- Individuals

- Investments

- CrediBolsa

CrediBolsa

Invest in the largest indexes with Credibolsa

Credibolsa is a credit line that allows trading market securities in the indexes PSI, IBEX35, CAC40, AEX25, DAX30, Nasdaq100 and Dow Jones IA, except BCP securities

Benefits

Why invest with CrediBolsa?

It's a loan that allows you to invest in the stock market if you don't have enough capital

Pay interest only on the amount used, not on the total amount of the loan

With CrediBolsa you can invest three times the amount of your own capital. For example, if you have €2,500, CrediBolsa lends €5,000 and invests €7,500 total

You can invest in the largest stock market indexes with personalized management

It's a loan that allows you to invest in the stock market if you don't have enough capital

Pay interest only on the amount used, not on the total amount of the loan

With CrediBolsa you can invest three times the amount of your own capital. For example, if you have €2,500, CrediBolsa lends €5,000 and invests €7,500 total

You can invest in the largest stock market indexes with personalized management

What are the risks of investing with a loan?

Before investing, look for information. There are many advantages to investing with a loan, however, you should be aware of the possible risks and the exposure to market variations.

In addition to covering the amount in the contract, you may have to make additional deliveries if the prices of the securities in your portfolio fall considerably.

The return generated by the investment may not be enough to cover all the expenses, such as the interest to be paid.

In addition to the amount of the loan (unused), a commitment fee will be charged every quarter.

Investing with CrediBolsa requires a greater knowledge of the stock market and is therefore recommended for more experienced investors.

When investing in international markets, keep in mind that the exchange rate risk is higher for investments that are made in currencies other than euro.

What are the degrees of default?

Keep yourself informed. The degree of default is always available in the query option “Details” in your CrediBolsa Account. You can access through the app or website.

Market securities are automatically liquidated in two situations: when the coverage level reaches 110% or when the account accumulates 8 days of non-compliance. These days refer to the ones where the coverage level can be below 125%.

The warning is sent in the following situations: Degree of coverage less than 150% Degree of coverage less than 125%

Rates, amounts and terms

Now on to the math

These are the funding amounts

Minimum amount

€ 5.000

€ 5.000

Maximum amount

€ 100.000

€ 100.000

Effective Annual Rate (TAE)

6.843%

6.843%

TAE calculated under the terms of DL 220/94 of August 23, based on a 6.637% TAN (Annual Effective Rate), corresponding to the 6-month Euribor rate - January 2026 - of 2.137%, plus a 4.500% spread, for an account with a credit limit of € 5.000, totally used, for a period of 6 months.

This is the contract term

Term

6 months

6 months

Contract with the possibility of renewal for the same term (only after you confirm).

And the coverage degree

Coverage degree

150%

150%

Whenever the value of the portfolio drops below the total investment allowed (below 150% or 125%), a warning is sent by email, informing of the need to transfer funds to your CrediBolsa account.

1, 2, 3 and that’s it!

Investing has never been so easy

Open a CrediBolsa account

Open a CrediBolsa account

and apply for a loan to invest.

and apply for a loan to invest.

Fill out the documentation

Fill out the documentation

sent by Millennium and return the RSF envelope provided.

sent by Millennium and return the RSF envelope provided.

Use the loan

Use the loan

after we contact you with the decision.

after we contact you with the decision.

What do you need?

What do you need?

To be over 18 years old

To be over 18 years old

To open a CrediBolsa account. The credit is accessed via a linked current account, which is associated with a securities account

To open a CrediBolsa account. The credit is accessed via a linked current account, which is associated with a securities account

To fill out and send the documentation

To fill out and send the documentation

1, 2, 3 and that’s it!

Investing has never been so easy

Open a CrediBolsa account

Open a CrediBolsa account

and apply for a loan to invest.

and apply for a loan to invest.

Fill out the documentation

Fill out the documentation

sent by Millennium and return the RSF envelope provided.

sent by Millennium and return the RSF envelope provided.

Use the loan

Use the loan

after we contact you with the decision.

after we contact you with the decision.

What do you need?

What do you need?

To be over 18 years old

To be over 18 years old

To open a CrediBolsa account. The credit is accessed via a linked current account, which is associated with a securities account

To open a CrediBolsa account. The credit is accessed via a linked current account, which is associated with a securities account

To fill out and send the documentation

To fill out and send the documentation

Related topics

Some more investment picks...

