- Individuals

- Loans

- Personal loan

- Online

Online Personal Loan TAEG 11.2%

Planing your next trip?

Apply for your personal loan up to €75,000

Apply for your loan 100% online between €1,000 and €25,000

Finance the expenses of your loan to make the payment easier

The decision is instant for requests up to €25,000 without any paperwork or waiting times

Add insurance to your loan for protection in case of unemployment

If approved, the money is deposited into your account immediately

Choose the term that best suits you, between 18 and 84 months

There’s always more to discover

A few more benefits

Life Insurance

Covers total and permanent disability due to accident

In the event of death, the insurer pays the insured amount to Millennium

80% of our Clients subscribe

Payment Protection Plan

Covers situations of unemployment, medical leave, or accidents

Includes salary protection plan

Includes compensation for death or permanent disability

Rates and charges

Now on to the math

Annual Percentage Rate of Charge (TAEG)

11.2%

Nominal Annual Rate (TAN)

9.700%

11.2% TAEG (annual percentage rate of charge) and 9.700% TAN (annual nominal rate) wwith monthly installments of €83.23, for a simulation of a €5,000 loan with an 84-month term. Total amount charged to the consumer: €7,079.32, including interest and Stamp Duty for the use of credit and interest. Subject to credit risk analysis. The granting of the credit is subject to Banco de Portugal's macro-prudential rules.

Conditions valid until February 18, 2026.

Conditions valid until February 18, 2026.

These are the amounts and terms you can choose from

€1,000 to €3,000

18 to 48 months

€3,001 to €25,000

18 to 84 months

And these are the charges and expenses

Loan opening Stamp Duty

Annual Percentage Rate of Charge (TAEG)

10.1%

Nominal Annual Rate (TAN)

8.700%

10.1% TAEG (annual percentage rate of charge) and 8.700% TAN (annual nominal rate) with monthly installments of €80.57, for simulation of a €5,000 loan with an 84- month term. Total amount charged to the consumer: €6,855.58, including interest and Stamp Duty for the use of credit and interest. Subject to credit risk analysis. The granting of the credit is subject to Banco de Portugal's macro-prudential rules.

Conditions valid until February 18, 2026.

Conditions valid until February 18, 2026.

