- Individuals

- Loans

- Salary Loan

Salary Loan TAEG 16.8%

Looking for more flexibility at the end of the month?

Get up to 100% of your salary or pension in advance, starting from €250, on the first day of each month.

You can receive up to 100% of your salary or pension

Use only when you need it and pay only when you use it

For those receiving a salary or pension of €250 and above

Available in your account on the first day of each month

Lease charges and rates

Now on to the math

These are the rates

Annual Percentage Rate of Charge (TAEG)

16.8%

Annual Percentage Rate (TAN)

15.000%

For an example of €1,500 used during 90 days with a TAN of 15.000%, the interest will be €56.25 plus Stamp Duty on the interest of €2.25, which corresponds to an annual effective global rate (TAEG) of 16.8%. You are exempt from Stamp Duty for the use of the loan, up to the amount of the monthly salary credited to the account.

Subject to credit risk analysis.

Subject to credit risk analysis.

And this is the term and amount

Term

Renewed every month

Amount

Up to 100% of the salary or pension

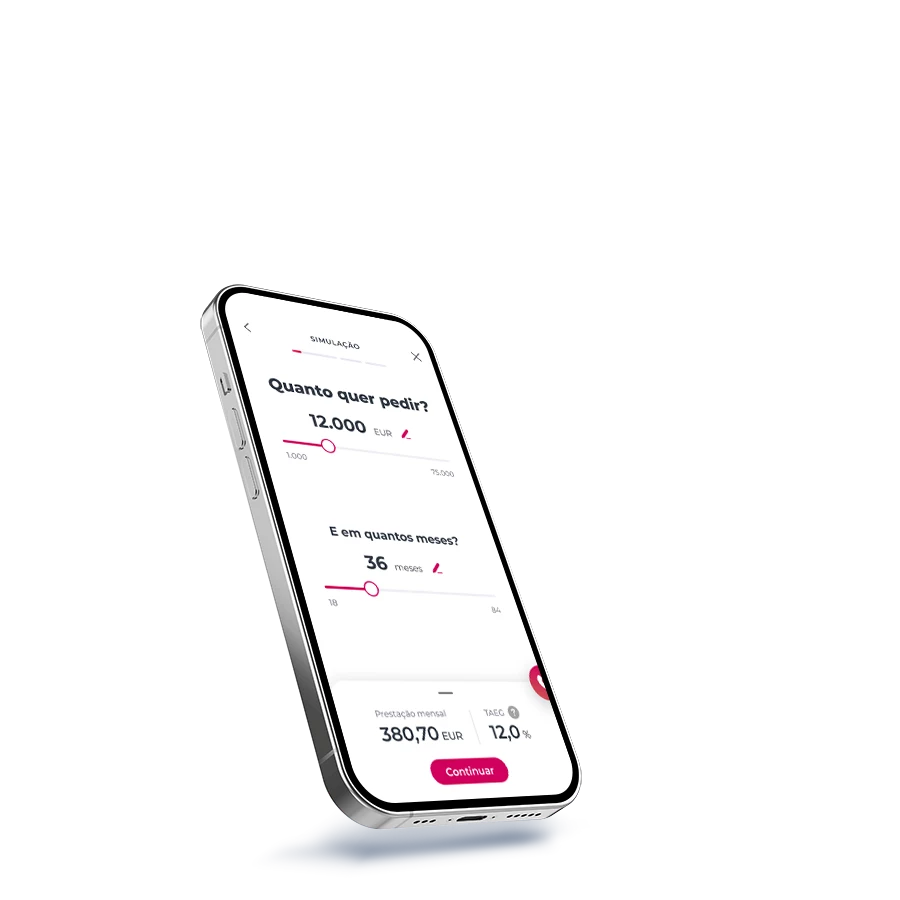

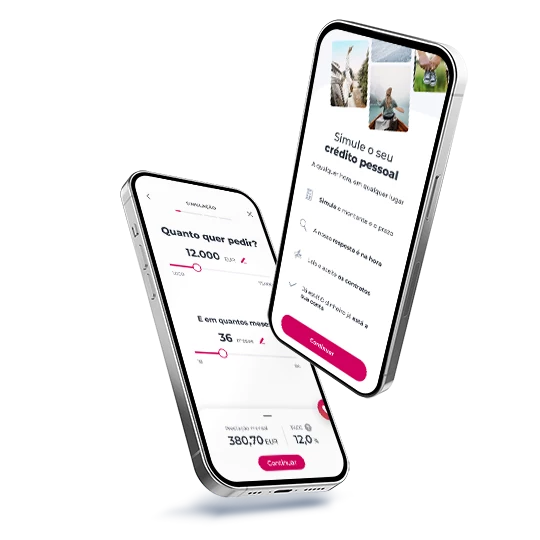

4 quick steps

Applying for a salary advance is simple

Login to the Millennium App

Login to the Millennium App

touch Loan > Salary advance.

touch Loan > Salary advance.

Tell us or confirm your net salary

Tell us or confirm your net salary

We'll show you the average from the last 2 months. You can edit it if it's wrong.

We'll show you the average from the last 2 months. You can edit it if it's wrong.

Choose how much you want to anticipate

Choose how much you want to anticipate

and authorize via SMS. You can anticipate up to 100% of your salary's amount.

and authorize via SMS. You can anticipate up to 100% of your salary's amount.

