- Individuals

- Loans

- Mortgage loan

- Build house

Mortgage loan to build a house

Build the home of your dreams

Premium service

No red tape. We take care of everything

Don't waste time, we collect all the necessary documentation

More flexibility to sign the deed, available on weekdays until 10pm and Saturdays from 9am to 12pm

If you can't be present, we can represent you at the signing

Loan charges and rates

Now on to the math

Awards and Distinctions

Fastest Process, Most Digital Bank, and Best Mortgage Transfer Campaign

Fastest Process

Millennium bcp was distinguished in the 2025 Summer Mortgage Loan Awards by ComparaJá.pt in the “Fastest Process” category, having been the Bank that most streamlined the credit process for Consumers who used ComparaJá’s services. This distinction is only possible thanks to the dedication and professionalism of the extensive team involved in the various stages of the mortgage loan process.

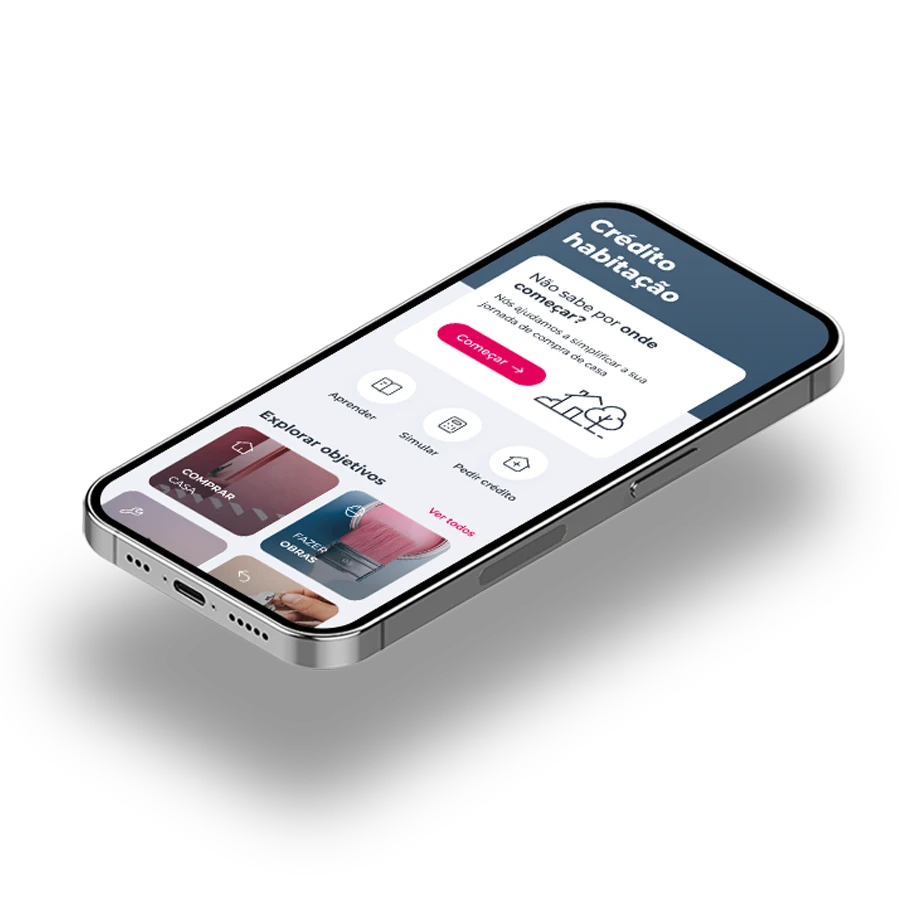

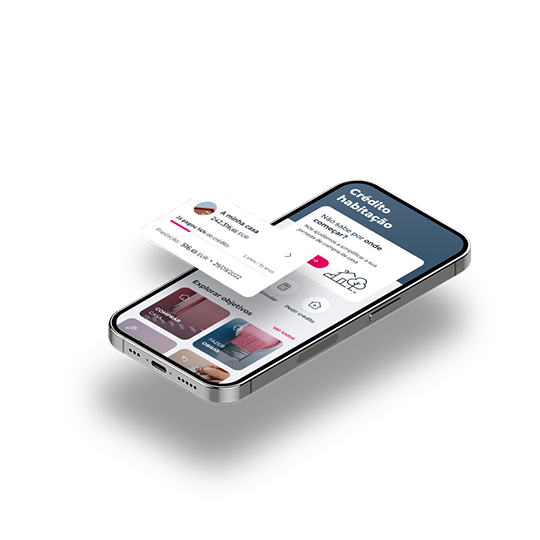

Most Digital Bank

Millennium bcp was distinguished in the 2025 Summer Mortgage Loan Awards by ComparaJá.pt in the “Most Digital Bank” category for offering innovative and practical digital solutions, ensuring an efficient and intuitive online experience throughout the summer. This distinction is only possible thanks to the dedication and professionalism of the extensive team involved in the various stages of the mortgage loan process.

Best Mortgage Transfer Campaign

Millennium bcp was distinguished in the 2025 Summer Mortgage Loan Awards by ComparaJá.pt in the “Best Credit Transfer Campaign” category, having presented the best transfer campaign and achieving the best scores in ComparaJá’s analysis. This distinction is only possible thanks to the dedication and professionalism of the extensive team involved in the various stages of the mortgage loan process.

These awards are the sole responsibility of the entities that granted them.

Awards and Distinctions

Fastest Process, Most Digital Bank, and Best Mortgage Transfer Campaign

Fastest Process

Millennium bcp was distinguished in the 2025 Summer Mortgage Loan Awards by ComparaJá.pt in the “Fastest Process” category, having been the Bank that most streamlined the credit process for Consumers who used ComparaJá’s services. This distinction is only possible thanks to the dedication and professionalism of the extensive team involved in the various stages of the mortgage loan process.

Most Digital Bank

Millennium bcp was distinguished in the 2025 Summer Mortgage Loan Awards by ComparaJá.pt in the “Most Digital Bank” category for offering innovative and practical digital solutions, ensuring an efficient and intuitive online experience throughout the summer. This distinction is only possible thanks to the dedication and professionalism of the extensive team involved in the various stages of the mortgage loan process.

