ETF (Exchange-Traded Fund)

Invest in stocks, indexes, bonds and a lot more at low costs

Benefits

Why invest in ETFs?

How to start investing in ETFs?

Have a diversified portfolio with a single investment

Invest in 5 steps!

It’s that easy!

Invest in 5 steps!

It’s that easy!

Articles, tips and a lot more

Everything you need to know to invest in ETF

Articles, tips and a lot more

Everything you need to know to invest in ETF

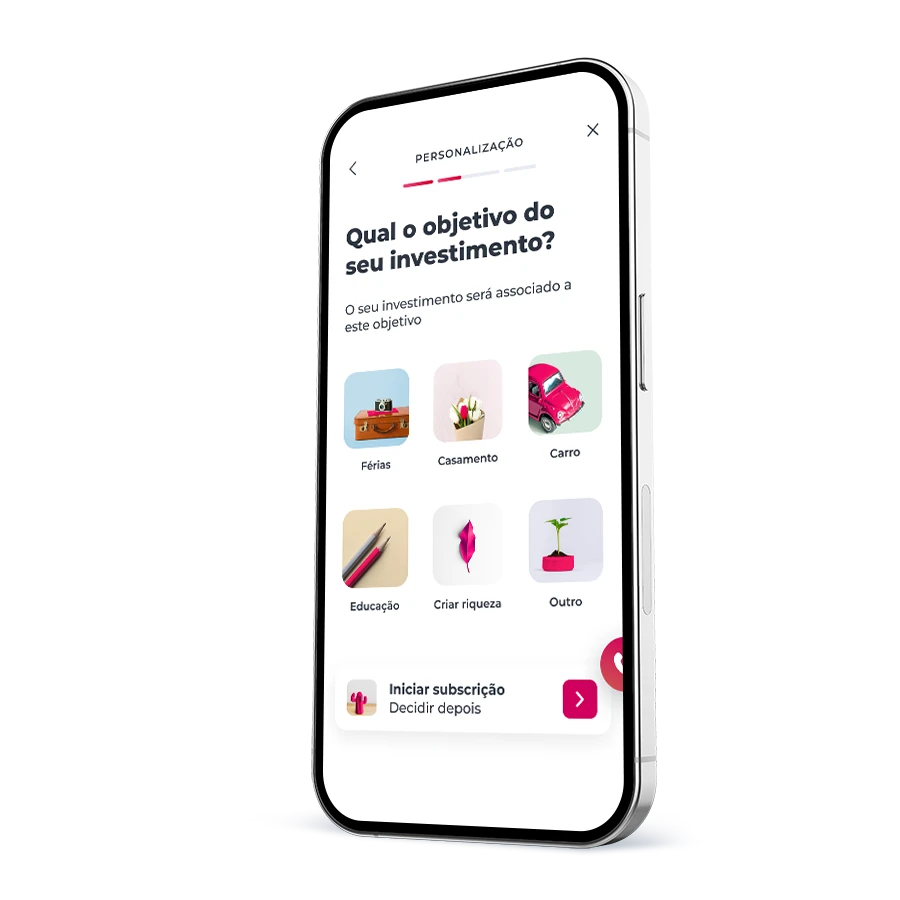

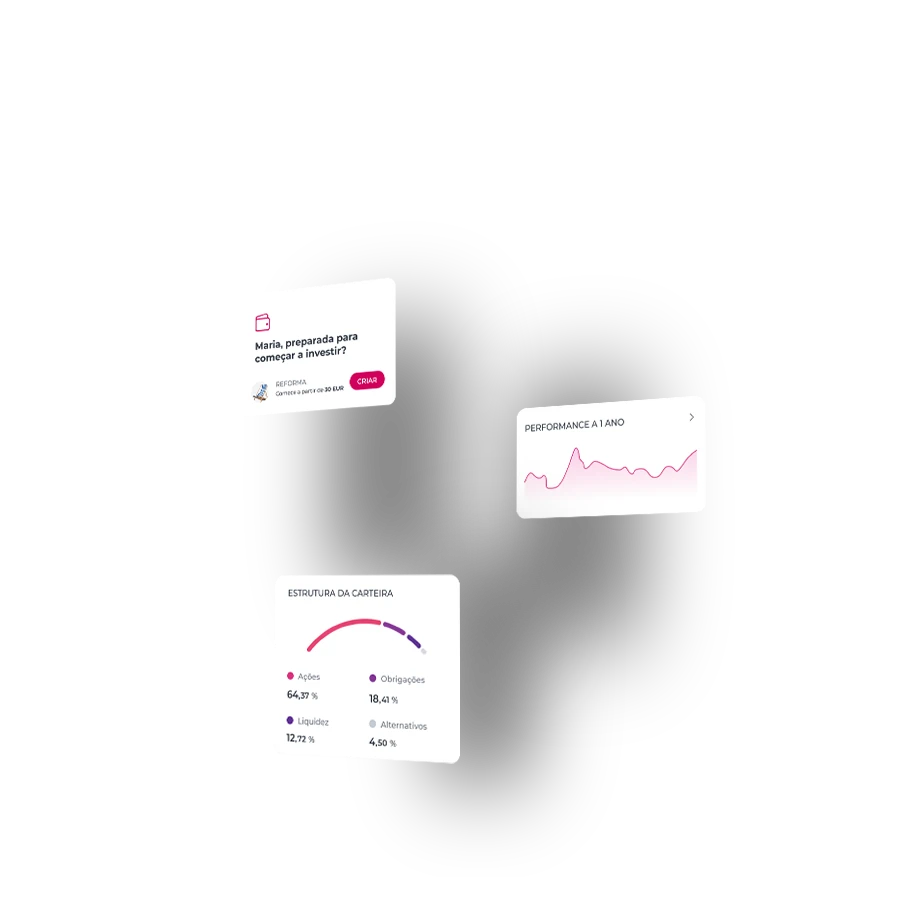

Millennium App

Investing is simpler than you think

Millennium AppMillennium App

MTrader

Stock market trading in your hands

MTraderMTrader

Frequently asked questions

Questions? We'll help

ETFs are investment funds traded on the stock exchange, meaning they are bought and sold throughout the day, and their price updates constantly. They are usually linked to an index, and as a result, are considered "passive investing", in the sense that there is no active manager trying to make the fund perform as well as possible, there is only an automatic system that ensures that the ETF performs similarly to the index. Thus, ETFs have much lower charges than mutual funds.

ETFs are investment funds traded on the stock exchange, meaning they are bought and sold throughout the day, and their price updates constantly. They are usually linked to an index, and as a result, are considered "passive investing", in the sense that there is no active manager trying to make the fund perform as well as possible, there is only an automatic system that ensures that the ETF performs similarly to the index. Thus, ETFs have much lower charges than mutual funds.

ETFs can be profitable for investors due to their many advantages:

- Flexibility: ETFs trade like stocks, which makes them more flexible to trade compared to traditional mutual funds. They can be traded at any time during the trading day and can place different orders such as market, limit, stop loss and stop limit. You can also buy them on margin or sell them short.

- Broad market exposure: As ETFs are made up of a collection of products, they are able to achieve broad market access. ETFs help in managing risk through diversification.

- Low costs: ETFs are usually managed passively. Therefore, they have lower costs compared to actively managed funds.

ETFs can be profitable for investors due to their many advantages:

- Flexibility: ETFs trade like stocks, which makes them more flexible to trade compared to traditional mutual funds. They can be traded at any time during the trading day and can place different orders such as market, limit, stop loss and stop limit. You can also buy them on margin or sell them short.

- Broad market exposure: As ETFs are made up of a collection of products, they are able to achieve broad market access. ETFs help in managing risk through diversification.

- Low costs: ETFs are usually managed passively. Therefore, they have lower costs compared to actively managed funds.

