- Individuals

- Loans

- Car loan

- New

- Calculator

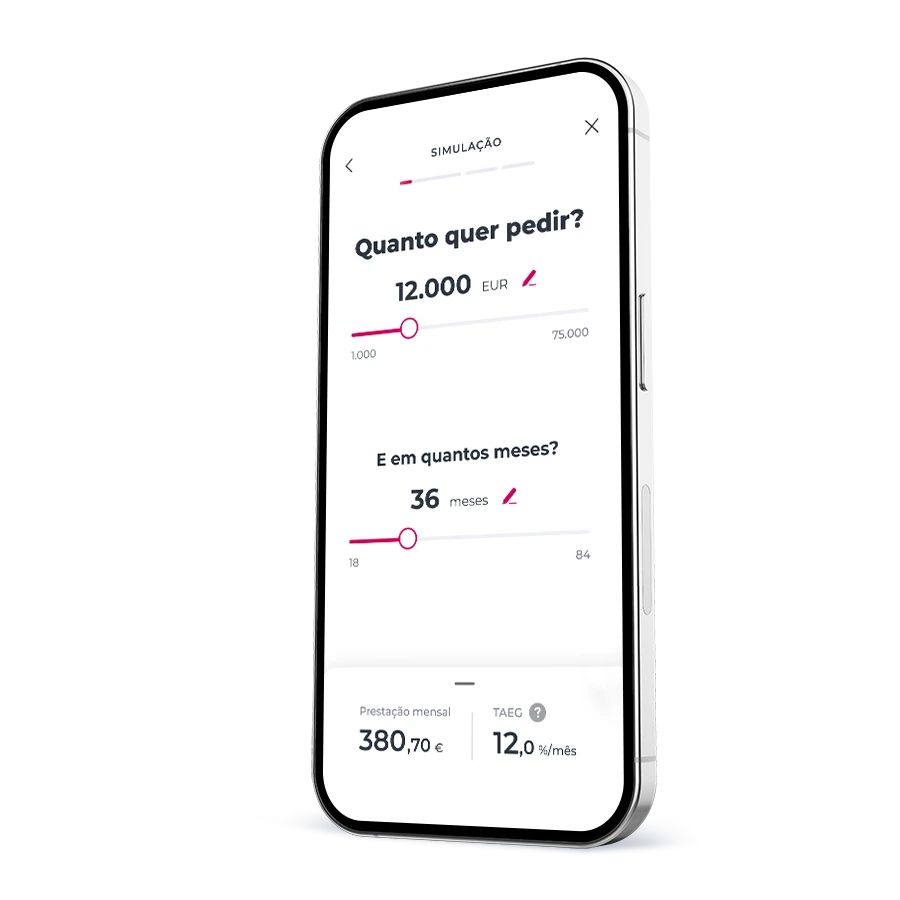

Calculate New Vehicle Loan

Discover how much you can borrow to buy a new car

Main benefits

Here’s how it works

Choose the term

The one that best suits you, between 24 and 120 months

Choose the term

The one that best suits you, between 24 and 120 months

Get 100% financing

Of the vehicle’s purchase amount

Get 100% financing

Of the vehicle’s purchase amount

Know exactly what you’ll pay

With a fixed rate until the end of the loan

Know exactly what you’ll pay

With a fixed rate until the end of the loan

Get 100% financing

Of the vehicle’s purchase amount

Get 100% financing

Of the vehicle’s purchase amount

Choose the term

The one that best suits you, between 24 and 120 months

Choose the term

The one that best suits you, between 24 and 120 months

Know exactly what you’ll pay

With a fixed rate until the end of the loan

Know exactly what you’ll pay

With a fixed rate until the end of the loan

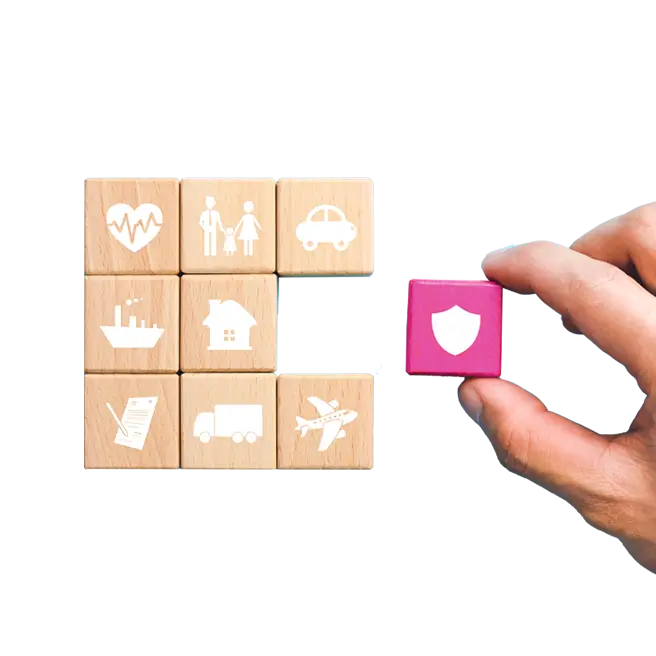

Loan add-ons

So you don't have to worry

80% of our Customers take out life insurance

We ensure your monthly loan payments

1,2,3 and that’s it!

