- Individuals

- Loans

- Car loan

- New Car Leasing

Lease for New Cars TAEG 5.0%

Your new car with lower installments

At the end of the contract you can choose to buy the car for a lower amount

Branch only

Leasing allows you to use a car temporarily by paying a monthly rent

Learn more

Apply for your Lease for New Cars and hit the road with no worries

Leasing has lower installments compared to other loan options

Learn more

Choose the term that best suits you, between 12 and 120 months

Leasing gives you the flexibility to choose your contract conditions

You can end the contract at any time

Loan charges and rates

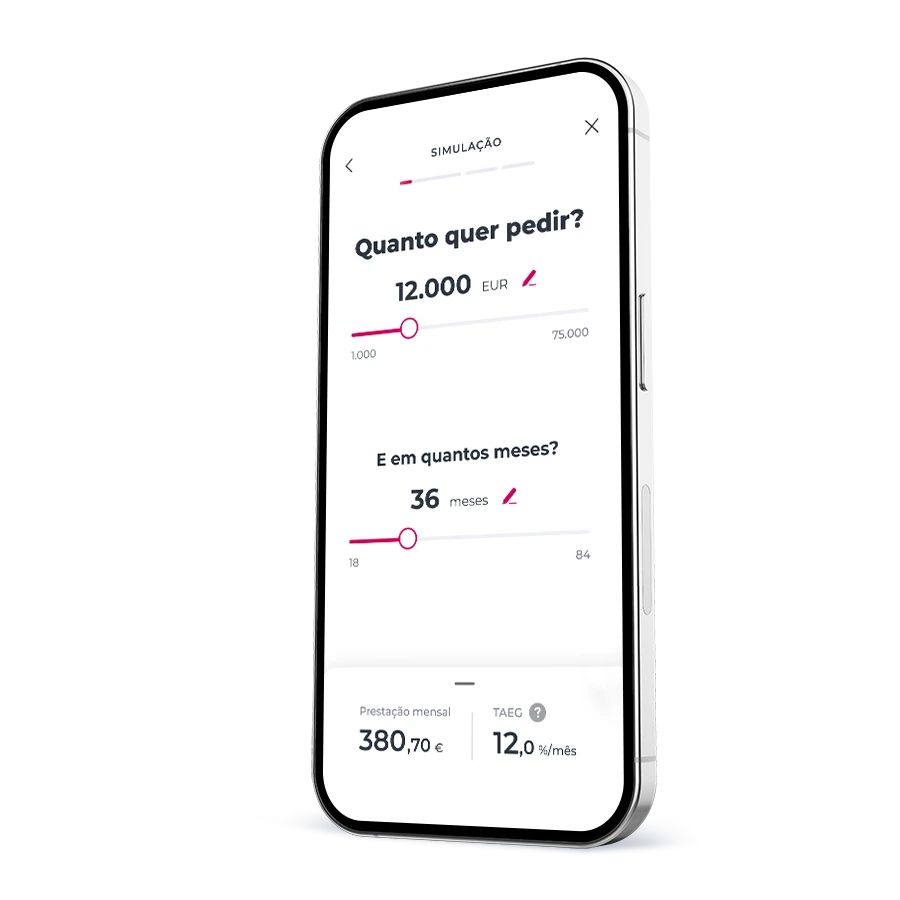

Now on to the math

Annual Percentage Rate of Charge (TAEG)

5.0%

Annual Percentage Rate (TAN)

4.745%

5.0% TAEG and TAN 4.745%¹ with monthly installments of €528.55, for a calculation of a €43,400 loan with an 96-month term, a down payment of €3,600 and a residual amount of €2,350. Total amount charged to the consumer: €56,476.75 including formalization fee (€150), fees, interest and Stamp Duty over the added cost of the rent and formalization fee. Interest rate indexed to 12-month Euribor plus spread, determined by client's risk profile and operation.

These are the terms and residual amount

Term

between 12 and 120 months

Residual amount/ Purchase option

between 1% and 5%

And these are the charges and expenses

Formalization fee (plus Value Added Tax at the rate in force)

VAT over the monthly payments

Fees (registration at the Vehicle Registry Office)

The information shared here doesn't replace the need to consult the legally required pre-contractual and contractual details.

1, 2, 3 and that’s it!

Applying for a lease is simple

Go to a Millennium branch

Go to a Millennium branch

and apply for a lease for new cars.

and apply for a lease for new cars.

Confirm the application

Confirm the application

after carefully reading all the legal documents.

after carefully reading all the legal documents.

