- Individuals

- Investments

- Bonds

Bonds

Earn interest when you buy a bond

Benefits

Why invest in bonds?

Bonds adapted to your investor profile

Through bonds, investors get a constant return from payments, usually every year, of interest and the return of the outstanding amount at maturity. On the website, you can buy bonds from the national market.

Invest in 5 steps!

It’s that easy!

Invest in 5 steps!

It’s that easy!

Articles, tips and a lot more

Everything you need to invest

Articles, tips and a lot more

Everything you need to invest

MTrader

Stock market trading in your hands

MTrader

Stock market trading in your hands

Frequently asked questions

Questions? We'll help

Bonds are debt securities representing a medium to long-term loan, issued by companies or governments. When an entity issues a bond, it commits to repay the amount invested by the bondholder on a pre-defined date. The interest coupon is one of the main components of a bond and can take various forms: fixed rate, variable/indexed rate, mixed, step-up or zero coupon.

Bonds are debt securities representing a medium to long-term loan, issued by companies or governments. When an entity issues a bond, it commits to repay the amount invested by the bondholder on a pre-defined date. The interest coupon is one of the main components of a bond and can take various forms: fixed rate, variable/indexed rate, mixed, step-up or zero coupon.

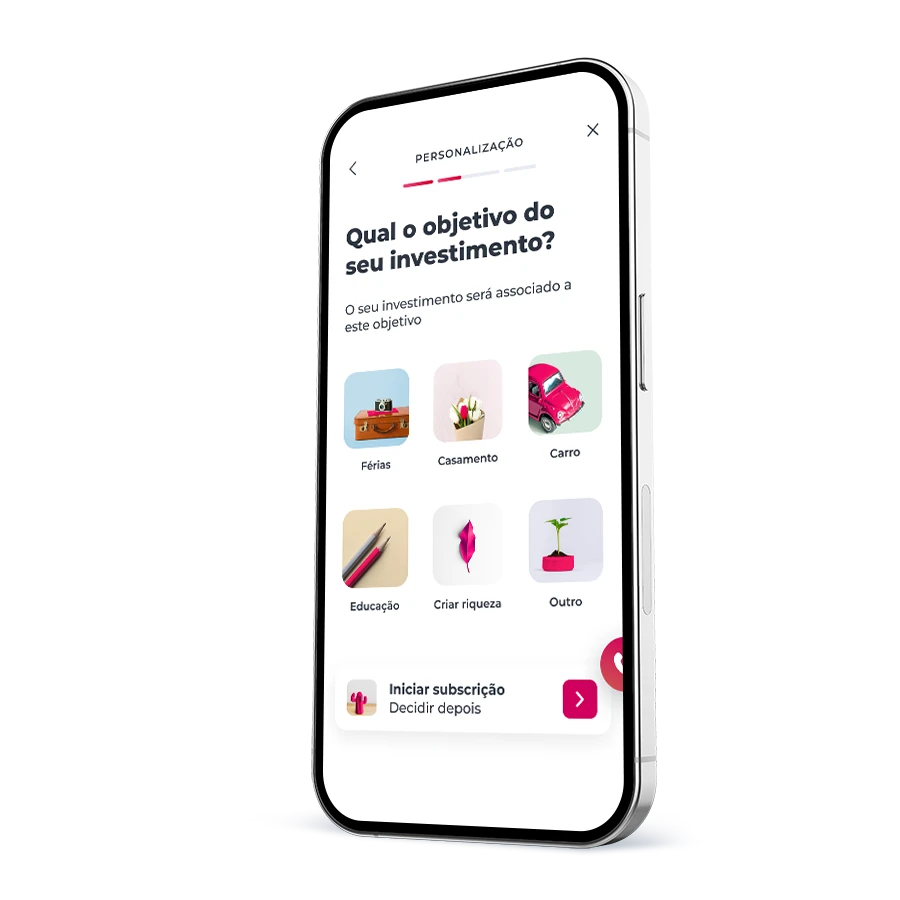

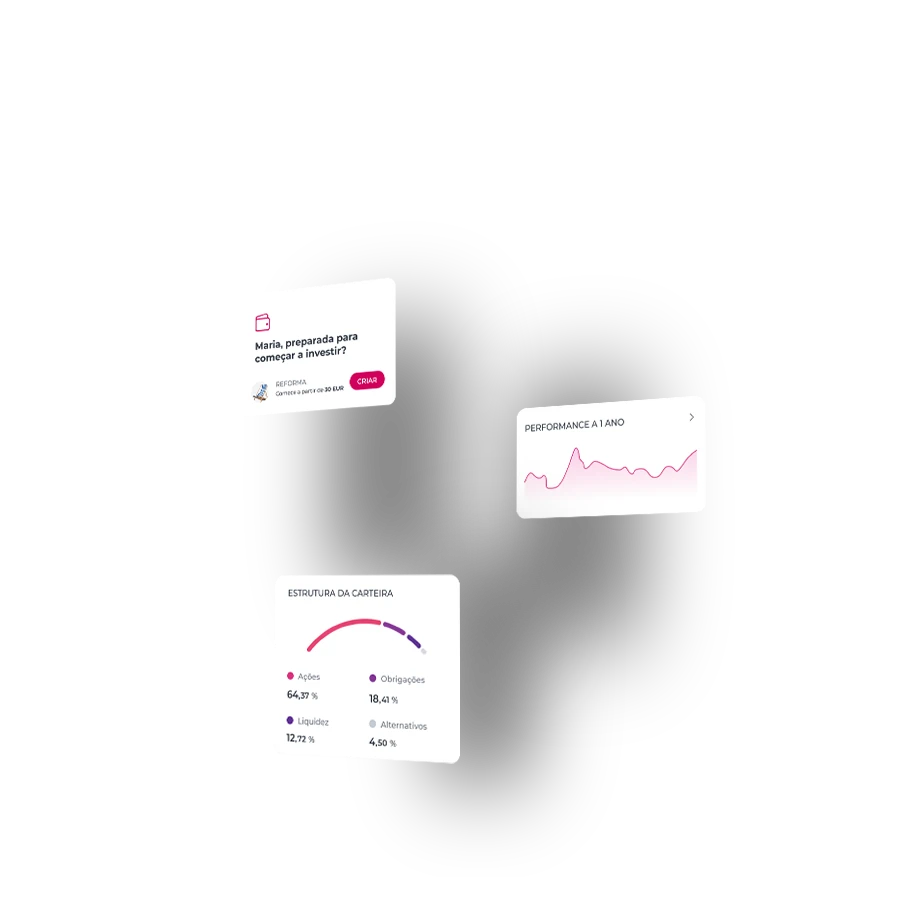

You can invest in bonds on our website or app. Or on the MTrader platform or app.

You can invest in bonds on our website or app. Or on the MTrader platform or app.

Bonds are an important part of investors' portfolios and are highly valued for the stability they bring to a portfolio. When you buy a bond, you are buying the right to receive a periodic income, according to a calculation formula known in advance.

Another feature of these loans is their maturity. Bonds have a term and a repayment value that is known in advance. So if you hold the bond until redemption, you will receive the nominal value, and the price is not subject to market fluctuations at that time.

Bonds are an important part of investors' portfolios and are highly valued for the stability they bring to a portfolio. When you buy a bond, you are buying the right to receive a periodic income, according to a calculation formula known in advance.

