Vantagem Profissão

Receive more than just a salary

More Benefits

Receiving your salary at Millennium brings you benefits

Exclusive to new Customers1

And, if you're already a Plano Mais Colaborador Customer, there's a little extra for you as well!2 View campaign

Credit subject to approval. Calculate mortgage

Credit subject to approval. Calculate mortgage

Exclusive to new Customers1

And, if you're already a Plano Mais Colaborador Customer, there's a little extra for you as well!2 View campaign

Credit subject to approval. Calculate mortgage

Credit subject to approval. Calculate mortgage

Integrated banking products and services solutions

Everything you need, for less

For Plano Vantagem Profissão

Enjoy benefits in insurance as well

Exemption of the 12th and 24th monthly payments in the first two years

Exemption of the 12th and 24th monthly payments in the first two years

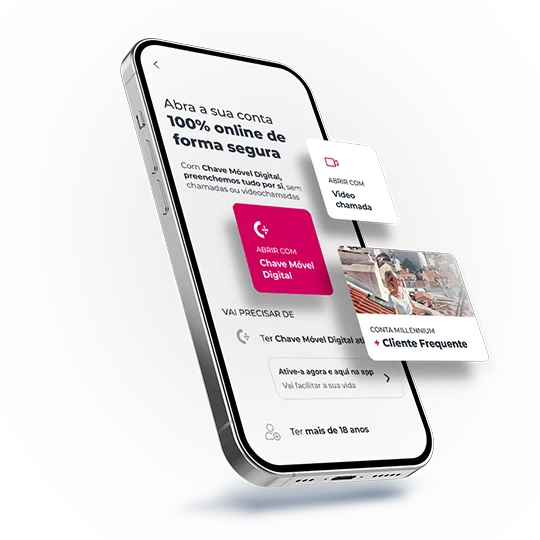

How to join?

It's just 3 steps

How to join?

It's just 3 steps

Frequently asked questions

Questions? We’ll help

To ensure eligibility for the Vantagem Profissão you must:

- Prove you are a student or alumni of the registered Entity (professional bodies & associations or specialized training school). To check eligibility please refer to your school/association page or contact us by vantagem.formacao@millenniumbcp.pt;

- Request activation of the Vantagem Formação;

- Receive your salary in the account where you've requested the Vantagem activation.

To ensure eligibility for the Vantagem Profissão you must:

- Prove you are a student or alumni of the registered Entity (professional bodies & associations or specialized training school). To check eligibility please refer to your school/association page or contact us by vantagem.formacao@millenniumbcp.pt;

- Request activation of the Vantagem Formação;

- Receive your salary in the account where you've requested the Vantagem activation.

The advantages inherent to the Vantagem Profissão are granted for an indefinite period of time and for as long as the eligibility conditions and the protocol relationship between Millennium bcp and the Registered Entity are met.

The advantages inherent to the Vantagem Profissão are granted for an indefinite period of time and for as long as the eligibility conditions and the protocol relationship between Millennium bcp and the Registered Entity are met.

Yes. Vantagem Profissão also provides access to preferential conditions in Personal Credit solutions.

Yes. Vantagem Profissão also provides access to preferential conditions in Personal Credit solutions.

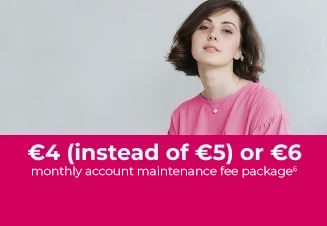

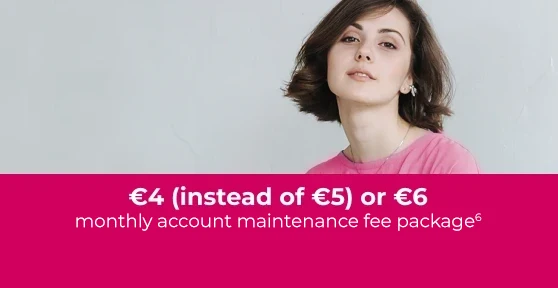

With the Vantagem Profissão active and assuming that you meet the involvement requirements for access to the reduced price list of the chosen integrated banking products and services solution, the protocol price will be ensured in the monthly package account maintenance fee for the following month.

With the Vantagem Profissão active and assuming that you meet the involvement requirements for access to the reduced price list of the chosen integrated banking products and services solution, the protocol price will be ensured in the monthly package account maintenance fee for the following month.

Having the Vantagem Profissão active, you will have immediate access to the protocol conditions. You can request an adjusted simulation from your Branch.

Having the Vantagem Profissão active, you will have immediate access to the protocol conditions. You can request an adjusted simulation from your Branch.

Request the necessary clarifications through the e-mail vantagem.profissao@millenniumbcp.pt.

Request the necessary clarifications through the e-mail vantagem.profissao@millenniumbcp.pt.

Frequently asked questions

Questions? We’ll help

To ensure eligibility for the Vantagem Profissão you must:

- Prove you are a student or alumni of the registered Entity (professional bodies & associations or specialized training school). To check eligibility please refer to your school/association page or contact us by vantagem.formacao@millenniumbcp.pt;

- Request activation of the Vantagem Formação;

- Receive your salary in the account where you've requested the Vantagem activation.

