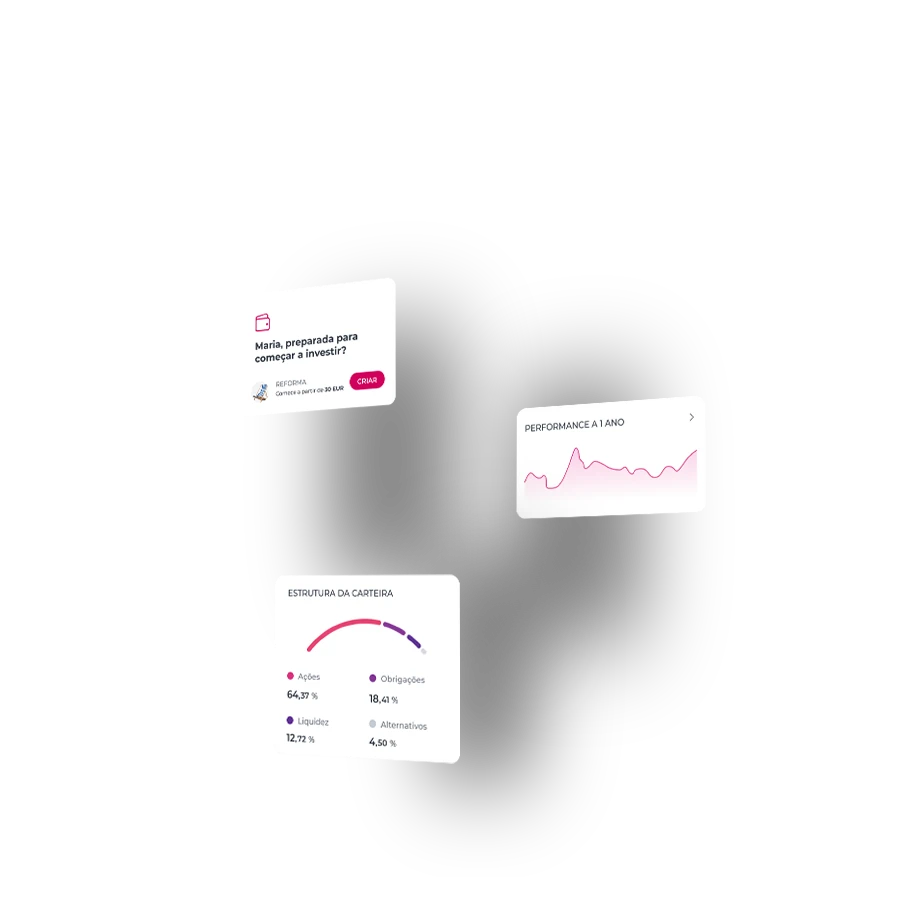

MTrader

Stock market trading in your hands

MTrader

Stock market trading in your hands

Frequently asked questions

Questions? We'll help

Stocks are securities that represent the ownership interest in a company (public limited companies).

The ownership of a company can be divided among a small group of individuals (an economic group or members of the same family) or spread among many people. This occurs when the company's stocks are listed on a stock exchange, making them easily accessible for public purchase.

Stocks are securities that represent the ownership interest in a company (public limited companies).

The ownership of a company can be divided among a small group of individuals (an economic group or members of the same family) or spread among many people. This occurs when the company's stocks are listed on a stock exchange, making them easily accessible for public purchase.

Stop Loss Order: it’s an automatic sell order that prevents losses after the devaluation of your security on the market. It detects in advance the decrease in value of your securities without the need for constant monitoring.

Stop Limit Order: it’s a buy order that only becomes active when the security you want to buy rises to a price set by you.

Stop Loss Order: it’s an automatic sell order that prevents losses after the devaluation of your security on the market. It detects in advance the decrease in value of your securities without the need for constant monitoring.

Stop Limit Order: it’s a buy order that only becomes active when the security you want to buy rises to a price set by you.

