- Individuals

- Investments

- Investment funds

Investment funds

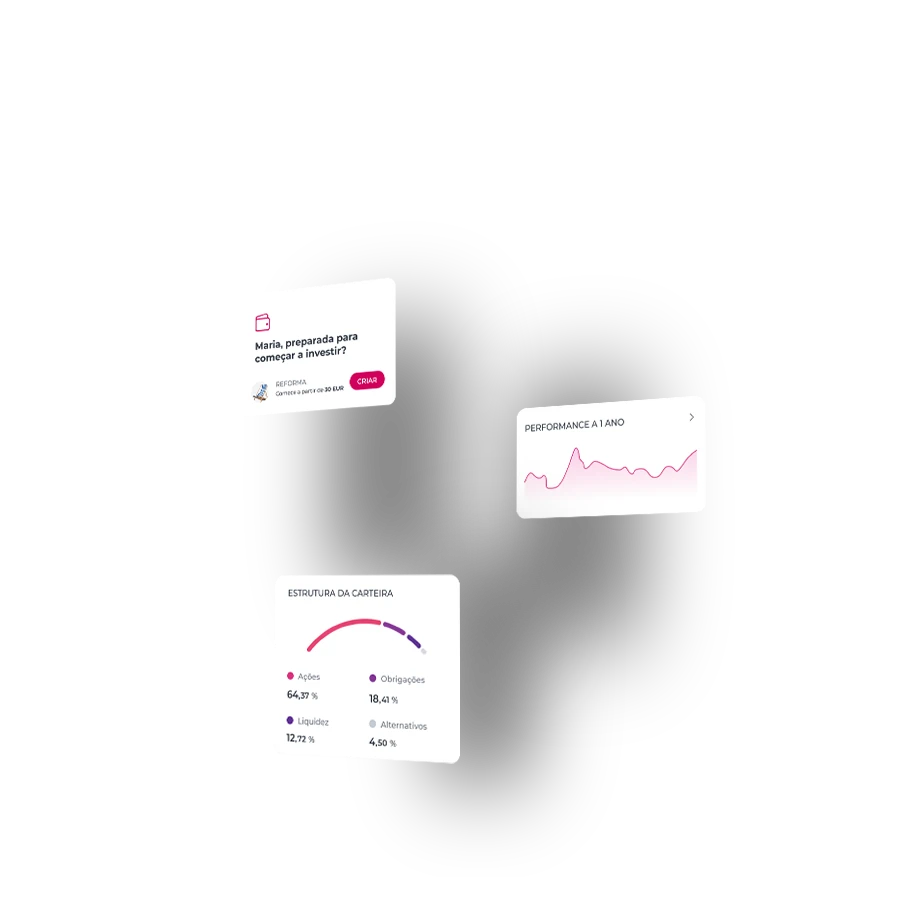

Invest in the app from €250, without subscription costs

Benefits

Why invest in funds?

What are the different types of funds?

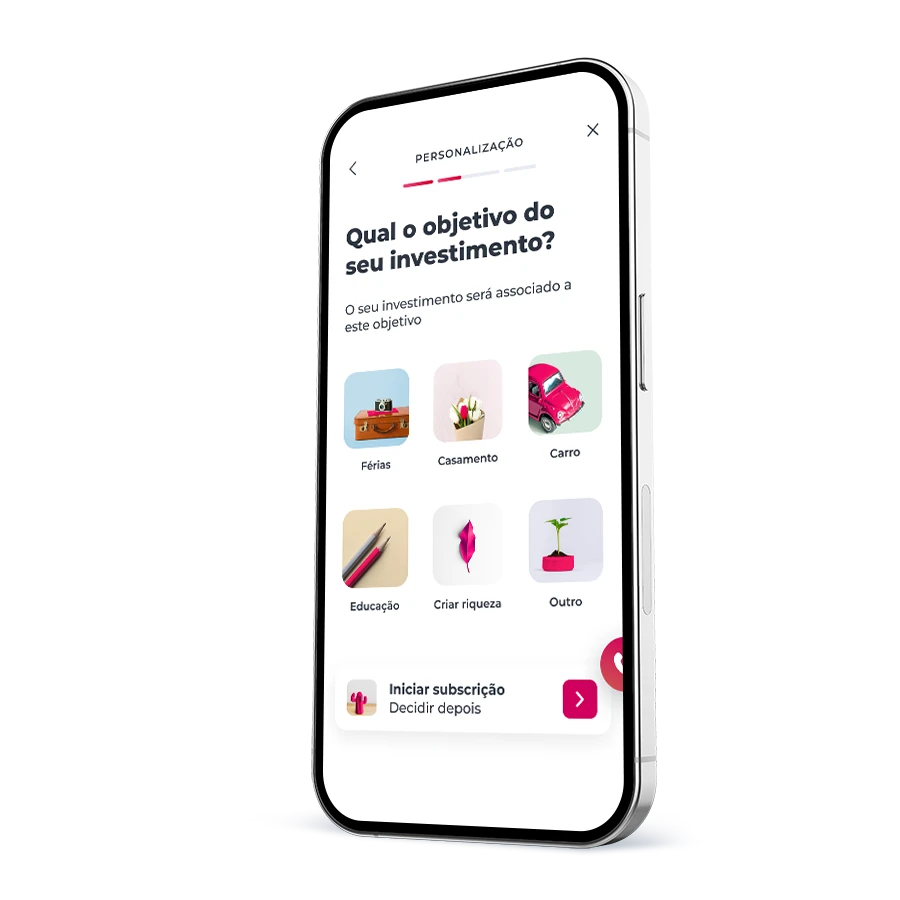

Invest in 4 steps!

