- Individuals

- Insurance

- Health

- M Vantagem plus

M Vantagem+

Advantages that support you in this new stage of life

Benefits and advantages

Assistance for any situation

Our costs

This is how much you’ll pay…

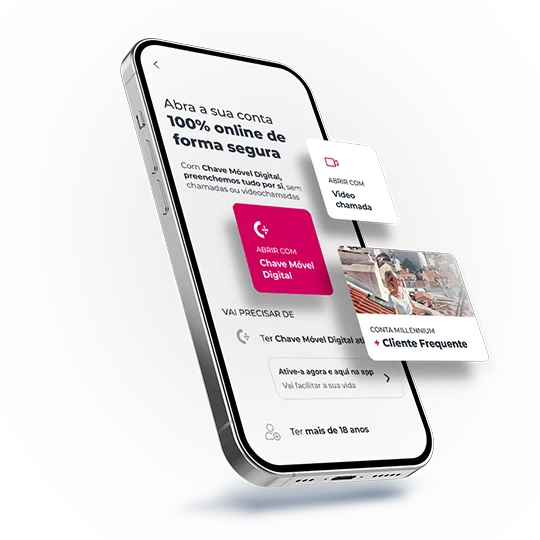

1,2,3 and that’s it!

Having + advantages is simple

1,2,3 and that’s it!

Having + advantages is simple

Activating coverage

To get home and healthcare assistance…

Call 210 347 933

(Available every day, from 00:00 to 24:00; call cost according to national landline rates)

Provide the full name and phone number of the insured person

Provide the address of the location where assistance is needed

Provide the address of the location where assistance is needed

Frequently asked questions

Questions? We’ll help

No, it must be in the account that includes one of the following integrated solutions of banking products and services: Cliente Frequente, Cliente Frequente Light, Mais Portugal, Programa Prestige, Prestige Start, and Family.

No, it must be in the account that includes one of the following integrated solutions of banking products and services: Cliente Frequente, Cliente Frequente Light, Mais Portugal, Programa Prestige, Prestige Start, and Family.

The M vantagem+ benefits are exclusive to a maximum of 2 account holders, aged between 55 and 90 years old at the time of subscription.

The M vantagem+ benefits are exclusive to a maximum of 2 account holders, aged between 55 and 90 years old at the time of subscription.

No, the benefits are for the 2 holders of the main account.

No, the benefits are for the 2 holders of the main account.

No, you can only join one.

No, you can only join one.

Yes, the debit of both fees is made from the current account on the 3rd business day of each month.

Yes, the debit of both fees is made from the current account on the 3rd business day of each month.

Yes, subscription is available for both products.

Yes, subscription is available for both products.

No, when the integrated solution of banking products and services is cancelled, M vantagem+ is automatically cancelled as well. However, if you cancel M vantagem+, you will still keep the Cliente Frequente solution.

No, when the integrated solution of banking products and services is cancelled, M vantagem+ is automatically cancelled as well. However, if you cancel M vantagem+, you will still keep the Cliente Frequente solution.

It is an event caused by a sudden, external, violent, and unforeseeable cause, beyond the control of the Insured Person.

It is an event caused by a sudden, external, violent, and unforeseeable cause, beyond the control of the Insured Person.

Reimbursement of expenses arising from an accident covered by this contract, up to a limit of €2,500. Reimbursement is made upon submission of the original documentation proving payment of the expense.

Hospitalizations solely for the purposes of rehabilitation, palliative care, long-term care, or when such care could reasonably be provided at the Insured Person's home, are not covered.

Reimbursement of expenses arising from an accident covered by this contract, up to a limit of €2,500. Reimbursement is made upon submission of the original documentation proving payment of the expense.

Hospitalizations solely for the purposes of rehabilitation, palliative care, long-term care, or when such care could reasonably be provided at the Insured Person's home, are not covered.

- Flu vaccine administration, limited to 2 per bank account per year;

- Pharmacy services, unlimited use;

- Diabetes Check, limited to 1 exam per insured person, up to a maximum of 2 exams per bank account per year;

- Heart Check, limited to 1 exam per insured person, up to a maximum of 2 exams per bank account per year;

- Medication delivery, limited to 12 deliveries per bank account per year.

- Flu vaccine administration, limited to 2 per bank account per year;

- Pharmacy services, unlimited use;

- Diabetes Check, limited to 1 exam per insured person, up to a maximum of 2 exams per bank account per year;

- Heart Check, limited to 1 exam per insured person, up to a maximum of 2 exams per bank account per year;

- Medication delivery, limited to 12 deliveries per bank account per year.

