- Individuals

- Cards

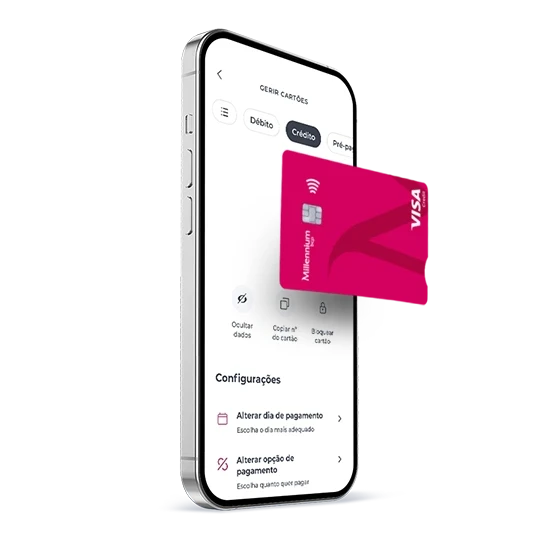

- Credit card

Credit cards

I want a credit card...

Classic

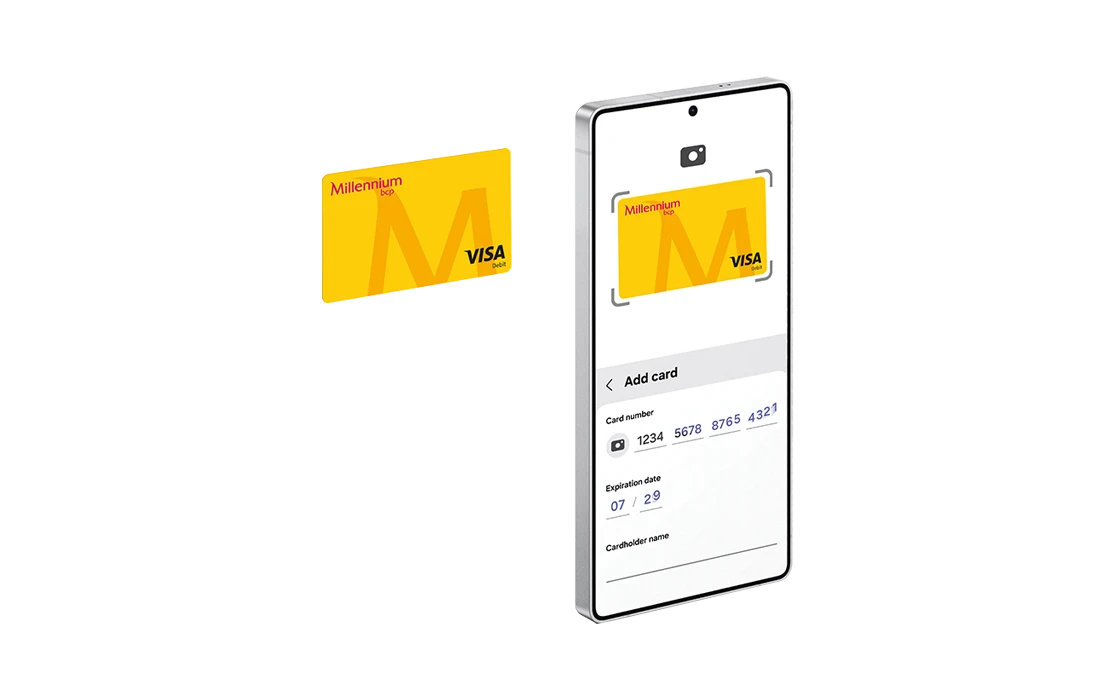

Add your card to digital wallets

Rent cars with discounted prices at Avis

Classic

Digital payments

Discounts at Avis

Platinum

All you need, in one card

All you need, in one card

Millennium Rewards

Travel insurance

GO!