One of the great advantages of investing in the stock market is the possibility of buying or selling stocks from different markets, sectors, and companies, allowing for portfolio diversification and risk reduction. Other advantages to highlight include:

Potential for appreciation: by investing in stocks, you have the opportunity to benefit from the appreciation of the assets in the long-term. If the company you have invested in performs well and its market value increases, the stock price may rise, allowing you to sell the stocks at a higher price than the initial purchase price.

Dividends and income: many companies distribute part of their profits to stockholders in the form of dividends or other income. These payments represent a portion of the company's earnings and are distributed regularly to stockholders.

Liquidity: stocks are liquid assets, which means that they can be bought and sold easily on the market. This gives investors the flexibility to convert their investments into cash whenever they want, offering high liquidity compared to other types of investments such as real estate.

Participation in business: when you invest in stocks you become a shareholder, and can participate in the business and growth of companies. You can also have voting rights at shareholder meetings and influence some corporate decisions.

One of the great advantages of investing in the stock market is the possibility of buying or selling stocks from different markets, sectors, and companies, allowing for portfolio diversification and risk reduction. Other advantages to highlight include:

Potential for appreciation: by investing in stocks, you have the opportunity to benefit from the appreciation of the assets in the long-term. If the company you have invested in performs well and its market value increases, the stock price may rise, allowing you to sell the stocks at a higher price than the initial purchase price.

Dividends and income: many companies distribute part of their profits to stockholders in the form of dividends or other income. These payments represent a portion of the company's earnings and are distributed regularly to stockholders.

Liquidity: stocks are liquid assets, which means that they can be bought and sold easily on the market. This gives investors the flexibility to convert their investments into cash whenever they want, offering high liquidity compared to other types of investments such as real estate.

Participation in business: when you invest in stocks you become a shareholder, and can participate in the business and growth of companies. You can also have voting rights at shareholder meetings and influence some corporate decisions.

Investing in stocks also involves certain risks. It's important to educate yourself before making any investment decisions. Some of the main risks associated with investing in stocks are:

Market fluctuations: the value of stocks can fluctuate due to various factors such as general economic conditions, political events, changes in interest rates, financial instability, and market volatility. These factors can negatively affect the stock price and result in financial losses.

Business risk: investing in stocks implies owning a part of a company. Therefore, investors are subject to specific risks related to the company in which they invest. These risks may include poor management, competition, changes in industry conditions, legal or regulatory problems, and more.

Concentrated portfolio: if an investor concentrates a large part of their investment portfolio in stocks of a single company or a specific sector, they are exposed to higher risk.. If that company or sector faces significant problems, the losses can be more severe.

Irregular dividends: while receiving dividends is an advantage, it’s important to know that not all companies pay dividends regularly or at all times. The payment of dividends is subject to the company's policy and financial performance.

Before making any investment decisions, perform a thorough analysis, diversify your portfolio, understand your risk tolerance, and seek guidance from financial professionals, if needed.

Investing in stocks also involves certain risks. It's important to educate yourself before making any investment decisions. Some of the main risks associated with investing in stocks are:

Market fluctuations: the value of stocks can fluctuate due to various factors such as general economic conditions, political events, changes in interest rates, financial instability, and market volatility. These factors can negatively affect the stock price and result in financial losses.

Business risk: investing in stocks implies owning a part of a company. Therefore, investors are subject to specific risks related to the company in which they invest. These risks may include poor management, competition, changes in industry conditions, legal or regulatory problems, and more.

Concentrated portfolio: if an investor concentrates a large part of their investment portfolio in stocks of a single company or a specific sector, they are exposed to higher risk.. If that company or sector faces significant problems, the losses can be more severe.

Irregular dividends: while receiving dividends is an advantage, it’s important to know that not all companies pay dividends regularly or at all times. The payment of dividends is subject to the company's policy and financial performance.

Before making any investment decisions, perform a thorough analysis, diversify your portfolio, understand your risk tolerance, and seek guidance from financial professionals, if needed.