Investing in ETFs can be beneficial, but it is not without risks. ETFs are usually not actively managed. The risk is that you cannot anticipate changes such as takeovers or a change in the composition of the index. While ETFs are made up of a range of products so that element is diversified, the timing of your investment can also have a substantial impact on your returns. Instead of investing a single amount at once and thus exposing yourself to the charges on your securities at a single point in time, you can choose to invest gradually over an extended period. By investing small amounts on a monthly or quarterly basis, you will be less exposed to the price paid at the time of investment, thus averaging the investment over a longer period.

Investing in ETFs can be beneficial, but it is not without risks. ETFs are usually not actively managed. The risk is that you cannot anticipate changes such as takeovers or a change in the composition of the index. While ETFs are made up of a range of products so that element is diversified, the timing of your investment can also have a substantial impact on your returns. Instead of investing a single amount at once and thus exposing yourself to the charges on your securities at a single point in time, you can choose to invest gradually over an extended period. By investing small amounts on a monthly or quarterly basis, you will be less exposed to the price paid at the time of investment, thus averaging the investment over a longer period.

Frequently asked questions

Questions? We'll help

ETFs are investment funds traded on the stock exchange, meaning they are bought and sold throughout the day, and their price updates constantly. They are usually linked to an index, and as a result, are considered "passive investing", in the sense that there is no active manager trying to make the fund perform as well as possible, there is only an automatic system that ensures that the ETF performs similarly to the index. Thus, ETFs have much lower charges than mutual funds.

ETFs are investment funds traded on the stock exchange, meaning they are bought and sold throughout the day, and their price updates constantly. They are usually linked to an index, and as a result, are considered "passive investing", in the sense that there is no active manager trying to make the fund perform as well as possible, there is only an automatic system that ensures that the ETF performs similarly to the index. Thus, ETFs have much lower charges than mutual funds.

ETFs can be profitable for investors due to their many advantages:

- Flexibility: ETFs trade like stocks, which makes them more flexible to trade compared to traditional mutual funds. They can be traded at any time during the trading day and can place different orders such as market, limit, stop loss and stop limit. You can also buy them on margin or sell them short.

- Broad market exposure: As ETFs are made up of a collection of products, they are able to achieve broad market access. ETFs help in managing risk through diversification.

- Low costs: ETFs are usually managed passively. Therefore, they have lower costs compared to actively managed funds.

ETFs can be profitable for investors due to their many advantages:

- Flexibility: ETFs trade like stocks, which makes them more flexible to trade compared to traditional mutual funds. They can be traded at any time during the trading day and can place different orders such as market, limit, stop loss and stop limit. You can also buy them on margin or sell them short.

- Broad market exposure: As ETFs are made up of a collection of products, they are able to achieve broad market access. ETFs help in managing risk through diversification.

- Low costs: ETFs are usually managed passively. Therefore, they have lower costs compared to actively managed funds.

Investing in ETFs can be beneficial, but it is not without risks. ETFs are usually not actively managed. The risk is that you cannot anticipate changes such as takeovers or a change in the composition of the index. While ETFs are made up of a range of products so that element is diversified, the timing of your investment can also have a substantial impact on your returns. Instead of investing a single amount at once and thus exposing yourself to the charges on your securities at a single point in time, you can choose to invest gradually over an extended period. By investing small amounts on a monthly or quarterly basis, you will be less exposed to the price paid at the time of investment, thus averaging the investment over a longer period.

Investing in ETFs can be beneficial, but it is not without risks. ETFs are usually not actively managed. The risk is that you cannot anticipate changes such as takeovers or a change in the composition of the index. While ETFs are made up of a range of products so that element is diversified, the timing of your investment can also have a substantial impact on your returns. Instead of investing a single amount at once and thus exposing yourself to the charges on your securities at a single point in time, you can choose to invest gradually over an extended period. By investing small amounts on a monthly or quarterly basis, you will be less exposed to the price paid at the time of investment, thus averaging the investment over a longer period.

Related topics

Some more investment picks...

Need help?

We are here for you

Need help?

Need help?

Looking for a branch?

Looking for a branch?

Need to call us?

Need to call us?