Within the Vantagem+ Pharmacy Network. Visit the website www.farmaciasportuguesas.pt

Within the Vantagem+ Pharmacy Network. Visit the website www.farmaciasportuguesas.pt

Included are:

- Laundry and Ironing Services, maximum of 1 request per week, with up to 40 items; limited to 6 requests per insured person per year;

- House Cleaning Services, maximum of 4 hours per request; limited to 10 requests per insured person per year;

- Pet Assistance, maximum of 10 hours, limited to 10 requests per insured person per year.

Included are:

- Laundry and Ironing Services, maximum of 1 request per week, with up to 40 items; limited to 6 requests per insured person per year;

- House Cleaning Services, maximum of 4 hours per request; limited to 10 requests per insured person per year;

- Pet Assistance, maximum of 10 hours, limited to 10 requests per insured person per year.

Included are:

- Doctor home visits, unlimited requests;

- Home nursing services, limited to 5 requests per insured person per year;

- Meal services, limited to 5 requests per insured person per year;

- Home physiotherapy services, limited to 5 requests per insured person per year;

- Home clinical tests, limited to 1 request per insured person per year;

- Non-emergency medical transportation, limited to 2 requests per insured person per year.

Included are:

- Doctor home visits, unlimited requests;

- Home nursing services, limited to 5 requests per insured person per year;

- Meal services, limited to 5 requests per insured person per year;

- Home physiotherapy services, limited to 5 requests per insured person per year;

- Home clinical tests, limited to 1 request per insured person per year;

- Non-emergency medical transportation, limited to 2 requests per insured person per year.

Frequently asked questions

Questions? We’ll help

No, it must be in the account that includes one of the following integrated solutions of banking products and services: Cliente Frequente, Cliente Frequente Light, Mais Portugal, Programa Prestige, Prestige Start, and Family.

No, it must be in the account that includes one of the following integrated solutions of banking products and services: Cliente Frequente, Cliente Frequente Light, Mais Portugal, Programa Prestige, Prestige Start, and Family.

The M vantagem+ benefits are exclusive to a maximum of 2 account holders, aged between 55 and 90 years old at the time of subscription.

The M vantagem+ benefits are exclusive to a maximum of 2 account holders, aged between 55 and 90 years old at the time of subscription.

No, the benefits are for the 2 holders of the main account.

No, the benefits are for the 2 holders of the main account.

No, you can only join one.

No, you can only join one.

Yes, the debit of both fees is made from the current account on the 3rd business day of each month.

Yes, the debit of both fees is made from the current account on the 3rd business day of each month.

Yes, subscription is available for both products.

Yes, subscription is available for both products.

No, when the integrated solution of banking products and services is cancelled, M vantagem+ is automatically cancelled as well. However, if you cancel M vantagem+, you will still keep the Cliente Frequente solution.

No, when the integrated solution of banking products and services is cancelled, M vantagem+ is automatically cancelled as well. However, if you cancel M vantagem+, you will still keep the Cliente Frequente solution.

It is an event caused by a sudden, external, violent, and unforeseeable cause, beyond the control of the Insured Person.

It is an event caused by a sudden, external, violent, and unforeseeable cause, beyond the control of the Insured Person.

Reimbursement of expenses arising from an accident covered by this contract, up to a limit of €2,500. Reimbursement is made upon submission of the original documentation proving payment of the expense.

Hospitalizations solely for the purposes of rehabilitation, palliative care, long-term care, or when such care could reasonably be provided at the Insured Person's home, are not covered.

Reimbursement of expenses arising from an accident covered by this contract, up to a limit of €2,500. Reimbursement is made upon submission of the original documentation proving payment of the expense.

Hospitalizations solely for the purposes of rehabilitation, palliative care, long-term care, or when such care could reasonably be provided at the Insured Person's home, are not covered.

- Flu vaccine administration, limited to 2 per bank account per year;

- Pharmacy services, unlimited use;

- Diabetes Check, limited to 1 exam per insured person, up to a maximum of 2 exams per bank account per year;

- Heart Check, limited to 1 exam per insured person, up to a maximum of 2 exams per bank account per year;

- Medication delivery, limited to 12 deliveries per bank account per year.

- Flu vaccine administration, limited to 2 per bank account per year;

- Pharmacy services, unlimited use;

- Diabetes Check, limited to 1 exam per insured person, up to a maximum of 2 exams per bank account per year;

- Heart Check, limited to 1 exam per insured person, up to a maximum of 2 exams per bank account per year;

- Medication delivery, limited to 12 deliveries per bank account per year.

