- Individuals

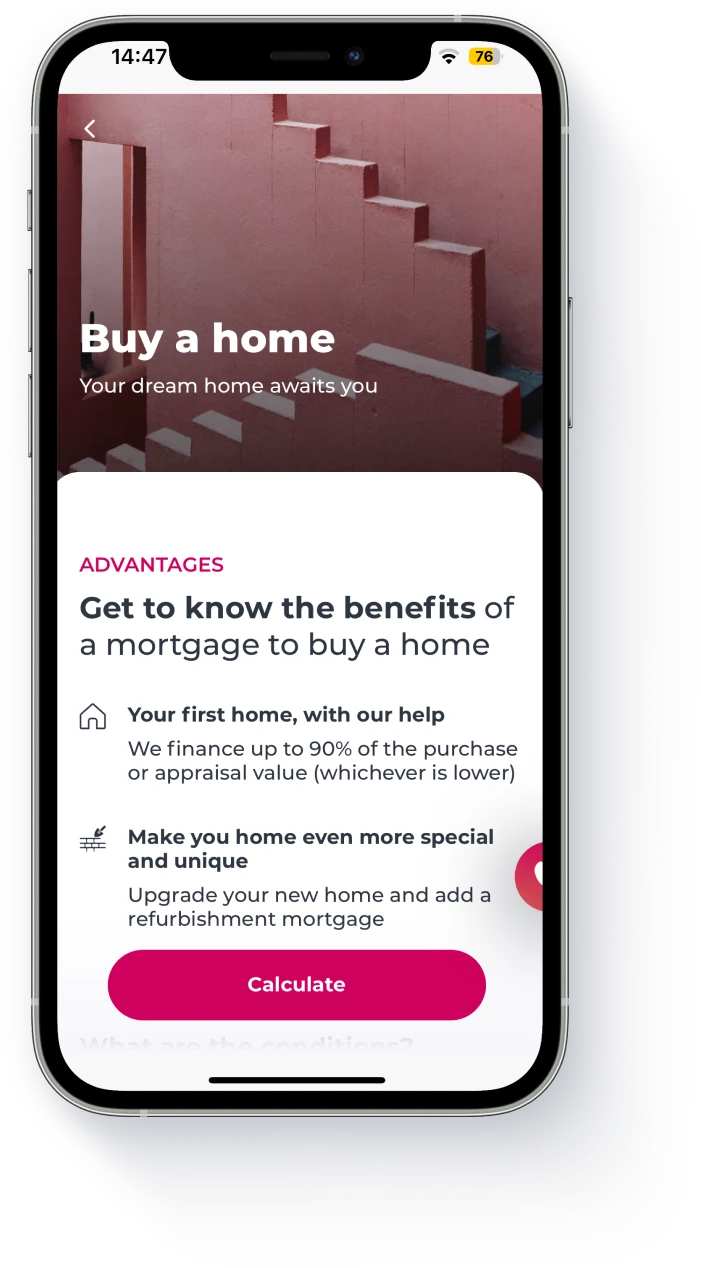

- Loans

- Mortgage loan

- IMT exemption

Buying a home with tax benefits

Who can benefit?

Young adults aged 35 or younger at the date of closing, who are not considered dependents for IRS purposes in the year of the closing.

First purchase of an urban property or apartment meant exclusively for personal and permanent living (first home).

Young adults who haven't owned property in the past 3 years.

Properties with an acquisition/closing value not exceeding €330,539.00 are exempt from IMT and Stamp Duty

Tax-exempt properties

Does your property fit this criteria?

Properties with an acquisition/closing value exceeding €648,022.00 are not eligible for exemption

Properties with an acquisition/closing value higher than €324,058.00 and lower than €648,022.00 are exempt up to €324,058.00 and taxed on the amount exceeding this limit

Tax-exempt properties

Does your property fit this criteria?

Properties with an acquisition/closing value not exceeding €330,539.00 are exempt from IMT and Stamp Duty

Properties with an acquisition/closing value exceeding €648,022.00 are not eligible for exemption

Properties with an acquisition/closing value higher than €324,058.00 and lower than €648,022.00 are exempt up to €324,058.00 and taxed on the amount exceeding this limit

Tax-exempt properties

Does your property fit this criteria?

Properties with an acquisition/closing value not exceeding €330,539.00 are exempt from IMT and Stamp Duty

Properties with an acquisition/closing value exceeding €648,022.00 are not eligible for exemption

Properties with an acquisition/closing value higher than €324,058.00 and lower than €648,022.00 are exempt up to €324,058.00 and taxed on the amount exceeding this limit

Some extra details

Keep in mind that:

In the Azores and Madeira, the portion of the IMT not exempted still retains the current benefit. The full exemption applies to amounts up to €405,073.00. A partial exemption applies to amounts between €405,073.00 and €810,028.00 (on the portion exceeding €405,073.00).