Applying for a loan is easy

1,2,3 and that’s it!

Applying for a loan is easy

Want to apply for a Vehicle Loan?

Before making a decision…

Frequently asked questions

Questions? We’ll help

A personal loan is a type of loan that you can use to, for example, buy household appliances, buy a trip, pay university fees, etc.

A personal loan is a type of loan that you can use to, for example, buy household appliances, buy a trip, pay university fees, etc.

Before applying for a loan, you should:

- Assess the need for the expense you are going to have.

- Consider the amount of the new loan together with your household's monthly income and expenses and make sure that the loan will not compromise your budget.

- Obtain all the information you consider relevant to making an informed decision before signing the contract.

- Read the pre-contractual information and the contract carefully and pay attention to the particular conditions of the loan, namely the amount, term, installments and rates.

Before applying for a loan, you should:

- Assess the need for the expense you are going to have.

- Consider the amount of the new loan together with your household's monthly income and expenses and make sure that the loan will not compromise your budget.

- Obtain all the information you consider relevant to making an informed decision before signing the contract.

- Read the pre-contractual information and the contract carefully and pay attention to the particular conditions of the loan, namely the amount, term, installments and rates.

When applying for a personal loan, the following documents may be requested:

- Last 3 payslips

- Latest tax return (with the applicant’s taxpayer number and validation code)

- ID documents of all parties involved (if the application is made at a branch)

- Certificate of regularized social contributions (mandatory for loans over €50,000)

- Additional documents depending on the purpose of the loan:

- Education - proof of enrollment/registration (showing the institution, course duration, and cost) and of the costs related to the course.

- Works/renovations -works estimate + proof of property ownership (Land Registry Certificate and Property Tax Record).

- Sustainable buildings – proof of eligible expenses.

- Automobile – proof of vehicle purchase (mandatory for terms over 84 months).

When applying for a personal loan, the following documents may be requested:

- Last 3 payslips

- Latest tax return (with the applicant’s taxpayer number and validation code)

- ID documents of all parties involved (if the application is made at a branch)

- Certificate of regularized social contributions (mandatory for loans over €50,000)

- Additional documents depending on the purpose of the loan:

- Education - proof of enrollment/registration (showing the institution, course duration, and cost) and of the costs related to the course.

- Works/renovations -works estimate + proof of property ownership (Land Registry Certificate and Property Tax Record).

- Sustainable buildings – proof of eligible expenses.

- Automobile – proof of vehicle purchase (mandatory for terms over 84 months).

It's the total amount you will pay for the loan, including the financed amount, interest, fees, taxes and charges.

It's the total amount you will pay for the loan, including the financed amount, interest, fees, taxes and charges.

Frequently asked questions

Questions? We’ll help

A personal loan is a type of loan that you can use to, for example, buy household appliances, buy a trip, pay university fees, etc.

A personal loan is a type of loan that you can use to, for example, buy household appliances, buy a trip, pay university fees, etc.

Before applying for a loan, you should:

- Assess the need for the expense you are going to have.

- Consider the amount of the new loan together with your household's monthly income and expenses and make sure that the loan will not compromise your budget.

- Obtain all the information you consider relevant to making an informed decision before signing the contract.

- Read the pre-contractual information and the contract carefully and pay attention to the particular conditions of the loan, namely the amount, term, installments and rates.

Before applying for a loan, you should:

- Assess the need for the expense you are going to have.

- Consider the amount of the new loan together with your household's monthly income and expenses and make sure that the loan will not compromise your budget.

- Obtain all the information you consider relevant to making an informed decision before signing the contract.

- Read the pre-contractual information and the contract carefully and pay attention to the particular conditions of the loan, namely the amount, term, installments and rates.

When applying for a personal loan, the following documents may be requested:

- Last 3 payslips

- Latest tax return (with the applicant’s taxpayer number and validation code)

- ID documents of all parties involved (if the application is made at a branch)

- Certificate of regularized social contributions (mandatory for loans over €50,000)

- Additional documents depending on the purpose of the loan:

- Education - proof of enrollment/registration (showing the institution, course duration, and cost) and of the costs related to the course.

- Works/renovations -works estimate + proof of property ownership (Land Registry Certificate and Property Tax Record).

- Sustainable buildings – proof of eligible expenses.

- Automobile – proof of vehicle purchase (mandatory for terms over 84 months).

When applying for a personal loan, the following documents may be requested:

- Last 3 payslips

- Latest tax return (with the applicant’s taxpayer number and validation code)

- ID documents of all parties involved (if the application is made at a branch)

- Certificate of regularized social contributions (mandatory for loans over €50,000)

- Additional documents depending on the purpose of the loan:

- Education - proof of enrollment/registration (showing the institution, course duration, and cost) and of the costs related to the course.

- Works/renovations -works estimate + proof of property ownership (Land Registry Certificate and Property Tax Record).

- Sustainable buildings – proof of eligible expenses.

- Automobile – proof of vehicle purchase (mandatory for terms over 84 months).

It's the total amount you will pay for the loan, including the financed amount, interest, fees, taxes and charges.

It's the total amount you will pay for the loan, including the financed amount, interest, fees, taxes and charges.

Need help?

We are here for you

Need help?

Need help?

Looking for a branch?

Looking for a branch?

Need to call us?

Need to call us?