- Individuals

- Investments

- Unit Linked

- Seguro Investidor Global

Seguro Investidor Global 2ª Série

Invest with 5 investment strategies and diversify according to the risk profiles

Benefits

Why invest in this insurance?

Tax benefits if you keep the investment for a minimum of 5 years

Includes life insurance coverage, for accidental death, applicable up to the age of 80

From the 4th year onward, you can redeem your investment partially or completely without penalties

You can change your investment strategy up to twice a year at no cost

Tax benefits if you keep the investment for a minimum of 5 years

Includes life insurance coverage, for accidental death, applicable up to the age of 80

From the 4th year onward, you can redeem your investment partially or completely without penalties

You can change your investment strategy up to twice a year at no cost

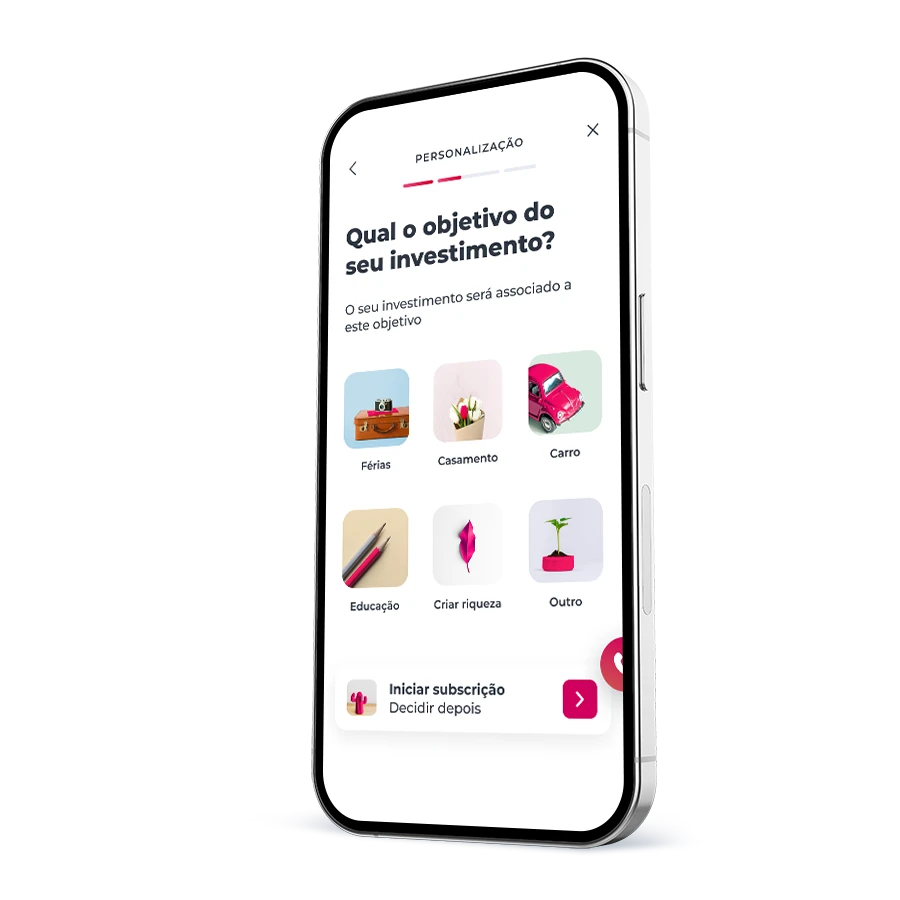

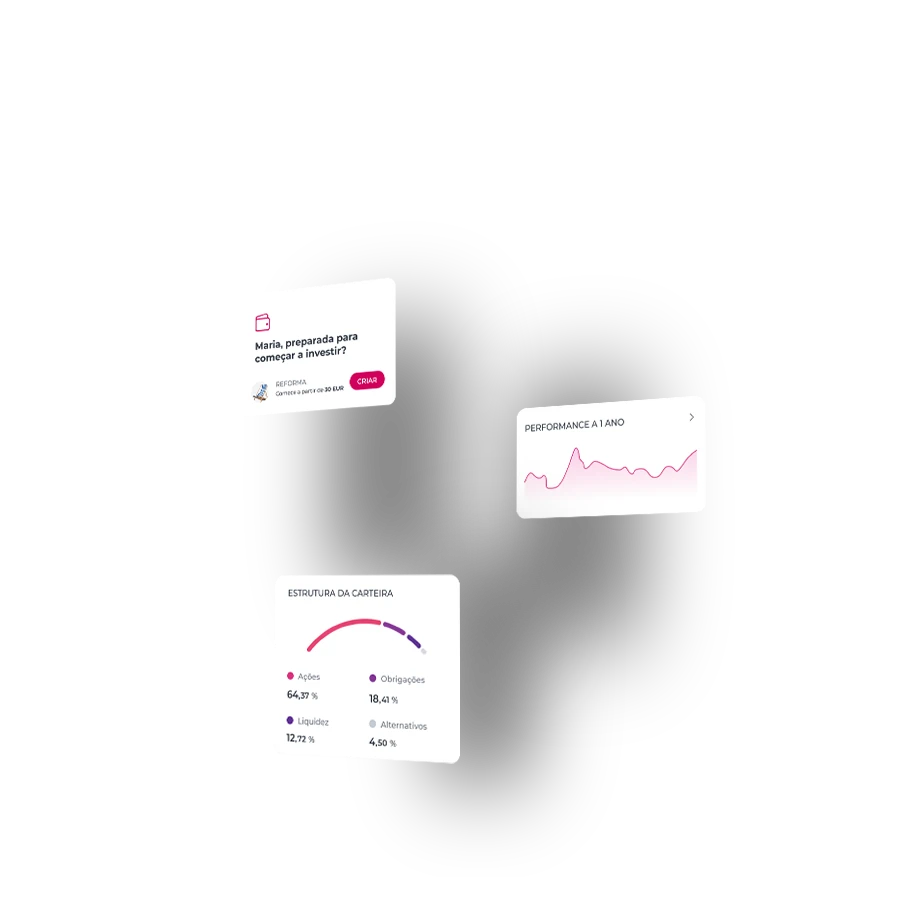

Investment strategies tailored to you

Seguro Investidor Global 2.ª Série (Unit Linked) has 5 investment strategies tailored to different risk profiles, and you can transfer your investment between strategies at any time (Maximum of 2 Body text: times per contract year. Implies sending an additional minute for €5).