Within the Vantagem+ Pharmacy Network. Visit the website www.farmaciasportuguesas.pt

Within the Vantagem+ Pharmacy Network. Visit the website www.farmaciasportuguesas.pt

Included are:

- Laundry and Ironing Services, maximum of 1 request per week, with up to 40 items; limited to 6 requests per insured person per year;

- House Cleaning Services, maximum of 4 hours per request; limited to 10 requests per insured person per year;

- Pet Assistance, maximum of 10 hours, limited to 10 requests per insured person per year.

Included are:

- Laundry and Ironing Services, maximum of 1 request per week, with up to 40 items; limited to 6 requests per insured person per year;

- House Cleaning Services, maximum of 4 hours per request; limited to 10 requests per insured person per year;

- Pet Assistance, maximum of 10 hours, limited to 10 requests per insured person per year.

Included are:

- Doctor home visits, unlimited requests;

- Home nursing services, limited to 5 requests per insured person per year;

- Meal services, limited to 5 requests per insured person per year;

- Home physiotherapy services, limited to 5 requests per insured person per year;

- Home clinical tests, limited to 1 request per insured person per year;

- Non-emergency medical transportation, limited to 2 requests per insured person per year.

Included are:

- Doctor home visits, unlimited requests;

- Home nursing services, limited to 5 requests per insured person per year;

- Meal services, limited to 5 requests per insured person per year;

- Home physiotherapy services, limited to 5 requests per insured person per year;

- Home clinical tests, limited to 1 request per insured person per year;

- Non-emergency medical transportation, limited to 2 requests per insured person per year.

Access to the lowest price tier (€5) requires subscription to digital document services.

- M vantagem+ Saúde: monthly fee of €3.5 + Stamp Duty (annual amount: €43.68, including Stamp Duty)

- M vantagem+ Saúde Premium: monthly fee of €7.5 + Stamp Duty (annual amount: €93.60, including Stamp Duty)

Exclusions are defined in the policy.

(+351) 21 005 24 24 (calls to national landlines)

Personalized service 24 hours a day.

Doctor at Home:

Health assistance at the Customer’s residence.

In the event of a sudden and urgent illness, the Assistance Service arranges for a General Practitioner to visit the Insured Person at home, covering the transportation costs and medical fees.

This service is available 24 hours a day, throughout the national territory.

If a doctor is not immediately available, the Assistance Service may, if necessary, arrange transportation of the Insured Person to an appropriate Medical Center, with transport costs also covered.

Unlimited service.

Nursing at Home:

If there is a medical prescription, the Assistance Service covers the travel and fees of a qualified nurse to perform the prescribed nursing care.

Covered procedures under this service include:

- Wound treatment, pressure ulcers and/or bedsores

- Injections

- Catheterization

- Nasogastric intubation

- IV fluid administration and monitoring

- Removal of stitches and staples

- Hygiene and comfort care

- Vaccinations

- Aerosol therapy

- Oxygen therapy

- Care related to colostomies, ileostomies, tracheostomies, and urostomies

The cost of consumables and medications used during the nursing procedures is the responsibility of the Insured Person.

Limit of 5 visits per Insured Person, per policy period or year.

Meal Preparation at Home:

Upon medical prescription, the Assistance Service organizes and covers the cost of sending a specialized professional to prepare meals at the Insured Person's residence, within defined limits.

The cost of food is borne by the Insured Person.

Costs are covered by the Assistance Service up to the specified limit. Once that limit is exceeded, the Insurer may still provide the services, but all costs will be the responsibility of the Insured Person, and the Assistance Service will only manage the organization and availability of the service.

Limit of 5 requests per Insured Person, per policy period or year.

Physical Therapy at Home:

Upon medical prescription, the Assistance Service covers the travel, professional fees, and related costs of a physiotherapist to carry out prescribed treatments that can be performed at the Insured Person’s home.

Costs are covered by the Assistance Service up to the defined limit. Beyond this limit, the Insurer may continue to provide the service, but all expenses will be borne by the Insured Person, with the Assistance Service only handling scheduling and availability.

Limit of 5 sessions per Insured Person, per policy period or year.

Lab Tests at Home:

Upon medical prescription, the Assistance Service covers the travel and fees of a healthcare technician to collect fluid samples from the Insured Person at home for prescribed lab tests.

Costs are covered by the Assistance Service up to the stipulated limit. Beyond that, the Insurer may still arrange for the services, but the Insured Person is responsible for all costs.

Laboratory test fees are always the responsibility of the Insured Person.

Limit of 1 request per Insured Person, per policy period or year.

Non-Urgent Patient Transport:

The Assistance Service organizes and covers transportation costs for the Insured Person, by ambulance or taxi, for trips between healthcare facilities and their residence, for diagnostic exams, consultations, hospital admissions, or discharge.

