- Individuals

- Loans

- Personal loan

- Renewable energy

Sustainable Buildings loan TAEG 7.0%

To build a more sustainable future

Apply for your loan 100% online, up to €25,000, on the app

Apply for your loan 100% online between €1,000 and €25,000

Allows you to buy equipment that increases the energy efficiency of residental buildings

The decision is instant for requests up to €25,000 without any paperwork or waiting times

If the loan is approved, you'll get the money in your account right away

We finance up to 100% of your renewable energy project

Choose the term that best suits you, between 24 and 120 months

There’s always more to discover

A few more benefits

Life Insurance

Covers total and permanent disability due to accident

In the event of death, the insurer pays the insured amount to Millennium

80% of our Clients subscribe

Payment Protection Plan

Covers situations of unemployment, medical leave, or accidents

Includes salary protection plan

Includes compensation for death or permanent disability

Rates and charges

Now on to the math

Annual Percentage Rate of Charge (TAEG)

7.0%

Nominal Annual Rate (TAN)

6.000%

7.0% TAEG (annual percentage rate of charge) and 6.000% TAN (annual nominal rate) with monthly installments of €147.24, for a calculation of a €10,000 loan with an 84-month term. Total amount charged to the consumer: €12,544.16, including interest and Stamp Duty for the use of credit and interest. Subject to credit risk analysis. The granting of the credit is subject to Banco de Portugal's macro-prudential rules.

These are the amounts and terms you can choose from

€1,000 to €3,000

24 to 48 months

€3,001 to €25,000

24 to 84 months

€25,001 to €75,000

24 to 120 months (Contracts made at branches)

And these are the charges and expenses

Formalization fee waived

Loan opening Stamp Duty

The investments must produce or store renewable energy or improve the energy efficiency of residential buildings. These include:

Efficient windows (A+)

Thermal isolation

Heating and/or cooling systems (A+)

Solar/photovoltaic panels

Heat pumps

Annual Percentage Rate of Charge (TAEG)

6.4%

Nominal Annual Rate (TAN)

5.500%

6.4% TAEG (annual percentage rate of charge) and 5.500% TAN (annual nominal rate) with monthly installments of €144.75 for a calculation of a €10,000 loan with an 84-month term. Total amount charged to the consumer: €12,335.00, including interest and Stamp Duty for the use of credit and interest. Subject to credit risk analysis. The granting of the credit is subject to Banco de Portugal's macro-prudential rules.

These are the amounts and terms you can choose from

€1,000 to €3,000

24 to 48 months

€3,001 to €25,000

24 to 84 months

€25,001 to €75,000

24 to 120 months (Contracts made at branches)

And these are the charges and expenses

Formalization fee waived

Loan opening Stamp Duty

The investments must produce or store renewable energy or improve the energy efficiency of residential buildings. These include:

Efficient windows (A+)

Thermal isolation

Heating and/or cooling systems (A+)

Solar/photovoltaic panels

Heat pumps

Electric vehicle chargers

How does it work?

Discover the available options

Apply 100% online on the app, with immediate response and decision.

You can apply on the app and after the approval go to a branch.

Want to apply for a Sustainable Buildings Loan?

Before you make a decision...

Assess the expense you plan to make, considering various factors.

Make sure the loan installments won’t compromise the budget of your household.

Verify the conditions of the loan and read all the pre-contractual and contract information.

If you change your mind after applying, you can cancel it on the website or app within 14 days.