The first step before making any investment decisions is to understand how the stock market works and familiarize yourself with its characteristics. It's important to know the different types of stocks, the associated risks, and the investment strategies you can take. Next, you should set your investment goals and determine your investor profile, taking into consideration your risk tolerance, available time for investing, and financial situation.

The next step is to open an account with a brokerage firm. Research and compare different brokerage options, considering factors such as fees, customer service, and available investment tools.

After opening your brokerage account, you can start building a diversified portfolio by investing in stocks from different sectors and industries. Conduct thorough research on companies you are interested in, analyze their financials, and consider factors such as their competitive position and growth prospects.

When you're ready to make investment decisions, place buy or sell orders through your brokerage account and regularly monitor the performance of your investments.

The first step before making any investment decisions is to understand how the stock market works and familiarize yourself with its characteristics. It's important to know the different types of stocks, the associated risks, and the investment strategies you can take. Next, you should set your investment goals and determine your investor profile, taking into consideration your risk tolerance, available time for investing, and financial situation.

The next step is to open an account with a brokerage firm. Research and compare different brokerage options, considering factors such as fees, customer service, and available investment tools.

After opening your brokerage account, you can start building a diversified portfolio by investing in stocks from different sectors and industries. Conduct thorough research on companies you are interested in, analyze their financials, and consider factors such as their competitive position and growth prospects.

When you're ready to make investment decisions, place buy or sell orders through your brokerage account and regularly monitor the performance of your investments.

Frequently asked questions

Questions? We'll help

Stocks are securities that represent the ownership interest in a company (public limited companies).

The ownership of a company can be divided among a small group of individuals (an economic group or members of the same family) or spread among many people. This occurs when the company's stocks are listed on a stock exchange, making them easily accessible for public purchase.

Stocks are securities that represent the ownership interest in a company (public limited companies).

The ownership of a company can be divided among a small group of individuals (an economic group or members of the same family) or spread among many people. This occurs when the company's stocks are listed on a stock exchange, making them easily accessible for public purchase.

Stop Loss Order: it’s an automatic sell order that prevents losses after the devaluation of your security on the market. It detects in advance the decrease in value of your securities without the need for constant monitoring.

Stop Limit Order: it’s a buy order that only becomes active when the security you want to buy rises to a price set by you.

Stop Loss Order: it’s an automatic sell order that prevents losses after the devaluation of your security on the market. It detects in advance the decrease in value of your securities without the need for constant monitoring.

Stop Limit Order: it’s a buy order that only becomes active when the security you want to buy rises to a price set by you.

One of the great advantages of investing in the stock market is the possibility of buying or selling stocks from different markets, sectors, and companies, allowing for portfolio diversification and risk reduction. Other advantages to highlight include:

Potential for appreciation: by investing in stocks, you have the opportunity to benefit from the appreciation of the assets in the long-term. If the company you have invested in performs well and its market value increases, the stock price may rise, allowing you to sell the stocks at a higher price than the initial purchase price.

Dividends and income: many companies distribute part of their profits to stockholders in the form of dividends or other income. These payments represent a portion of the company's earnings and are distributed regularly to stockholders.

Liquidity: stocks are liquid assets, which means that they can be bought and sold easily on the market. This gives investors the flexibility to convert their investments into cash whenever they want, offering high liquidity compared to other types of investments such as real estate.

Participation in business: when you invest in stocks you become a shareholder, and can participate in the business and growth of companies. You can also have voting rights at shareholder meetings and influence some corporate decisions.

One of the great advantages of investing in the stock market is the possibility of buying or selling stocks from different markets, sectors, and companies, allowing for portfolio diversification and risk reduction. Other advantages to highlight include:

Potential for appreciation: by investing in stocks, you have the opportunity to benefit from the appreciation of the assets in the long-term. If the company you have invested in performs well and its market value increases, the stock price may rise, allowing you to sell the stocks at a higher price than the initial purchase price.

Dividends and income: many companies distribute part of their profits to stockholders in the form of dividends or other income. These payments represent a portion of the company's earnings and are distributed regularly to stockholders.