In the Azores and Madeira, the portion of the IMT not exempted still retains the current benefit. The full exemption applies to amounts up to €405,073.00. A partial exemption applies to amounts between €405,073.00 and €810,028.00 (on the portion exceeding €405,073.00).

Young adults are exempt from property registration costs when buying their first home for permanent residence. The discount is €225 for the acquisition registration and €450 for acquisition and mortgage. If there are two buyers and only one qualifies, the discount is halved.

Young adults are exempt from property registration costs when buying their first home for permanent residence. The discount is €225 for the acquisition registration and €450 for acquisition and mortgage. If there are two buyers and only one qualifies, the discount is halved.

The IMT calculation considers the number of buyers. For example, in a purchase made by 2 people, one buyer might be eligible for this regime, while the other is not.

The IMT calculation considers the number of buyers. For example, in a purchase made by 2 people, one buyer might be eligible for this regime, while the other is not.

In the Azores and Madeira, the portion of the IMT not exempted still retains the current benefit. The full exemption applies to amounts up to €405,073.00. A partial exemption applies to amounts between €405,073.00 and €810,028.00 (on the portion exceeding €405,073.00).

In the Azores and Madeira, the portion of the IMT not exempted still retains the current benefit. The full exemption applies to amounts up to €405,073.00. A partial exemption applies to amounts between €405,073.00 and €810,028.00 (on the portion exceeding €405,073.00).

The IMT calculation considers the number of buyers. For example, in a purchase made by 2 people, one buyer might be eligible for this regime, while the other is not.

The IMT calculation considers the number of buyers. For example, in a purchase made by 2 people, one buyer might be eligible for this regime, while the other is not.

Young adults are exempt from property registration costs when buying their first home for permanent residence. The discount is €225 for the acquisition registration and €450 for acquisition and mortgage. If there are two buyers and only one qualifies, the discount is halved.

Young adults are exempt from property registration costs when buying their first home for permanent residence. The discount is €225 for the acquisition registration and €450 for acquisition and mortgage. If there are two buyers and only one qualifies, the discount is halved.

For a primary residence

Here's a practical example

Example for purchasing a home with 2 people, valued at €300,000| Ages | 35/35 | 35/36 | 36/36 |

|---|---|---|---|

| IMT | 0 | €5,488.79 | €10,977.58 |

| SD | 0 | €1,200 | €2,400 |

| Total | 0 | €6,688.79 | €13,377.58 |

Frequently asked questions

Questions? We'll help

These exemptions are available to young adults between 18 and 35 years old who are purchasing their first permanent residence and are not classified as dependents for IRS purposes.

These exemptions are available to young adults between 18 and 35 years old who are purchasing their first permanent residence and are not classified as dependents for IRS purposes.

Yes. The exemption applies, but only to half of the tax that would otherwise be due. For instance, for a house valued at 250,000 euros, which would normally incur 9,478 euros in IMT plus Stamp Duty, the exemption reduces the payment to 4,739 euros since only one person qualifies for the exemption.

Yes. The exemption applies, but only to half of the tax that would otherwise be due. For instance, for a house valued at 250,000 euros, which would normally incur 9,478 euros in IMT plus Stamp Duty, the exemption reduces the payment to 4,739 euros since only one person qualifies for the exemption.

Yes. The exemption remains the same as in the previous scenario, so they would pay half of the tax.

Yes. The exemption remains the same as in the previous scenario, so they would pay half of the tax.

No. This measure only applies to properties purchased after this date.

No. This measure only applies to properties purchased after this date.

No. The income of young adults does not impact this exemption.

No. The income of young adults does not impact this exemption.

Frequently asked questions

Questions? We'll help

These exemptions are available to young adults between 18 and 35 years old who are purchasing their first permanent residence and are not classified as dependents for IRS purposes.

These exemptions are available to young adults between 18 and 35 years old who are purchasing their first permanent residence and are not classified as dependents for IRS purposes.

Yes. The exemption applies, but only to half of the tax that would otherwise be due. For instance, for a house valued at 250,000 euros, which would normally incur 9,478 euros in IMT plus Stamp Duty, the exemption reduces the payment to 4,739 euros since only one person qualifies for the exemption.

Yes. The exemption applies, but only to half of the tax that would otherwise be due. For instance, for a house valued at 250,000 euros, which would normally incur 9,478 euros in IMT plus Stamp Duty, the exemption reduces the payment to 4,739 euros since only one person qualifies for the exemption.

Yes. The exemption remains the same as in the previous scenario, so they would pay half of the tax.

Yes. The exemption remains the same as in the previous scenario, so they would pay half of the tax.

No. This measure only applies to properties purchased after this date.

No. This measure only applies to properties purchased after this date.

No. The income of young adults does not impact this exemption.

No. The income of young adults does not impact this exemption.

Need help?

We are here for you

Need help?

Need help?

Looking for a branch?

Looking for a branch?

Need to call us?

Need to call us?