It’s that easy

Invest in 4 steps!

It’s that easy

Articles, tips and more

Everything you need to know to invest in funds

Articles, tips and more

Everything you need to know to invest in funds

Frequently asked questions

Questions? We'll help

Investment funds are independent financial entities with assets owned by multiple individuals or legal entities, referred to as unit-holders. These funds can be categorized as either open or closed. Open funds have a variable number of units, whereas closed funds have a fixed number of units.

Investment funds are independent financial entities with assets owned by multiple individuals or legal entities, referred to as unit-holders. These funds can be categorized as either open or closed. Open funds have a variable number of units, whereas closed funds have a fixed number of units.

- Short-term investment funds invest in highly liquid securities (e.g. term deposits).

- Bonds invest mainly in bonds.

- Equities invest mainly in equities.

- Multi-asset invest diversely across bonds and equities and set barriers for the weight of investments in the portfolio.

- There are two main types of alternative funds, those investing in non-traditional assets (such as infrastructure, real estate and private equity) and those investing in traditional assets (such as short selling and loans).

- Short-term investment funds invest in highly liquid securities (e.g. term deposits).

- Bonds invest mainly in bonds.

- Equities invest mainly in equities.

- Multi-asset invest diversely across bonds and equities and set barriers for the weight of investments in the portfolio.

- There are two main types of alternative funds, those investing in non-traditional assets (such as infrastructure, real estate and private equity) and those investing in traditional assets (such as short selling and loans).

Any investment has its associated risks. In the case of funds, you should bear in mind that:

- They have no capital guarantee, so at the time of redemption you may not be able to recover all the money invested.

- They are made up of a set of assets, whose market price may increase or decrease. This variation is reflected in the value of the unit, which means that the investor may lose part or even all of the capital invested.

Any investment has its associated risks. In the case of funds, you should bear in mind that:

- They have no capital guarantee, so at the time of redemption you may not be able to recover all the money invested.

- They are made up of a set of assets, whose market price may increase or decrease. This variation is reflected in the value of the unit, which means that the investor may lose part or even all of the capital invested.

- Expert management by a Management Company

- Low initial investment

- Risk diversification and mitigation

- Access to hard-to-reach markets

- Daily share quotations

- Expert management by a Management Company

- Low initial investment

- Risk diversification and mitigation

- Access to hard-to-reach markets

- Daily share quotations

Frequently asked questions

Questions? We'll help

Investment funds are independent financial entities with assets owned by multiple individuals or legal entities, referred to as unit-holders. These funds can be categorized as either open or closed. Open funds have a variable number of units, whereas closed funds have a fixed number of units.

Investment funds are independent financial entities with assets owned by multiple individuals or legal entities, referred to as unit-holders. These funds can be categorized as either open or closed. Open funds have a variable number of units, whereas closed funds have a fixed number of units.

- Short-term investment funds invest in highly liquid securities (e.g. term deposits).

- Bonds invest mainly in bonds.

- Equities invest mainly in equities.

- Multi-asset invest diversely across bonds and equities and set barriers for the weight of investments in the portfolio.

- There are two main types of alternative funds, those investing in non-traditional assets (such as infrastructure, real estate and private equity) and those investing in traditional assets (such as short selling and loans).

- Short-term investment funds invest in highly liquid securities (e.g. term deposits).

- Bonds invest mainly in bonds.

- Equities invest mainly in equities.

- Multi-asset invest diversely across bonds and equities and set barriers for the weight of investments in the portfolio.

- There are two main types of alternative funds, those investing in non-traditional assets (such as infrastructure, real estate and private equity) and those investing in traditional assets (such as short selling and loans).

Any investment has its associated risks. In the case of funds, you should bear in mind that:

- They have no capital guarantee, so at the time of redemption you may not be able to recover all the money invested.

- They are made up of a set of assets, whose market price may increase or decrease. This variation is reflected in the value of the unit, which means that the investor may lose part or even all of the capital invested.

Any investment has its associated risks. In the case of funds, you should bear in mind that:

- They have no capital guarantee, so at the time of redemption you may not be able to recover all the money invested.

- They are made up of a set of assets, whose market price may increase or decrease. This variation is reflected in the value of the unit, which means that the investor may lose part or even all of the capital invested.

- Expert management by a Management Company

- Low initial investment

- Risk diversification and mitigation

- Access to hard-to-reach markets

- Daily share quotations

- Expert management by a Management Company

- Low initial investment

- Risk diversification and mitigation

- Access to hard-to-reach markets

- Daily share quotations

Related topics

Some more investment picks...

Legal information

Investing in funds does not exempt the reading of the Key Investor Information Document (KIID) , of the Prospectus and of the Specific Distribution Conditions (when applicable), available on this website and at CMVM.

This information does not exempt the reading of the Key Investor Information Document (KIID) , of the Full Prospectus and of the Specific Distribution Conditions (when applicable), that provides the conditions applicable to the subscription and redemption of each fund. It is recommended that you read these documents before making a decision to invest in the fund.

The information provided is merely informative and private, to be used merely as a backup tool, and should not be used to trigger or justify any action or omission, or as grounds for any operation, or replace the investors’ own judgment. Investors are responsible for their acts and omissions.

Need help?

We are here for you

Need help?

Need help?

Looking for a branch?

Looking for a branch?

Need to call us?

Need to call us?