A round-trip journey between the Insured Person’s location and the healthcare facility counts as one trip for limit calculation.

Costs are covered by the Assistance Service up to the defined limit. Beyond that, the Insurer may continue to provide the service, but the Insured Person assumes all associated expenses, with the Assistance Service only managing scheduling and coordination.

Limit of 2 requests per Insured Person, per policy period or year.

Doctor at Home:

Health assistance at the Customer’s residence.

In the event of a sudden and urgent illness, the Assistance Service arranges for a General Practitioner to visit the Insured Person at home, covering the transportation costs and medical fees.

This service is available 24 hours a day, throughout the national territory.

If a doctor is not immediately available, the Assistance Service may, if necessary, arrange transportation of the Insured Person to an appropriate Medical Center, with transport costs also covered.

Unlimited service.

Nursing at Home:

If there is a medical prescription, the Assistance Service covers the travel and fees of a qualified nurse to perform the prescribed nursing care.

Covered procedures under this service include:

- Wound treatment, pressure ulcers and/or bedsores

- Injections

- Catheterization

- Nasogastric intubation

- IV fluid administration and monitoring

- Removal of stitches and staples

- Hygiene and comfort care

- Vaccinations

- Aerosol therapy

- Oxygen therapy

- Care related to colostomies, ileostomies, tracheostomies, and urostomies

The cost of consumables and medications used during the nursing procedures is the responsibility of the Insured Person.

Limit of 5 visits per Insured Person, per policy period or year.

Meal Preparation at Home:

Upon medical prescription, the Assistance Service organizes and covers the cost of sending a specialized professional to prepare meals at the Insured Person's residence, within defined limits.

The cost of food is borne by the Insured Person.

Costs are covered by the Assistance Service up to the specified limit. Once that limit is exceeded, the Insurer may still provide the services, but all costs will be the responsibility of the Insured Person, and the Assistance Service will only manage the organization and availability of the service.

Limit of 5 requests per Insured Person, per policy period or year.

Physical Therapy at Home:

Upon medical prescription, the Assistance Service covers the travel, professional fees, and related costs of a physiotherapist to carry out prescribed treatments that can be performed at the Insured Person’s home.

Costs are covered by the Assistance Service up to the defined limit. Beyond this limit, the Insurer may continue to provide the service, but all expenses will be borne by the Insured Person, with the Assistance Service only handling scheduling and availability.

Limit of 5 sessions per Insured Person, per policy period or year.

Lab Tests at Home:

Upon medical prescription, the Assistance Service covers the travel and fees of a healthcare technician to collect fluid samples from the Insured Person at home for prescribed lab tests.

Costs are covered by the Assistance Service up to the stipulated limit. Beyond that, the Insurer may still arrange for the services, but the Insured Person is responsible for all costs.

Laboratory test fees are always the responsibility of the Insured Person.

Limit of 1 request per Insured Person, per policy period or year.

Non-Urgent Patient Transport:

The Assistance Service organizes and covers transportation costs for the Insured Person, by ambulance or taxi, for trips between healthcare facilities and their residence, for diagnostic exams, consultations, hospital admissions, or discharge.

A round-trip journey between the Insured Person’s location and the healthcare facility counts as one trip for limit calculation.

Costs are covered by the Assistance Service up to the defined limit. Beyond that, the Insurer may continue to provide the service, but the Insured Person assumes all associated expenses, with the Assistance Service only managing scheduling and coordination.

Limit of 2 requests per Insured Person, per policy period or year.

