- Individuals

- Loans

- Personal loan

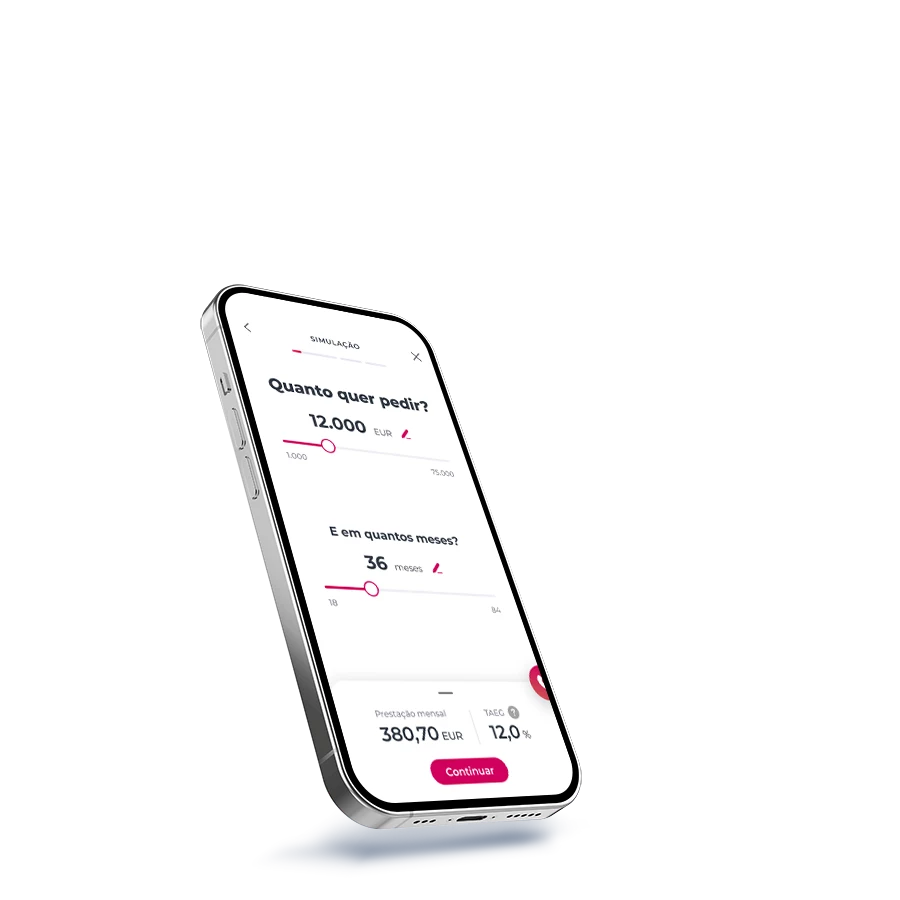

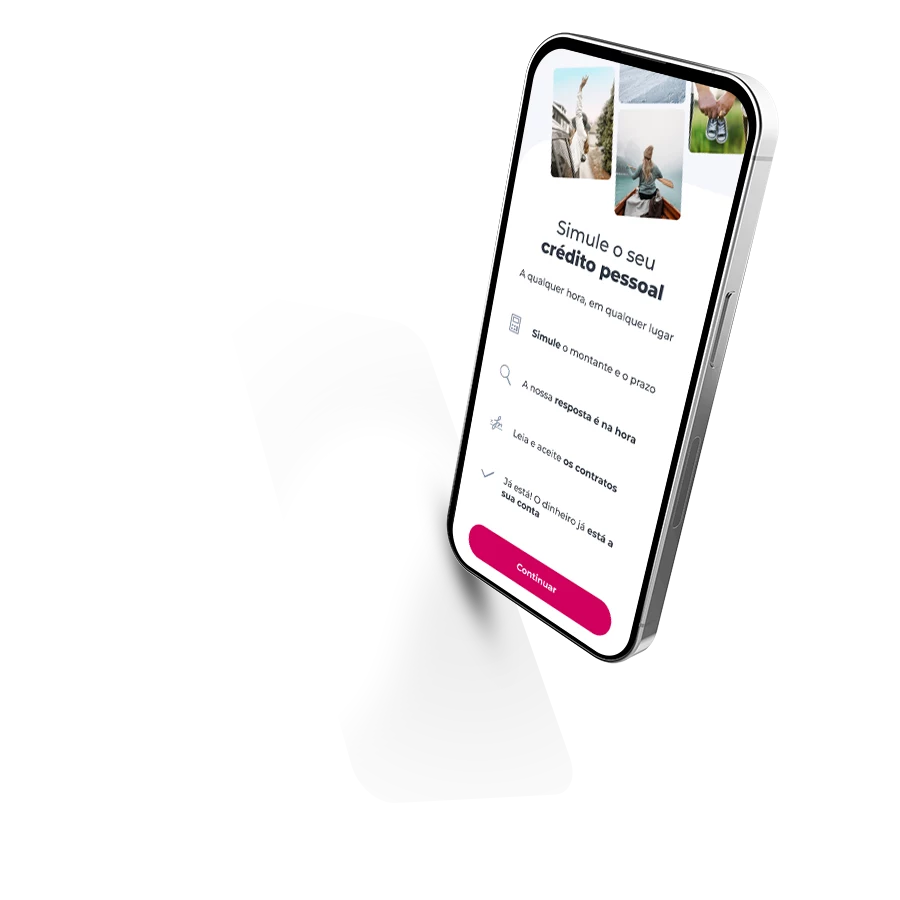

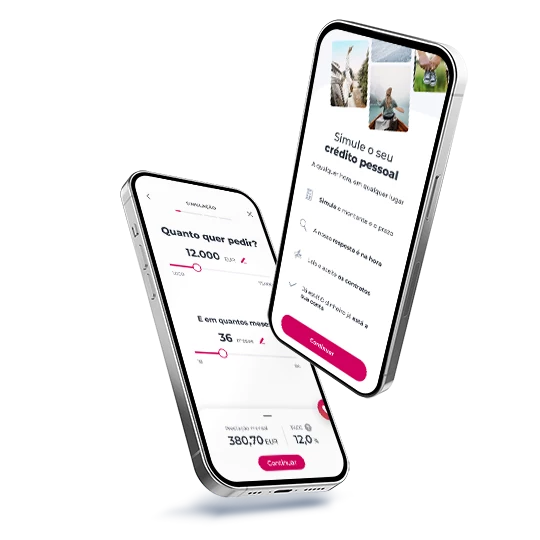

Personal loan solutions

Make your plan happen today

Personal Loan

Sustainable Buildings loan TAEG 7.0%

To help build

Home Improvement Loan TAEG 14.1%

Home Improvement Loan

Home Renovations Loan TAEG 13.6%

To carry out renovations

Education Loan TAEG 6.9%

For education expenses

Health Loan TAEG 7.0%

To finance treatments

Salary Loan

Any unexpected expenses this month?

Salary Loan

Any unexpected expenses this month?

Insurance, responsibility, and more

We're here to help with your loan

We ensure your monthly loan payments

New

With the Personal Loan Life Insurance

Learn what happens in case of credit agreement default

New

Learn how the Financial Follow Up service works

Before making a decision…

Frequently asked questions

Questions? We'll help

The Annual Percentage Rate of Charge is the total cost of the loan to the consumer (as an annual percentage of the loan amount). It includes the loan and interest payments, as well as other mandatory charges (taxes, fees and interest).

The Annual Percentage Rate of Charge is the total cost of the loan to the consumer (as an annual percentage of the loan amount). It includes the loan and interest payments, as well as other mandatory charges (taxes, fees and interest).

The Nominal Annual Rate is the interest rate, expressed as a fixed or variable percentage, that is applied annually to the used loan amount.

The Nominal Annual Rate is the interest rate, expressed as a fixed or variable percentage, that is applied annually to the used loan amount.

It's the total amount you will pay for the loan, including the financed amount, interest, fees, taxes and charges.

It's the total amount you will pay for the loan, including the financed amount, interest, fees, taxes and charges.

You have up to 14 days to change your mind (from the date of contracting), without having to invoke any reason, under the terms of article 17 of Decree-Law 133/2009 of June 2nd.

The contracting of credit operations is subject to prior assessment and decision in terms of credit risk and the possible constitution of guarantees that the Bank considers suitable, as well as verification of the data declared by the Client.

The granting of credit is subject to the macro-prudential rules of the Banco de Portugal.

You have up to 14 days to change your mind (from the date of contracting), without having to invoke any reason, under the terms of article 17 of Decree-Law 133/2009 of June 2nd.