These are the amounts and terms you can choose from

€1,000 to €3,000

18 to 48 months

€3,001 to €25,000

18 to 84 months

And these are the charges and expenses

Loan opening Stamp Duty

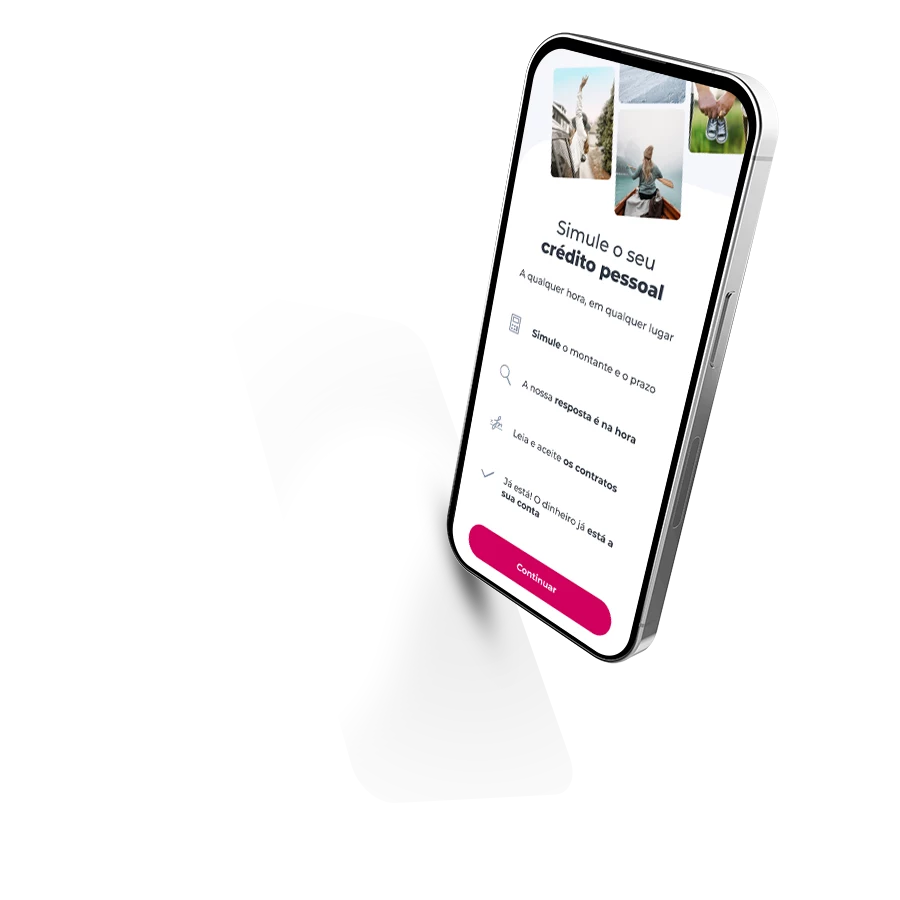

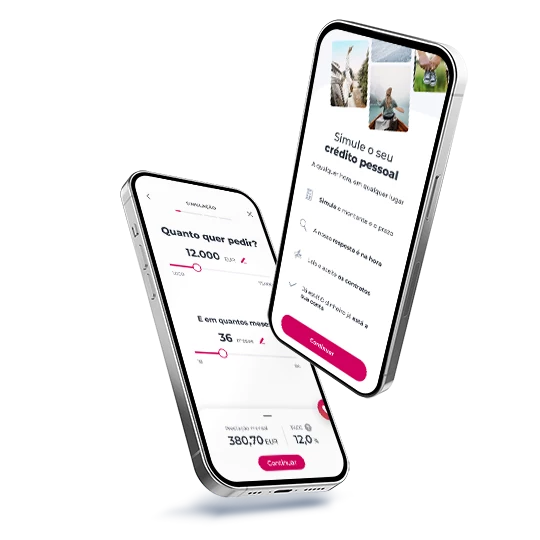

How it works

These are the available amount options

Apply online, on the app or on the website, with instant decision.

You can make your request on the app or website and after the approval you must go to a branch.

You can apply at a branch and benefit from fee discounts if you subscribe to banking products.

Want to apply for a Personal Loan?

Before you make a decision…

Assess the expense you plan to make, considering various factors.

Make sure the loan installments won’t compromise the budget of your household.

Verify the conditions of the loan and read all the pre-contractual and contract information.

If you change your mind after applying, you can cancel it on the website or app within 14 days.