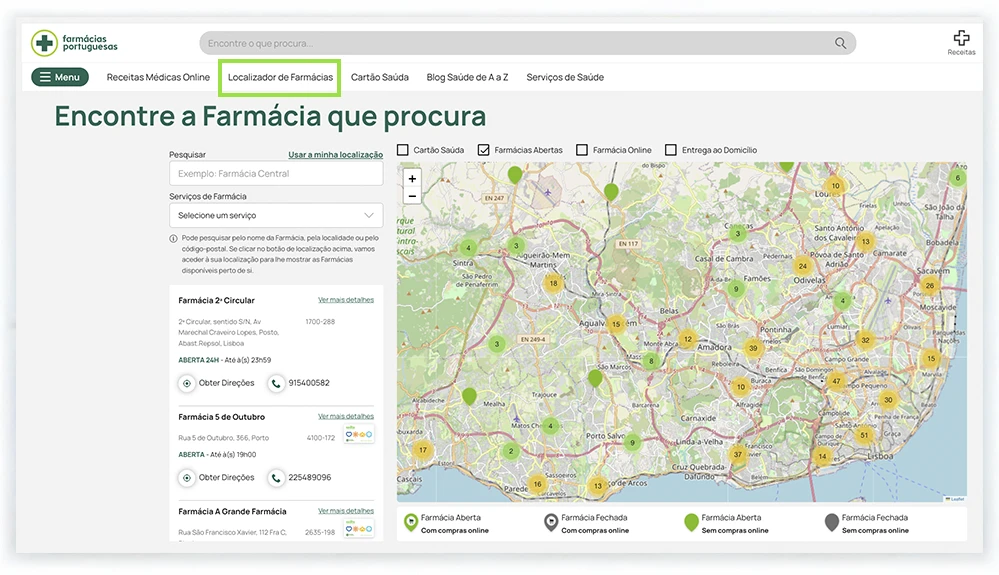

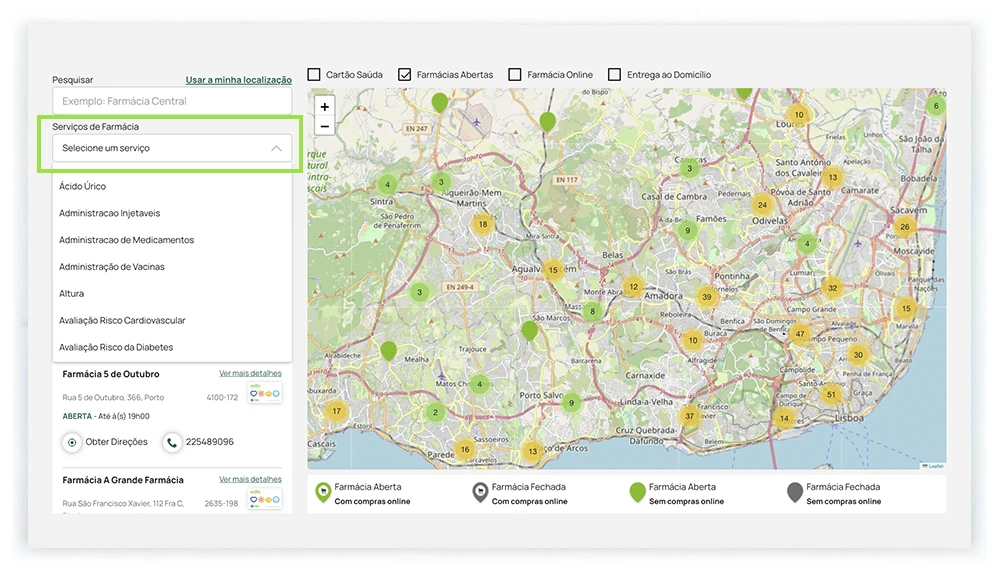

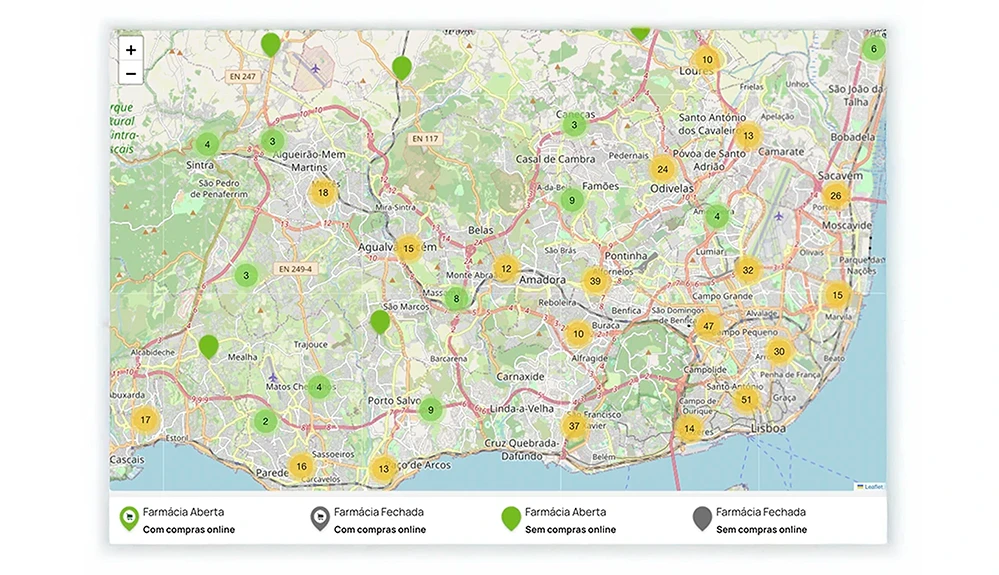

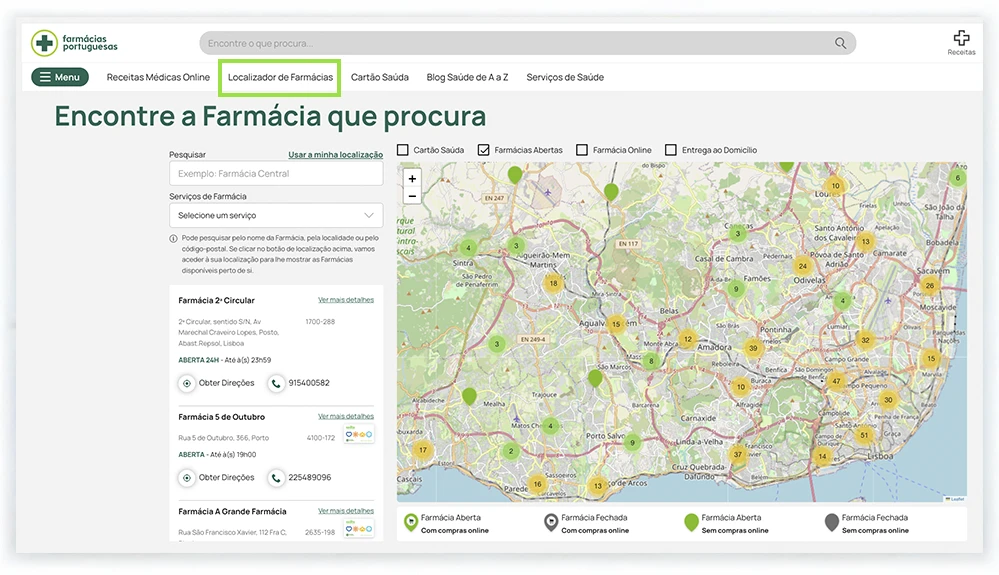

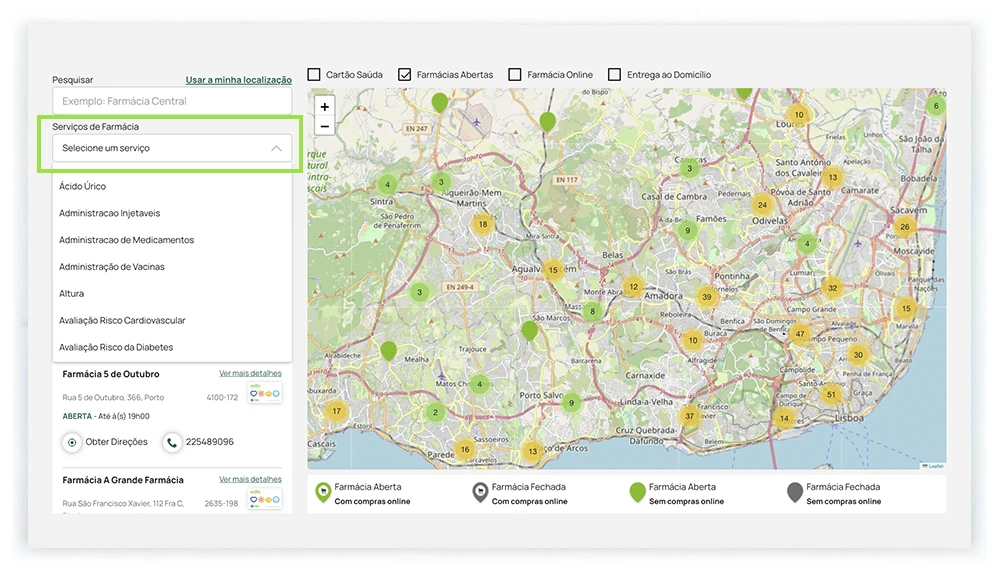

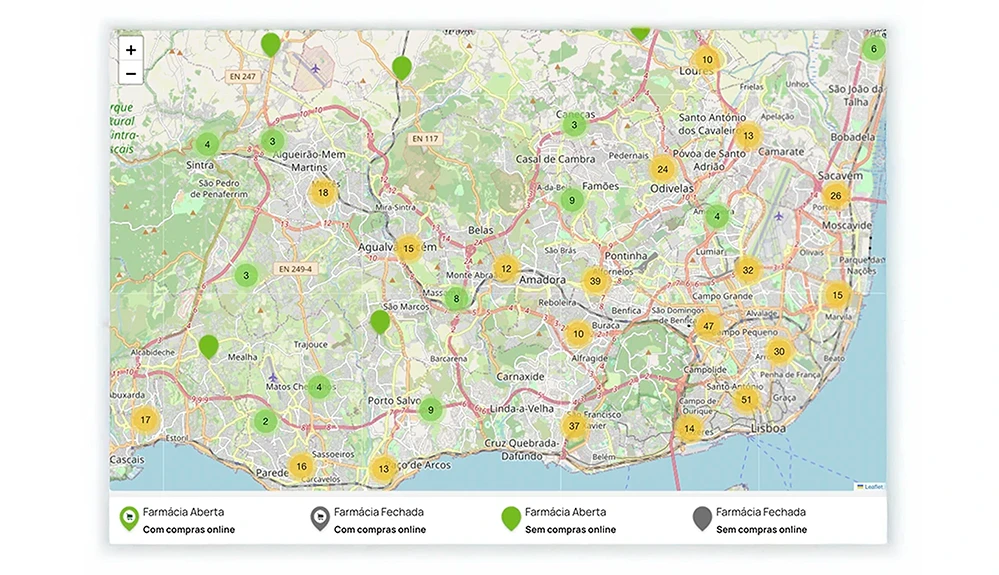

Find out how to locate the pharmacies included in the M vantagem+ service here

1. On the Farmácias Portuguesas website, select the button "Pharmacy locator".

2. Click on the "Filter" button, then go to "Pharmacy Services", and in alphabetical order, select M vantagem+ Saúde Millennium BCP.

3. On the map, choose the pharmacy that best suits you, with information about opening hours and available services.

Flu Vaccine Administration:

Service for administering the flu vaccine and providing the flu vaccine subsidized by the National Health Service (SNS).

Service available at a Vantagem+ Network Pharmacy, upon presentation of a medical prescription and subject to stock availability.

Limit of 1 vaccine per person, with a maximum of 2 per bank account, per policy period or year.

This service is included in M vantagem+ Saúde and M vantagem+ Saúde Premium.

Pharmacy Services:

Access to special prices, with no annual usage limit, for Clients at a Vantagem+ Network Pharmacy participating in the services.

The following services are provided:

- Body Mass Index (BMI) Assessment