The contracting of credit operations is subject to prior assessment and decision in terms of credit risk and the possible constitution of guarantees that the Bank considers suitable, as well as verification of the data declared by the Client.

The granting of credit is subject to the macro-prudential rules of the Banco de Portugal.

Frequently asked questions

Questions? We'll help

The Annual Percentage Rate of Charge is the total cost of the loan to the consumer (as an annual percentage of the loan amount). It includes the loan and interest payments, as well as other mandatory charges (taxes, fees and interest).

The Annual Percentage Rate of Charge is the total cost of the loan to the consumer (as an annual percentage of the loan amount). It includes the loan and interest payments, as well as other mandatory charges (taxes, fees and interest).

The Nominal Annual Rate is the interest rate, expressed as a fixed or variable percentage, that is applied annually to the used loan amount.

The Nominal Annual Rate is the interest rate, expressed as a fixed or variable percentage, that is applied annually to the used loan amount.

It's the total amount you will pay for the loan, including the financed amount, interest, fees, taxes and charges.

It's the total amount you will pay for the loan, including the financed amount, interest, fees, taxes and charges.

You have up to 14 days to change your mind (from the date of contracting), without having to invoke any reason, under the terms of article 17 of Decree-Law 133/2009 of June 2nd.

The contracting of credit operations is subject to prior assessment and decision in terms of credit risk and the possible constitution of guarantees that the Bank considers suitable, as well as verification of the data declared by the Client.

The granting of credit is subject to the macro-prudential rules of the Banco de Portugal.

You have up to 14 days to change your mind (from the date of contracting), without having to invoke any reason, under the terms of article 17 of Decree-Law 133/2009 of June 2nd.

The contracting of credit operations is subject to prior assessment and decision in terms of credit risk and the possible constitution of guarantees that the Bank considers suitable, as well as verification of the data declared by the Client.

The granting of credit is subject to the macro-prudential rules of the Banco de Portugal.

Need help?

We are here for you

Need help?

Need help?

Looking for a branch?

Looking for a branch?

Need to call us?

Need to call us?