Get an immediate response

Get an immediate response

If the request is authorized, the chosen amount will become available on the 1st day of each month.

If the request is authorized, the chosen amount will become available on the 1st day of each month.

What do you need?

What do you need?

To be over 18 years old

To be over 18 years old

To have a current account and your salary at Millennium

To have a current account and your salary at Millennium

To present the last 3 payslips or pension receipts

To present the last 3 payslips or pension receipts

4 quick steps

Applying for a salary advance is simple

Login to the Millennium App

Login to the Millennium App

touch Loan > Salary advance.

touch Loan > Salary advance.

Tell us or confirm your net salary

Tell us or confirm your net salary

We'll show you the average from the last 2 months. You can edit it if it's wrong.

We'll show you the average from the last 2 months. You can edit it if it's wrong.

Choose how much you want to anticipate

Choose how much you want to anticipate

and authorize via SMS. You can anticipate up to 100% of your salary's amount.

and authorize via SMS. You can anticipate up to 100% of your salary's amount.

Get an immediate response

Get an immediate response

If the request is authorized, the chosen amount will become available on the 1st day of each month.

If the request is authorized, the chosen amount will become available on the 1st day of each month.

What do you need?

What do you need?

To be over 18 years old

To be over 18 years old

To have a current account and your salary at Millennium

To have a current account and your salary at Millennium

To present the last 3 payslips or pension receipts

To present the last 3 payslips or pension receipts

Related topics

You might like these too...