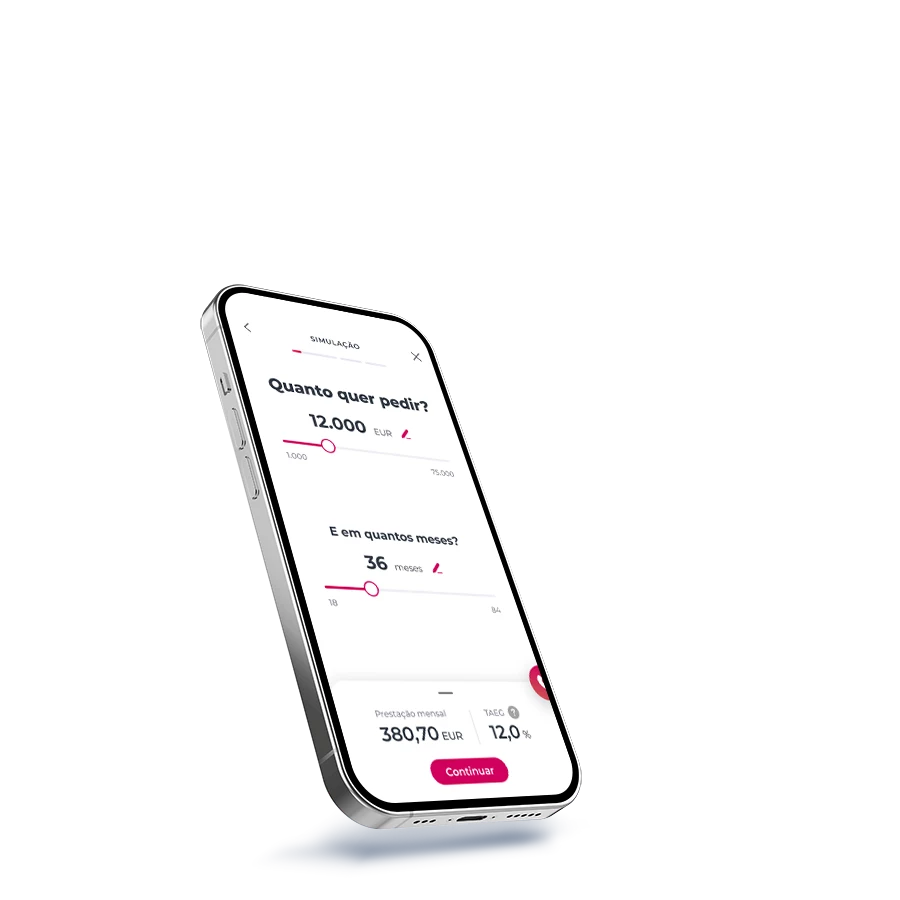

1, 2, 3 and that’s it!

Applying for a loan is simple

Calculate the loan

Calculate the loan

by choosing the amount and term to discover the monthly fee.

by choosing the amount and term to discover the monthly fee.

Confirm the application

Confirm the application

and send us the proof of purchase of the equipment.

and send us the proof of purchase of the equipment.

Receive the money in your account

Receive the money in your account

after the loan has been approved and after you have read and signed the contract.

after the loan has been approved and after you have read and signed the contract.

What do you need?

What do you need?

To be over 18 years old

To be over 18 years old

Proof of income documents

Proof of income documents

(latest income statement and/or last 3 payslips)

(latest income statement and/or last 3 payslips)

ID documents of the parties involved

ID documents of the parties involved

1, 2, 3 and that’s it!

Applying for a loan is simple

Calculate the loan

Calculate the loan

by choosing the amount and term to discover the monthly fee.

by choosing the amount and term to discover the monthly fee.

Confirm the application

Confirm the application

and send us the proof of purchase of the equipment.

and send us the proof of purchase of the equipment.

Receive the money in your account

Receive the money in your account

after the loan has been approved and after you have read and signed the contract.

after the loan has been approved and after you have read and signed the contract.

What do you need?

What do you need?

To be over 18 years old

To be over 18 years old

Proof of income documents

Proof of income documents

(latest income statement and/or last 3 payslips)

(latest income statement and/or last 3 payslips)

ID documents of the parties involved

ID documents of the parties involved

We might request subject A's NIF and the IRS validation code. For requests over €25,000 these details are mandatory.

Related topics

You might like these too...

Green Mortgage Loan

Green Mortgage Loan

Benefits? We have a few

Benefits? We have a few

Online Personal Loan TAEG 11.8%

Online Personal Loan TAEG 11.8%

Apply for your personal loan online up to €25,000

Apply for your personal loan online up to €25,000

Account opening

Account opening

Open your account with us in just a few minutes

Open your account with us in just a few minutes

Green Mortgage Loan

Green Mortgage Loan

Benefits? We have a few

Benefits? We have a few

Online Personal Loan TAEG 11.8%

Online Personal Loan TAEG 11.8%

Apply for your personal loan online up to €25,000

Apply for your personal loan online up to €25,000

Account opening

Account opening

Open your account with us in just a few minutes

Open your account with us in just a few minutes

Eligible investments must produce or store renewable energy for self-consumption or climate control, generate domestic hot water, or improve the energy efficiency of residential properties:

- Replacing inefficient windows with efficient ones, rated as energy class "A+";

- Adding or replacing thermal insulation in roofs, walls, or floors, as well as replacing entrance doors;

- Heating and/or cooling systems and domestic hot water (DHW) systems using renewable energy, rated as energy class "A+" or higher;

- Installation of photovoltaic panels and other renewable energy production equipment for self-consumption with or without storage (e.g., solar panels/photovoltaic, solar energy kits, solar thermosiphon kits, consumption meters, wind turbines, wind turbine tower kits, heat pumps, inverters, controllers, home batteries, solar chargers);

- Interventions aimed at water efficiency by replacing water use devices in housing with more efficient ones; the installation of monitoring solutions for intelligent control of water consumption; or the installation of rainwater harvesting systems;

- Interventions to incorporate bioclimatic architecture solutions, involving the installation or adaptation of fixed building elements, like shading devices, greenhouses, and green roofs or facades, favouring natural-based solutions;

- Electric vehicle chargers.

The concession of credit is subject to the macroprudential rules of the Bank of Portugal.

The contracting of the credit operations advertised herein is subject to its prior assessment and decision on credit risk and the possible constitution of guarantees that the Bank considers suitable.

The information presented here does not dispense with consulting the legally required pre-contractual and contractual information.

Need help?

We are here for you

Need help?

Need help?

Here you can find the answer to all your questions

Here you can find the answer to all your questions

Looking for a branch?

Looking for a branch?

Find the nearest branch

Find the nearest branch

Need to call us?

Need to call us?

Call whenever you need to

Call whenever you need to

Need help?

Here you can find the answer to all your questions

Here you can find the answer to all your questions

Looking for a branch?

Find the nearest branch

Find the nearest branch

Need to call us?

Call whenever you need to

Call whenever you need to