This portfolio is built to keep your amount invested and will always invest a minimum of 5% in bank deposits. The Extra Moderate Strategy will invest mostly in bonds and liquidity.

This portfolio is built to keep the amount invested and will always invest a minimum of 5% in bank deposits. Liquidity will be mostly bank deposits or short-term Treasury Bills (less than 6 months).

This portfolio is built to increase your medium/long term investment and is aimed at investors with risk tolerance. This strategy will invest mostly in bonds, with some exposure to stocks.

This portfolio is built to boost the returns in the medium/long term and is aimed at investors with a risk appetite. This strategy will invest mostly in bonds, with some exposure to stocks.

This portfolio is built to boost the returns in the medium/long term and is aimed at investors who seek risk. This strategy will invest mostly in stocks and some exposure to bonds.

Fees, charges and amounts

Now on to the math

These are the fees

Subscription fee

0.0%

Policy costs

€ 5

Current financial management fee (max)

1.50%

The financial management fee is applied daily to the fund’s net asset value and charged the following month. The percentage above shows the current maximum fee that may apply to each fund.

Changes to the contract requested by the Customer will incur an additional charge of €5.

Changes to the contract requested by the Customer will incur an additional charge of €5.

This is the early redemption fee

1st year

1.0%

2nd and 3rd years

0.5%

From 4th year onwards

0%

And these are the deliveries

Single deliveries

€ 500.00

Regular monthly deliveries

€ 30.00

Regular quarterly deliveries

€ 90.00

Deliveries

Regular deliveries every 6 months

€ 180.00

Regular annual deliveries

€ 360.00

One-off deliveries

€ 30.00

1, 2, 3 and that’s it!

It’s that easy

Login to the website

Login to the website

and choose the insurance.

and choose the insurance.

Calculate

Calculate

by filling out the details.

by filling out the details.

Confirm the subscription

Confirm the subscription

after reading and accepting the contractual documents.

after reading and accepting the contractual documents.

What do you need?

What do you need?

To be over 18 years old

To be over 18 years old

To have a tax address in Portugal

To have a tax address in Portugal

Fill out the Investor Questionnaire to avoid investing in products you don't understand or about which you are not aware of the risks

Fill out the Investor Questionnaire to avoid investing in products you don't understand or about which you are not aware of the risks

1, 2, 3 and that’s it!

It’s that easy

Login to the website

Login to the website

and choose the insurance.

and choose the insurance.

Calculate

Calculate

by filling out the details.

by filling out the details.

Confirm the subscription

Confirm the subscription

after reading and accepting the contractual documents.

after reading and accepting the contractual documents.

What do you need?

What do you need?

To be over 18 years old

To be over 18 years old

To have a tax address in Portugal

To have a tax address in Portugal

Fill out the Investor Questionnaire to avoid investing in products you don't understand or about which you are not aware of the risks

Fill out the Investor Questionnaire to avoid investing in products you don't understand or about which you are not aware of the risks

Related topics

Some more investment picks...

Reforma Ativa PPR 2ª Série

Reforma Ativa PPR 2ª Série

Enjoy up to €400 on tax benefits

Enjoy up to €400 on tax benefits

Investment Funds

Investment Funds

Access several markets with a single investment

Access several markets with a single investment

ETF (Exchange-Traded Fund)

ETF (Exchange-Traded Fund)

For a low-cost diversified risk portfolio

For a low-cost diversified risk portfolio

Certificates

Certificates

Traded in the stock market and managed by experts

Traded in the stock market and managed by experts

Reforma Ativa PPR 2ª Série

Reforma Ativa PPR 2ª Série

Enjoy up to €400 on tax benefits

Enjoy up to €400 on tax benefits

Investment Funds

Investment Funds

Access several markets with a single investment

Access several markets with a single investment

ETF (Exchange-Traded Fund)

ETF (Exchange-Traded Fund)

For a low-cost diversified risk portfolio

For a low-cost diversified risk portfolio

Certificates

Certificates

Traded in the stock market and managed by experts

Traded in the stock market and managed by experts

Legal documents and other information

General documents

General Conditions

DownloadExtra Moderate Strategy

Costs and Charges Information

DownloadModerate Strategy

Costs and Charges Information

DownloadBalanced Strategy (Stocks)

Costs and Charges Information

DownloadDynamic Strategy (Stocks)

Costs and Charges Information

DownloadAggressive Strategy (Stocks)

Costs and Charges Information

DownloadAdvertising

Does not dispense with the consultation of legally required pre-contractual and contractual information.

Need help?

We are here for you

Need help?

Need help?

Here you can find the answer to all your questions

Here you can find the answer to all your questions

Looking for a branch?

Looking for a branch?

Find the nearest branch

Find the nearest branch

Need to call us?

Need to call us?

Call whenever you need to

Call whenever you need to

Need help?

Here you can find the answer to all your questions

Here you can find the answer to all your questions

Looking for a branch?

Find the nearest branch

Find the nearest branch

Need to call us?

Call whenever you need to

Call whenever you need to