Best Mortgage Transfer Campaign

Millennium bcp was distinguished in the 2025 Summer Mortgage Loan Awards by ComparaJá.pt in the “Best Credit Transfer Campaign” category, having presented the best transfer campaign and achieving the best scores in ComparaJá’s analysis. This distinction is only possible thanks to the dedication and professionalism of the extensive team involved in the various stages of the mortgage loan process.

These awards are the sole responsibility of the entities that granted them.

Want to apply for a mortgage loan?

Before you make a decision...

All it takes is 6 steps

Applying for a mortgage is simple

All it takes is 6 steps

Applying for a mortgage is simple

Frequently asked questions

Questions? We'll help

Millennium disburses the financed amount for self-construction and renovations in multiple tranches (up to a maximum of 6) over a period of up to 24 months. During the installment disbursement phase, you only pay interest on the used amounts during that time.

Millennium disburses the financed amount for self-construction and renovations in multiple tranches (up to a maximum of 6) over a period of up to 24 months. During the installment disbursement phase, you only pay interest on the used amounts during that time.

You can apply through our app, website, or by visiting a branch in person. When using the app or website, follow these steps: calculate the mortgage, complete the application, and submit it. Ensure you have your last three months' payslips and the IRS validation code ready. Additionally, you can attach essential property documents, including the Permanent Certificate, Caderneta Predial, and the listed building plan.

You can apply through our app, website, or by visiting a branch in person. When using the app or website, follow these steps: calculate the mortgage, complete the application, and submit it. Ensure you have your last three months' payslips and the IRS validation code ready. Additionally, you can attach essential property documents, including the Permanent Certificate, Caderneta Predial, and the listed building plan.

The loan formalization, along with the purchase and sale process, includes expenses such as contract costs, fees, notary fees, and registry fees. These fees are payable to the entities offering these services. You can see the amounts of these expenses in the calculation result.

The loan formalization, along with the purchase and sale process, includes expenses such as contract costs, fees, notary fees, and registry fees. These fees are payable to the entities offering these services. You can see the amounts of these expenses in the calculation result.

The primary house documents necessary for obtaining a mortgage loan include:

- Permanent Certificate

- Caderneta Predial (Property Tax Document)

- Dimensioned Plan

- Energy Certificate

Additionally, a usage license might be necessary.