Your card with €0 annual fee

Your card with €0 annual fee

Safe purchases

Digital payments

Gold Prestige

Shop, earn points, get rewards

Shop, earn points, get rewards

Millennium Rewards

Medical assistance

TAP Classic

Earn 1 mile

Earn 1 mile

Earn miles

Exclusive insurance

TAP Gold

Earn 1.5 miles

Earn 1.5 miles

Skip lines

Exclusive insurance

TAP Platinum

Earn 2 miles

Earn 2 miles

VIP lounges

Extra luggage

Greater flexibility

Here's how credit cards work

Pay at your own pace

Choose how you want to pay

Features and benefits

Your card comes with a lot more

Buy now, pay later on the app

Classic credit card TAEG 15.7%

Maximum of 50 transactions simultaneously

Travel without borders

Earn miles with your purchases

Join Millennium Rewards

Use MB WAY on the Millennium App

Samsung Wallet is the key to your everyday life,

Pay in a flash with your Swatch

With 3D Secure

Leave your wallet, pay on the go

Join the alerts service

Frequently asked questions

Questions? We'll help

You can view the balance of your credit card in the app. On the accounts screen, select the card you want to view and tap on "View details", then tap on "Balances".

You can view the balance of your credit card in the app. On the accounts screen, select the card you want to view and tap on "View details", then tap on "Balances".

If you exceed your credit card limit, the excess amount is debited from the current account. An over-limit fee will be charged, which you can find on the price list.

If you exceed your credit card limit, the excess amount is debited from the current account. An over-limit fee will be charged, which you can find on the price list.

You can apply for a credit limit increase through the Millennium App. You just need to enter the amount you want to apply for and you'll get our response instantly.

You can apply for a credit limit increase through the Millennium App. You just need to enter the amount you want to apply for and you'll get our response instantly.

You should request the replacement of your card, at a branch, and hand over the damaged one.

You should request the replacement of your card, at a branch, and hand over the damaged one.

When you apply for a card through the Millennium App, you can track the delivery in real-time until it reaches your address or a designated branch. The usual timeframe for a card delivery is approximately 10 business days.

When you apply for a card through the Millennium App, you can track the delivery in real-time until it reaches your address or a designated branch. The usual timeframe for a card delivery is approximately 10 business days.

In the event that your card is lost or stolen, you can cancel it in the Millennium App. Open the app, tap on the top left corner, and select "Cards". From there, choose "Cancel card" and follow the provided steps to select the specific card you wish to cancel.

If you no longer wish to use the card and want to cancel it, you can visit a Millennium branch to cancel the card.

In the event that your card is lost or stolen, you can cancel it in the Millennium App. Open the app, tap on the top left corner, and select "Cards". From there, choose "Cancel card" and follow the provided steps to select the specific card you wish to cancel.

If you no longer wish to use the card and want to cancel it, you can visit a Millennium branch to cancel the card.