Sign the contract

Sign the contract

after the lease has been approved and hit the road with your car.

after the lease has been approved and hit the road with your car.

What do you need?

What do you need?

To be over 18 years old

To be over 18 years old

The last 3 payslips and the IRS validation code

The last 3 payslips and the IRS validation code

ID documents of all participants

ID documents of all participants

Pro forma invoice for the purchased car

Pro forma invoice for the purchased car

Tax compliance declaration (for leases exceeding €50,000)

Tax compliance declaration (for leases exceeding €50,000)

Mandatory car insurance

Mandatory car insurance

1, 2, 3 and that’s it!

Applying for a lease is simple

Go to a Millennium branch

Go to a Millennium branch

and apply for a lease for new cars.

and apply for a lease for new cars.

Confirm the application

Confirm the application

after carefully reading all the legal documents.

after carefully reading all the legal documents.

Sign the contract

Sign the contract

after the lease has been approved and hit the road with your car.

after the lease has been approved and hit the road with your car.

What do you need?

What do you need?

To be over 18 years old

To be over 18 years old

The last 3 payslips and the IRS validation code

The last 3 payslips and the IRS validation code

ID documents of all participants

ID documents of all participants

Pro forma invoice for the purchased car

Pro forma invoice for the purchased car

Tax compliance declaration (for leases exceeding €50,000)

Tax compliance declaration (for leases exceeding €50,000)

Mandatory car insurance

Mandatory car insurance

Want to apply for a lease?

Before making a decision...

Consider if you need to make this purchase taking into account different factors.

Make sure the installments won’t compromise the budget of your household.

Verify the conditions of the lease and read all the pre-contractual and contract information.

If you change your mind after applying, you can cancel it on the website or app within 14 days.

Related topics

You might like these too...

Móbis car insurance

Móbis car insurance

Protect your car from the unforeseeable

Protect your car from the unforeseeable

Loan for new cars TAEG 9.2%

Loan for new cars TAEG 9.2%

Buy your new car with a hassle-free loan

Buy your new car with a hassle-free loan

Filing claims

Filing claims

File your claims in a simple and quick way

File your claims in a simple and quick way

Payment Protection Plan Personal Loan

Payment Protection Plan Personal Loan

Never miss a payment from your personal loan

Never miss a payment from your personal loan

Móbis car insurance

Móbis car insurance

Protect your car from the unforeseeable

Protect your car from the unforeseeable

Loan for new cars TAEG 9.2%

Loan for new cars TAEG 9.2%

Buy your new car with a hassle-free loan

Buy your new car with a hassle-free loan

Filing claims

Filing claims

File your claims in a simple and quick way

File your claims in a simple and quick way

Payment Protection Plan Personal Loan

Payment Protection Plan Personal Loan

Never miss a payment from your personal loan

Never miss a payment from your personal loan

¹ The indicated TAN is the sum of the simple arithmetic average of the daily quotations of the 12-month Euribor on a 360-day basis, for the month of January 2026 (month prior to the first interest counting period, or of each annual period of validity, rounded to the nearest thousandth), of 2.245%, plus a spread of 2.50%. The spread is defined when the financing is approved, according to the Client's risk profile and the characteristics of the operation). Subject to credit risk analysis and Banco de Portugal recommendations.

The information presented here does not dispense with consulting the legally required pre-contractual and contractual information.

This type of contract allows the customer temporary use of the vehicle, upon payment of a fee and for a certain period of time. At the end of the contract, if the customer chooses to acquire the vehicle, they must pay the residual value as initially established.

This type of contract allows the customer temporary use of the vehicle, upon payment of a fee and for a certain period of time. At the end of the contract, if the customer chooses to acquire the vehicle, they must pay the residual value as initially established.

It is possible to contract a residual value that allows postponing the payment of part of the financed amount until the end of the contract.

It is possible to contract a residual value that allows postponing the payment of part of the financed amount until the end of the contract.

Need help?

We are here for you

Need help?

Need help?

Here you can find the answer to all your questions

Here you can find the answer to all your questions

Looking for a branch?

Looking for a branch?

Find the nearest branch

Find the nearest branch

Need to call us?

Need to call us?

Call whenever you need to

Call whenever you need to

Need help?

Here you can find the answer to all your questions

Here you can find the answer to all your questions

Looking for a branch?

Find the nearest branch

Find the nearest branch

Need to call us?

Call whenever you need to

Call whenever you need to