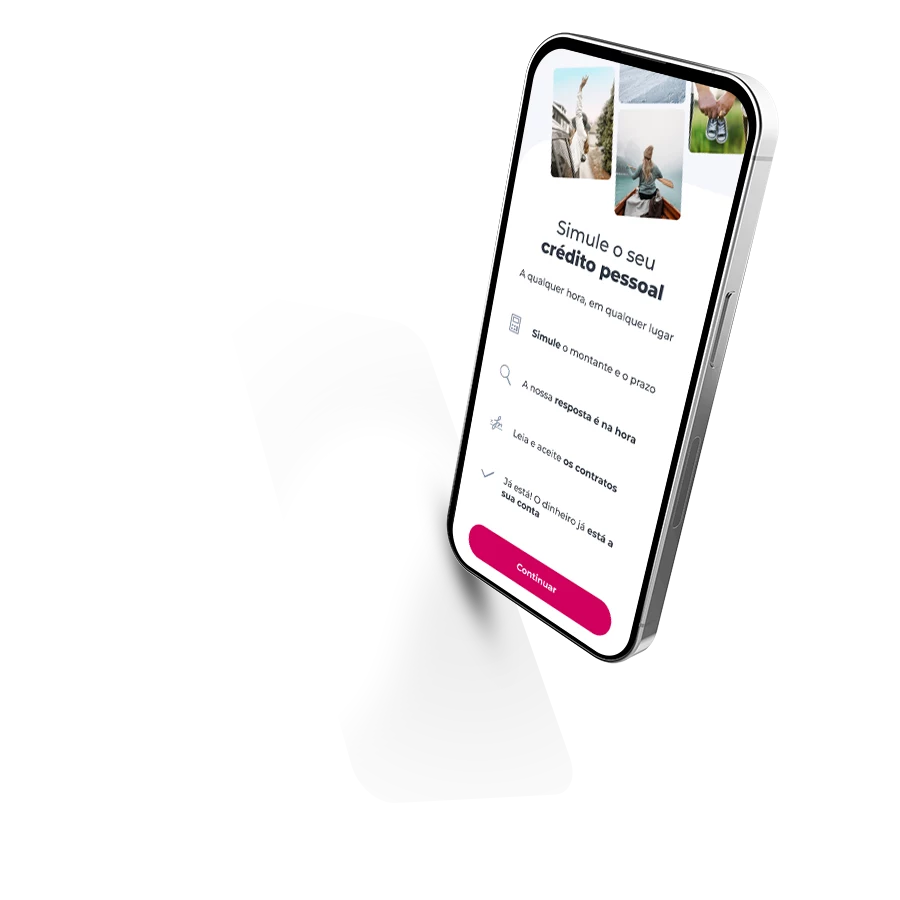

Online Personal Loan TAEG 11.8%

Online Personal Loan TAEG 11.8%

Apply for your personal loan online up to €25,000

Apply for your personal loan online up to €25,000

Buy a home

Buy a home

To buy your new home with exclusive benefits

To buy your new home with exclusive benefits

Sustainable Buildings Loan TAEG 7.0%

Sustainable Buildings Loan TAEG 7.0%

Loan to produce renewable energy

Loan to produce renewable energy

Online Personal Loan TAEG 11.8%

Online Personal Loan TAEG 11.8%

Apply for your personal loan online up to €25,000

Apply for your personal loan online up to €25,000

Buy a home

Buy a home

To buy your new home with exclusive benefits

To buy your new home with exclusive benefits

Sustainable Buildings Loan TAEG 7.0%

Sustainable Buildings Loan TAEG 7.0%

Loan to produce renewable energy

Loan to produce renewable energy

You are exempt from Stamp Duty for the use of the credit, up to the amount of the monthly salary credited to the account.

It is subject to a credit decision and an autonomous contract.

It has a term of one calendar month, starting on the first day and ending on the last day of each month. This term is automatically and successively renewed for periods of one month, until either party terminates the contract.

The value of the Salary Loan will be credited on the 1st day of each month, with the maximum amount being equal to the monthly average of the amounts credited to the Current Account over the previous two months, as salary or retirement/pension; If in the immediately preceding month no amounts are credited as salary or pension, the maximum amount of the Salary Loan will be 75% of the amount calculated as above; If for 2 consecutive months no duly coded salary or retirement/pension transfers are processed, you will no longer have access to the anticipated salary or retirement/pension.

Subject to credit risk analysis.

Need help?

We are here for you

Need help?

Need help?

Here you can find the answer to all your questions

Here you can find the answer to all your questions

Looking for a branch?

Looking for a branch?

Find the nearest branch

Find the nearest branch

Need to call us?

Need to call us?

Call whenever you need to

Call whenever you need to

Need help?

Here you can find the answer to all your questions

Here you can find the answer to all your questions

Looking for a branch?

Find the nearest branch

Find the nearest branch

Need to call us?

Call whenever you need to

Call whenever you need to