Another feature of these loans is their maturity. Bonds have a term and a repayment value that is known in advance. So if you hold the bond until redemption, you will receive the nominal value, and the price is not subject to market fluctuations at that time.

Frequently asked questions

Questions? We'll help

Bonds are debt securities representing a medium to long-term loan, issued by companies or governments. When an entity issues a bond, it commits to repay the amount invested by the bondholder on a pre-defined date. The interest coupon is one of the main components of a bond and can take various forms: fixed rate, variable/indexed rate, mixed, step-up or zero coupon.

Bonds are debt securities representing a medium to long-term loan, issued by companies or governments. When an entity issues a bond, it commits to repay the amount invested by the bondholder on a pre-defined date. The interest coupon is one of the main components of a bond and can take various forms: fixed rate, variable/indexed rate, mixed, step-up or zero coupon.

You can invest in bonds on our website or app. Or on the MTrader platform or app.

You can invest in bonds on our website or app. Or on the MTrader platform or app.

Bonds are an important part of investors' portfolios and are highly valued for the stability they bring to a portfolio. When you buy a bond, you are buying the right to receive a periodic income, according to a calculation formula known in advance.

Another feature of these loans is their maturity. Bonds have a term and a repayment value that is known in advance. So if you hold the bond until redemption, you will receive the nominal value, and the price is not subject to market fluctuations at that time.

Bonds are an important part of investors' portfolios and are highly valued for the stability they bring to a portfolio. When you buy a bond, you are buying the right to receive a periodic income, according to a calculation formula known in advance.

Another feature of these loans is their maturity. Bonds have a term and a repayment value that is known in advance. So if you hold the bond until redemption, you will receive the nominal value, and the price is not subject to market fluctuations at that time.

Related topics

Some more investment picks...

Need help?

We are here for you

Need help?

Need help?

Looking for a branch?

Looking for a branch?

Need to call us?

Need to call us?