- Blood Glucose Measurement

- Total Cholesterol Measurement

- Triglycerides Measurement

- Clinical Nutrition Consultation

- Blood Pressure and Heart Rate Measurement

- INR (International Normalized Ratio)

- Vaccine Administration (excluding National Vaccination Program vaccines)

- Injectable Administration (IM/SC)

- Glycated Hemoglobin (HbA1c)

- Lipid Profile

The cost of consumables and medication used during these procedures is the responsibility of the Insured Person.

No usage limits apply.

This service is included in M vantagem+ Saúde and M vantagem+ Saúde Premium.

Diabetes Check:

Early detection and prevention service, including:

- Body Mass Index Assessment

- Blood Pressure and Heart Rate Measurement

- Capillary Blood Glucose Measurement

Limit of 2 tests per bank account. Maximum 1 test per Insured Person per policy period or year.

This service is exclusive to M vantagem+ Saúde Premium.

Heart Check:

Early detection and prevention service, including:

- Body Mass Index

- Blood Pressure and Heart Rate

- Capillary Total Cholesterol

Limit of 2 tests per bank account. Maximum 1 test per Insured Person per policy period or year.

This service is exclusive to M vantagem+ Saúde Premium.

Medication Delivery:

Delivery of medicines (with or without prescription) and health & wellness products via CTT nationwide, available at Vantagem+ Network Pharmacies participating in the service.

Service available through direct contact between the Client and the participating Vantagem+ Pharmacy (email or phone).

Maximum of 12 deliveries per bank account per policy period or year.

This service is exclusive to M vantagem+ Saúde Premium.

Find out how to locate the pharmacies included in the M vantagem+ service here

1. On the Farmácias Portuguesas website, select the button "Pharmacy locator".

2. Click on the "Filter" button, then go to "Pharmacy Services", and in alphabetical order, select M vantagem+ Saúde Millennium BCP.

3. On the map, choose the pharmacy that best suits you, with information about opening hours and available services.

Flu Vaccine Administration:

Service for administering the flu vaccine and providing the flu vaccine subsidized by the National Health Service (SNS).

Service available at a Vantagem+ Network Pharmacy, upon presentation of a medical prescription and subject to stock availability.

Limit of 1 vaccine per person, with a maximum of 2 per bank account, per policy period or year.

This service is included in M vantagem+ Saúde and M vantagem+ Saúde Premium.

Pharmacy Services:

Access to special prices, with no annual usage limit, for Clients at a Vantagem+ Network Pharmacy participating in the services.