Depending on the loan type, there might be additional documents requested as well.

The primary house documents necessary for obtaining a mortgage loan include:

- Permanent Certificate

- Caderneta Predial (Property Tax Document)

- Dimensioned Plan

- Energy Certificate

Additionally, a usage license might be necessary.

Depending on the loan type, there might be additional documents requested as well.

The spread is the additional interest rate set by Millennium. It’s added to the index (monthly average of the 3, 6 or 12 month Euribor) to obtain the nominal annual interest rate (TAN).

The spread is the additional interest rate set by Millennium. It’s added to the index (monthly average of the 3, 6 or 12 month Euribor) to obtain the nominal annual interest rate (TAN).

The effort rate, also known as the debt-to-income ratio, represents the proportion of your total monthly loan payments to your monthly net income. When deciding whether to grant you a loan, we always take this information into account, and the loan will only be approved if this effort rate is in harmony with your financial capacity.

The effort rate, also known as the debt-to-income ratio, represents the proportion of your total monthly loan payments to your monthly net income. When deciding whether to grant you a loan, we always take this information into account, and the loan will only be approved if this effort rate is in harmony with your financial capacity.

Frequently asked questions

Questions? We'll help

Millennium disburses the financed amount for self-construction and renovations in multiple tranches (up to a maximum of 6) over a period of up to 24 months. During the installment disbursement phase, you only pay interest on the used amounts during that time.

Millennium disburses the financed amount for self-construction and renovations in multiple tranches (up to a maximum of 6) over a period of up to 24 months. During the installment disbursement phase, you only pay interest on the used amounts during that time.

You can apply through our app, website, or by visiting a branch in person. When using the app or website, follow these steps: calculate the mortgage, complete the application, and submit it. Ensure you have your last three months' payslips and the IRS validation code ready. Additionally, you can attach essential property documents, including the Permanent Certificate, Caderneta Predial, and the listed building plan.

You can apply through our app, website, or by visiting a branch in person. When using the app or website, follow these steps: calculate the mortgage, complete the application, and submit it. Ensure you have your last three months' payslips and the IRS validation code ready. Additionally, you can attach essential property documents, including the Permanent Certificate, Caderneta Predial, and the listed building plan.

The loan formalization, along with the purchase and sale process, includes expenses such as contract costs, fees, notary fees, and registry fees. These fees are payable to the entities offering these services. You can see the amounts of these expenses in the calculation result.

The loan formalization, along with the purchase and sale process, includes expenses such as contract costs, fees, notary fees, and registry fees. These fees are payable to the entities offering these services. You can see the amounts of these expenses in the calculation result.

The primary house documents necessary for obtaining a mortgage loan include:

- Permanent Certificate

- Caderneta Predial (Property Tax Document)

- Dimensioned Plan

- Energy Certificate

Additionally, a usage license might be necessary.

Depending on the loan type, there might be additional documents requested as well.

The primary house documents necessary for obtaining a mortgage loan include:

- Permanent Certificate

- Caderneta Predial (Property Tax Document)

- Dimensioned Plan

- Energy Certificate

Additionally, a usage license might be necessary.

Depending on the loan type, there might be additional documents requested as well.

The spread is the additional interest rate set by Millennium. It’s added to the index (monthly average of the 3, 6 or 12 month Euribor) to obtain the nominal annual interest rate (TAN).

The spread is the additional interest rate set by Millennium. It’s added to the index (monthly average of the 3, 6 or 12 month Euribor) to obtain the nominal annual interest rate (TAN).

The effort rate, also known as the debt-to-income ratio, represents the proportion of your total monthly loan payments to your monthly net income. When deciding whether to grant you a loan, we always take this information into account, and the loan will only be approved if this effort rate is in harmony with your financial capacity.

The effort rate, also known as the debt-to-income ratio, represents the proportion of your total monthly loan payments to your monthly net income. When deciding whether to grant you a loan, we always take this information into account, and the loan will only be approved if this effort rate is in harmony with your financial capacity.

Related topics

You might like these too...

Legal documents and other information

General Pre-Contractual Information

DownloadNeed help?

We are here for you

Need help?

Need help?

Looking for a branch?

Looking for a branch?

Need to call us?

Need to call us?