Investment Funds

Investment Funds

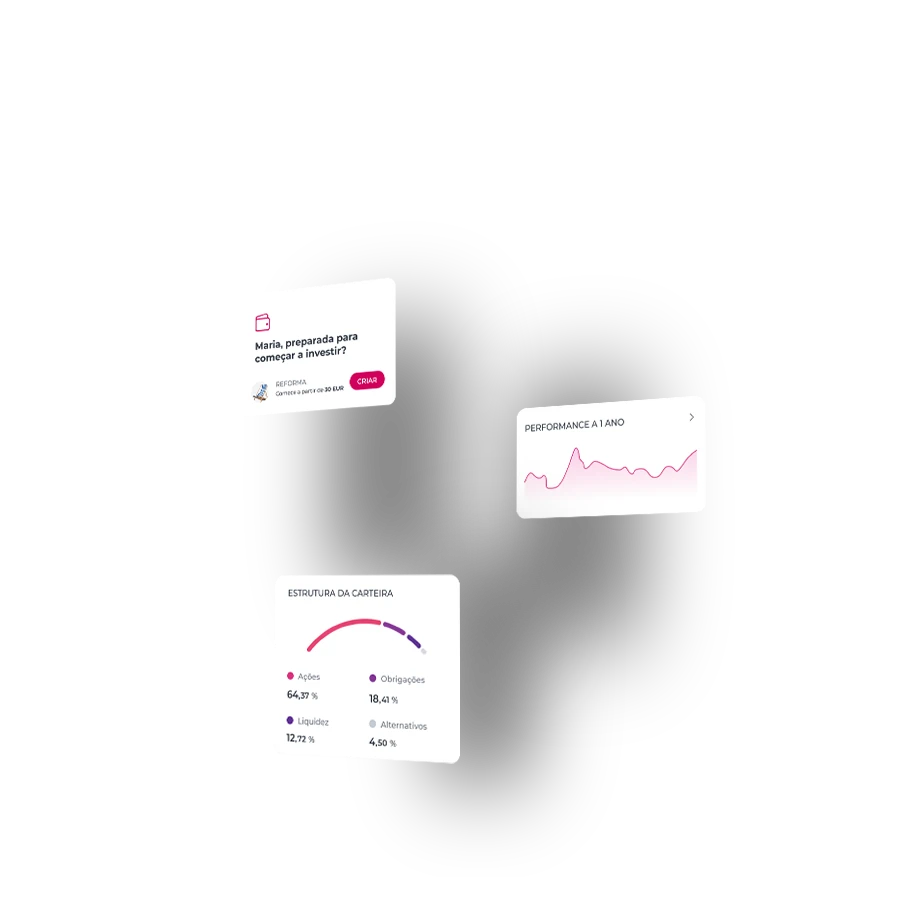

Start investing from €250 in the app

Start investing from €250 in the app

Investment products

Investment products

Looking for a more profitable solution?

Looking for a more profitable solution?

Stocks

Stocks

Make your future profitable by investing in what you believe in

Make your future profitable by investing in what you believe in

Investment Funds

Investment Funds

Start investing from €250 in the app

Start investing from €250 in the app

Investment products

Investment products

Looking for a more profitable solution?

Looking for a more profitable solution?

Stocks

Stocks

Make your future profitable by investing in what you believe in

Make your future profitable by investing in what you believe in

Stamp Duty on the amount used

Article 17.1.4 of the TGIS: The rate to be applied is 0.04%, the tax being levied on the monthly average of the credit used, obtained through the sum of the outstanding balances ascertained daily, during the month, divided by 30 then applying the said rate. The amount thus calculated will be entered into the account on the last business day of the month with a value date of the same day, and with subsequent transfer to the destination account for the interest owed (if any);

Stamp Duty on interest (Art.17.3.1. of the TGIS): 4%.

Stamp Duty on the commitment fee (Article 17.3.4 of the TGIS): 4%.

Default levels

Securities are automatically liquidated when the 110% degree of coverage is reached, or when the account registers 8 calendar days of default (the number of days of default is the number of days in the CrediBolsa account that the coverage degree is "allowed" to remain below 125%).

Need help?

We are here for you

Need help?

Need help?

Here you can find the answer to all your questions

Here you can find the answer to all your questions

Looking for a branch?

Looking for a branch?

Find the nearest branch

Find the nearest branch

Need to call us?

Need to call us?

Call whenever you need to

Call whenever you need to

Need help?

Here you can find the answer to all your questions

Here you can find the answer to all your questions

Looking for a branch?

Find the nearest branch

Find the nearest branch

Need to call us?

Call whenever you need to

Call whenever you need to