The following services are provided:

- Body Mass Index (BMI) Assessment

- Blood Glucose Measurement

- Total Cholesterol Measurement

- Triglycerides Measurement

- Clinical Nutrition Consultation

- Blood Pressure and Heart Rate Measurement

- INR (International Normalized Ratio)

- Vaccine Administration (excluding National Vaccination Program vaccines)

- Injectable Administration (IM/SC)

- Glycated Hemoglobin (HbA1c)

- Lipid Profile

The cost of consumables and medication used during these procedures is the responsibility of the Insured Person.

No usage limits apply.

This service is included in M vantagem+ Saúde and M vantagem+ Saúde Premium.

Diabetes Check:

Early detection and prevention service, including:

- Body Mass Index Assessment

- Blood Pressure and Heart Rate Measurement

- Capillary Blood Glucose Measurement

Limit of 2 tests per bank account. Maximum 1 test per Insured Person per policy period or year.

This service is exclusive to M vantagem+ Saúde Premium.

Heart Check:

Early detection and prevention service, including:

- Body Mass Index

- Blood Pressure and Heart Rate

- Capillary Total Cholesterol

Limit of 2 tests per bank account. Maximum 1 test per Insured Person per policy period or year.

This service is exclusive to M vantagem+ Saúde Premium.

Medication Delivery:

Delivery of medicines (with or without prescription) and health & wellness products via CTT nationwide, available at Vantagem+ Network Pharmacies participating in the service.

Service available through direct contact between the Client and the participating Vantagem+ Pharmacy (email or phone).

Maximum of 12 deliveries per bank account per policy period or year.

This service is exclusive to M vantagem+ Saúde Premium.

Laundry and Ironing Services:

Upon medical prescription, validated by the Clinical Management of the Assistance Service, the service arranges and covers the cost of a person or company to carry out laundry and ironing services, up to the established limits.

Limit of 6 requests per Insured Person, per policy period or year. Maximum of 1 request per week and 40 pieces per request.

House Cleaning Services:

Upon medical prescription, validated by the Clinical Management of the Assistance Service, the service arranges and covers the cost of a person or company to perform cleaning of the Insured Person’s home, up to the established limits.

Limit of 10 requests per Insured Person, per policy period or year. Maximum of 4 hours per request.

Pet Assistance:

Upon medical prescription, validated by the Clinical Management of the Assistance Service, the service arranges and covers the cost of a person or company to walk the Insured Person’s pet, as well as accompany the pet on veterinary visits, up to the established limits.

Limit of 10 requests per Insured Person, per policy period or year. Maximum of 10 hours per request.

Laundry and Ironing Services:

Upon medical prescription, validated by the Clinical Management of the Assistance Service, the service arranges and covers the cost of a person or company to carry out laundry and ironing services, up to the established limits.

Limit of 6 requests per Insured Person, per policy period or year. Maximum of 1 request per week and 40 pieces per request.

House Cleaning Services:

Upon medical prescription, validated by the Clinical Management of the Assistance Service, the service arranges and covers the cost of a person or company to perform cleaning of the Insured Person’s home, up to the established limits.

Limit of 10 requests per Insured Person, per policy period or year. Maximum of 4 hours per request.

Pet Assistance:

Upon medical prescription, validated by the Clinical Management of the Assistance Service, the service arranges and covers the cost of a person or company to walk the Insured Person’s pet, as well as accompany the pet on veterinary visits, up to the established limits.

Limit of 10 requests per Insured Person, per policy period or year. Maximum of 10 hours per request.

Hospitalization expenses resulting from an accident covered under this contract are reimbursed—up to an annual limit of €2,500 per bank account, as defined in the contractual terms—for the necessary costs of hospital treatment related to the injuries sustained by the Insured Person.

This coverage applies as long as the hospital stay continues, for a maximum of 360 days per claim, starting from the date of admission, and provided the expenses are validated by the Insurer’s medical team.

Reimbursement up to €2,500 per year.

This service is exclusive to the M vantagem+ Saúde Premium plan.

Hospitalization expenses resulting from an accident covered under this contract are reimbursed—up to an annual limit of €2,500 per bank account, as defined in the contractual terms—for the necessary costs of hospital treatment related to the injuries sustained by the Insured Person.

This coverage applies as long as the hospital stay continues, for a maximum of 360 days per claim, starting from the date of admission, and provided the expenses are validated by the Insurer’s medical team.

Reimbursement up to €2,500 per year.

This service is exclusive to the M vantagem+ Saúde Premium plan.

Need help?

We are here for you

Need help?

Need help?

Looking for a branch?

Looking for a branch?

Need to call us?

Need to call us?