Liquidity: stocks are liquid assets, which means that they can be bought and sold easily on the market. This gives investors the flexibility to convert their investments into cash whenever they want, offering high liquidity compared to other types of investments such as real estate.

Participation in business: when you invest in stocks you become a shareholder, and can participate in the business and growth of companies. You can also have voting rights at shareholder meetings and influence some corporate decisions.

Investing in stocks also involves certain risks. It's important to educate yourself before making any investment decisions. Some of the main risks associated with investing in stocks are:

Market fluctuations: the value of stocks can fluctuate due to various factors such as general economic conditions, political events, changes in interest rates, financial instability, and market volatility. These factors can negatively affect the stock price and result in financial losses.

Business risk: investing in stocks implies owning a part of a company. Therefore, investors are subject to specific risks related to the company in which they invest. These risks may include poor management, competition, changes in industry conditions, legal or regulatory problems, and more.

Concentrated portfolio: if an investor concentrates a large part of their investment portfolio in stocks of a single company or a specific sector, they are exposed to higher risk.. If that company or sector faces significant problems, the losses can be more severe.

Irregular dividends: while receiving dividends is an advantage, it’s important to know that not all companies pay dividends regularly or at all times. The payment of dividends is subject to the company's policy and financial performance.

Before making any investment decisions, perform a thorough analysis, diversify your portfolio, understand your risk tolerance, and seek guidance from financial professionals, if needed.

Investing in stocks also involves certain risks. It's important to educate yourself before making any investment decisions. Some of the main risks associated with investing in stocks are:

Market fluctuations: the value of stocks can fluctuate due to various factors such as general economic conditions, political events, changes in interest rates, financial instability, and market volatility. These factors can negatively affect the stock price and result in financial losses.

Business risk: investing in stocks implies owning a part of a company. Therefore, investors are subject to specific risks related to the company in which they invest. These risks may include poor management, competition, changes in industry conditions, legal or regulatory problems, and more.

Concentrated portfolio: if an investor concentrates a large part of their investment portfolio in stocks of a single company or a specific sector, they are exposed to higher risk.. If that company or sector faces significant problems, the losses can be more severe.

Irregular dividends: while receiving dividends is an advantage, it’s important to know that not all companies pay dividends regularly or at all times. The payment of dividends is subject to the company's policy and financial performance.

Before making any investment decisions, perform a thorough analysis, diversify your portfolio, understand your risk tolerance, and seek guidance from financial professionals, if needed.

The first step before making any investment decisions is to understand how the stock market works and familiarize yourself with its characteristics. It's important to know the different types of stocks, the associated risks, and the investment strategies you can take. Next, you should set your investment goals and determine your investor profile, taking into consideration your risk tolerance, available time for investing, and financial situation.

The next step is to open an account with a brokerage firm. Research and compare different brokerage options, considering factors such as fees, customer service, and available investment tools.

After opening your brokerage account, you can start building a diversified portfolio by investing in stocks from different sectors and industries. Conduct thorough research on companies you are interested in, analyze their financials, and consider factors such as their competitive position and growth prospects.

When you're ready to make investment decisions, place buy or sell orders through your brokerage account and regularly monitor the performance of your investments.

The first step before making any investment decisions is to understand how the stock market works and familiarize yourself with its characteristics. It's important to know the different types of stocks, the associated risks, and the investment strategies you can take. Next, you should set your investment goals and determine your investor profile, taking into consideration your risk tolerance, available time for investing, and financial situation.

The next step is to open an account with a brokerage firm. Research and compare different brokerage options, considering factors such as fees, customer service, and available investment tools.

After opening your brokerage account, you can start building a diversified portfolio by investing in stocks from different sectors and industries. Conduct thorough research on companies you are interested in, analyze their financials, and consider factors such as their competitive position and growth prospects.

When you're ready to make investment decisions, place buy or sell orders through your brokerage account and regularly monitor the performance of your investments.

Related topics

Some more investment picks...

Need help?

We are here for you

Need help?

Need help?

Looking for a branch?

Looking for a branch?

Need to call us?

Need to call us?