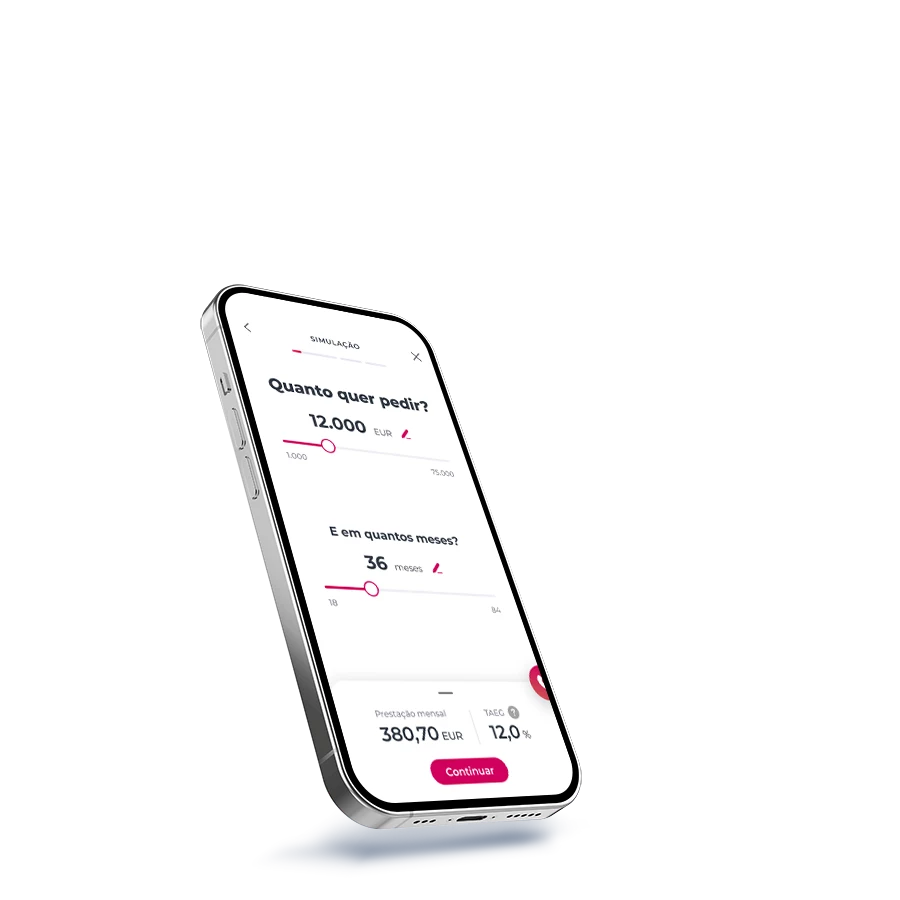

1, 2, 3 and that’s it!

Applying for a loan is simple

Calculate the loan

Calculate the loan

by choosing the amount and term to discover the monthly fee.

by choosing the amount and term to discover the monthly fee.

Confirm the application

Confirm the application

after reading all the legal documentation.

after reading all the legal documentation.

Receive the money in your account

Receive the money in your account

after the loan has been approved and after you have read and signed the contract.

after the loan has been approved and after you have read and signed the contract.

What do you need?

What do you need?

To be over 18 years old

To be over 18 years old

Proof of income documents

Proof of income documents

(latest income statement and/or last 3 payslips)

(latest income statement and/or last 3 payslips)

ID documents of the parties involved

ID documents of the parties involved

1, 2, 3 and that’s it!

Applying for a loan is simple

Calculate the loan

Calculate the loan

by choosing the amount and term to discover the monthly fee.

by choosing the amount and term to discover the monthly fee.

Confirm the application

Confirm the application

after reading all the legal documentation.

after reading all the legal documentation.

Receive the money in your account

Receive the money in your account

after the loan has been approved and after you have read and signed the contract.

after the loan has been approved and after you have read and signed the contract.

What do you need?

What do you need?

To be over 18 years old

To be over 18 years old

Proof of income documents

Proof of income documents

(latest income statement and/or last 3 payslips)

(latest income statement and/or last 3 payslips)

ID documents of the parties involved

ID documents of the parties involved

We might request subject A's NIF and the IRS validation code. For requests over €25,000 these details are mandatory.

Related topics

You might like these too...

Sustainable Buildings Personal Loan TAEG 7.0%

Sustainable Buildings Personal Loan TAEG 7.0%

Loan for the production of renewable energy

Loan for the production of renewable energy

Account opening

Account opening

Open your account with us in just a few minutes

Open your account with us in just a few minutes

Used Car Loan Online TAEG 11.0%

Used Car Loan Online TAEG 11.0%

Unlock the road to your used car

Unlock the road to your used car

Sustainable Buildings Personal Loan TAEG 7.0%

Sustainable Buildings Personal Loan TAEG 7.0%

Loan for the production of renewable energy

Loan for the production of renewable energy

Account opening

Account opening

Open your account with us in just a few minutes

Open your account with us in just a few minutes

Used Car Loan Online TAEG 11.0%

Used Car Loan Online TAEG 11.0%

Unlock the road to your used car

Unlock the road to your used car

Subject to credit risk analysis.

The concession of credit is subject to the macroprudential rules of the Bank of Portugal.

Advertising

Does not dispense with the consultation of legally required pre-contractual and contractual information.

Need help?

We are here for you

Need help?

Need help?

Here you can find the answer to all your questions

Here you can find the answer to all your questions

Looking for a branch?

Looking for a branch?

Find the nearest branch

Find the nearest branch

Need to call us?

Need to call us?

Call whenever you need to

Call whenever you need to

Need help?

Here you can find the answer to all your questions

Here you can find the answer to all your questions

Looking for a branch?

Find the nearest branch

Find the nearest branch

Need to call us?

Call whenever you need to

Call whenever you need to