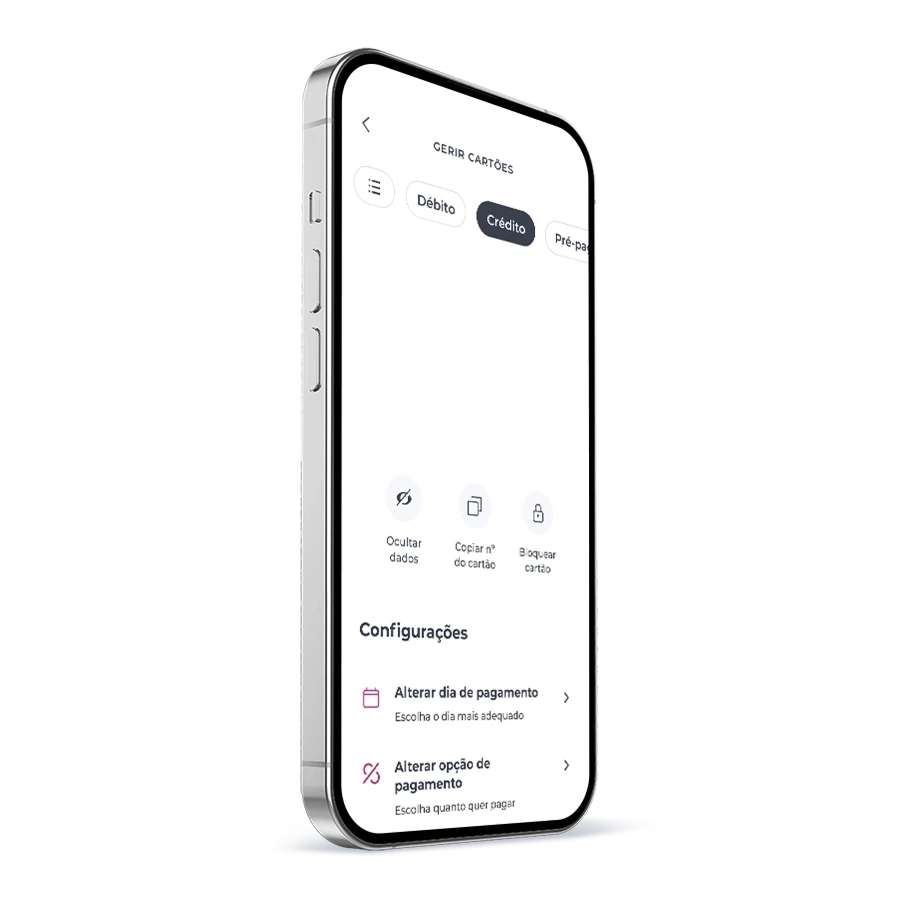

To block your card, you can use the Millennium App. Open the app and swipe left at the top of the screen until you find your credit card. Then, select the option "Block card". If you want to unblock the card, just toggle off the option.

To block your card, you can use the Millennium App. Open the app and swipe left at the top of the screen until you find your credit card. Then, select the option "Block card". If you want to unblock the card, just toggle off the option.

Frequently asked questions

Questions? We'll help

You can view the balance of your credit card in the app. On the accounts screen, select the card you want to view and tap on "View details", then tap on "Balances".

You can view the balance of your credit card in the app. On the accounts screen, select the card you want to view and tap on "View details", then tap on "Balances".

If you exceed your credit card limit, the excess amount is debited from the current account. An over-limit fee will be charged, which you can find on the price list.

If you exceed your credit card limit, the excess amount is debited from the current account. An over-limit fee will be charged, which you can find on the price list.

You can apply for a credit limit increase through the Millennium App. You just need to enter the amount you want to apply for and you'll get our response instantly.

You can apply for a credit limit increase through the Millennium App. You just need to enter the amount you want to apply for and you'll get our response instantly.

You should request the replacement of your card, at a branch, and hand over the damaged one.

You should request the replacement of your card, at a branch, and hand over the damaged one.

When you apply for a card through the Millennium App, you can track the delivery in real-time until it reaches your address or a designated branch. The usual timeframe for a card delivery is approximately 10 business days.

When you apply for a card through the Millennium App, you can track the delivery in real-time until it reaches your address or a designated branch. The usual timeframe for a card delivery is approximately 10 business days.

In the event that your card is lost or stolen, you can cancel it in the Millennium App. Open the app, tap on the top left corner, and select "Cards". From there, choose "Cancel card" and follow the provided steps to select the specific card you wish to cancel.

If you no longer wish to use the card and want to cancel it, you can visit a Millennium branch to cancel the card.

In the event that your card is lost or stolen, you can cancel it in the Millennium App. Open the app, tap on the top left corner, and select "Cards". From there, choose "Cancel card" and follow the provided steps to select the specific card you wish to cancel.

If you no longer wish to use the card and want to cancel it, you can visit a Millennium branch to cancel the card.

To block your card, you can use the Millennium App. Open the app and swipe left at the top of the screen until you find your credit card. Then, select the option "Block card". If you want to unblock the card, just toggle off the option.

To block your card, you can use the Millennium App. Open the app and swipe left at the top of the screen until you find your credit card. Then, select the option "Block card". If you want to unblock the card, just toggle off the option.

Compare cards

Need help?

We are here for you

Need help?

Need help?

Looking for a branch?

Looking for a branch?

Need to call us?

Need to call us?