To ensure eligibility for the Vantagem Profissão you must:

- Prove you are a student or alumni of the registered Entity (professional bodies & associations or specialized training school). To check eligibility please refer to your school/association page or contact us by vantagem.formacao@millenniumbcp.pt;

- Request activation of the Vantagem Formação;

- Receive your salary in the account where you've requested the Vantagem activation.

The advantages inherent to the Vantagem Profissão are granted for an indefinite period of time and for as long as the eligibility conditions and the protocol relationship between Millennium bcp and the Registered Entity are met.

The advantages inherent to the Vantagem Profissão are granted for an indefinite period of time and for as long as the eligibility conditions and the protocol relationship between Millennium bcp and the Registered Entity are met.

Yes. Vantagem Profissão also provides access to preferential conditions in Personal Credit solutions.

Yes. Vantagem Profissão also provides access to preferential conditions in Personal Credit solutions.

With the Vantagem Profissão active and assuming that you meet the involvement requirements for access to the reduced price list of the chosen integrated banking products and services solution, the protocol price will be ensured in the monthly package account maintenance fee for the following month.

With the Vantagem Profissão active and assuming that you meet the involvement requirements for access to the reduced price list of the chosen integrated banking products and services solution, the protocol price will be ensured in the monthly package account maintenance fee for the following month.

Having the Vantagem Profissão active, you will have immediate access to the protocol conditions. You can request an adjusted simulation from your Branch.

Having the Vantagem Profissão active, you will have immediate access to the protocol conditions. You can request an adjusted simulation from your Branch.

Request the necessary clarifications through the e-mail vantagem.profissao@millenniumbcp.pt.

Request the necessary clarifications through the e-mail vantagem.profissao@millenniumbcp.pt.

Campaign details

Campaign terms and conditions

Download|

Fee

|

||

|

€6

|

Salary > €750 or FA €7,500

|

Digital statement

|

|

|

Salary > €750 and credit card billing > €100/month

|

Digital statement

|

|

Fee

|

>18 and <35 years

|

>35 and <45 years

|

>45 years

|

|

|

FA > €20.000 or salary > €1,500

|

Fa > €35.000 or salary > €2,000

|

FA > €50.000 or salary > €2,500

|

|

|

FA > €20.000 +

|

FA > €35.000 +

|

FA > €50.000 +

|

|

Salary > €750 or credit card billing >€250/month

|

|||

|

+ Digital statement

|

|||

Credit Card Billing: To calculate monthly credit card billing, withdrawals, cash advance transactions, free-meal cards, and cards held by non-depositing customers (e.g., Amex and TAP) will not be considered. However, credit cards held by non-depositing customers will be considered if they are linked to a current account.

- If you are 18-35 years old and purchasing your primary residence, you will be exempt from all initial fees, including:

- Dossier Fee: €290 + Stamp Duty

- Formalization Fee: €200 + Stamp Duty

- Appraisal Fee: €230 + Stamp Duty

- Total Exemption Value: €748.80

Requires the following products

-

Domiciliation of salary of €1,000/month in the account associated with the loan;

-

Meet additionally three of the five listed requirements products services:

-

Credit card with transactions in payments for purchases and services with a minimum usage of €250/month with semi-annual control of the accumulated amount - TAEG 15.7%4;

-

Consumer credit ALD or Auto Leasing with a minimum outstanding balance of €1,500;

-

Domiciliation of 2 monthly payments in the account associated with the financing for utility payments electricity water gas communications;

-

Life insurance associated with the credit with Ocidental Vida8;

-

5. Multi-risk home insurance associated with the credit marketed by Ageas Portugal under the Ocidental8 brand with active policies registered to the loan.

Representative Examples Home Loan

PURCHASE / CONSTRUCTION

TAEG 4.4% | TAEG 3.6% with optional associated sales

With optional associated sales:

-

Spread 0% during the first 2 years

-

Spread 0.70% thereafter

-

Rates Variable Mixed Fixed rate during the first 2 3 or 5 years followed by a variable rate indexed to Euribor Fixed Rate from 5 to 30 years

-

Reduction of Fees

-

Dossier Fee €145 + IS without reduction €290 + IS

-

Formalization Fee €100 + IS without reduction €200 + IS

-

Total reduction amount €254.80

-

Dossier Fee €290 + IS

-

Formalization Fee €200 + IS

-

Evaluation Fee €230 + IS

-

Total exemption amount €748.80

-

Salary domiciliation of €1,000 in the account associated with the loan;

-

Domiciliation of 2 monthly payments for water gas electricity or communications;

-

Home insurance associated with the loan marketed by Ageas Portugal under the Ocidental8 brand;

-

Life insurance associated with the loan under Ocidental Vida8.

All mentioned fees are subject to Stamp Duty.

Ocidental - Companhia Portuguesa de Seguros de Vida, Public limited company, with head office at Praça Príncipe Perfeito n.º 2, 1990-278 Lisbon. Legal Person No. 501836926. Lisbon Trade Register. Share Capital of 22.375.000 Euros. Registration ASF 1024, www.asf.com.pt.

Ageas Portugal - Companhia de Seguros, Public limited company, with head office at Praça Príncipe Perfeito n.º 2, 1990-278 Lisboa. Legal Person No. 503454109. Porto Trade Register. Share Capital of 7.500.000 Euros. Registration ASF 1129, www.asf.com.pt.