- Individuals

- Loans

- Personal loan

- Health

Health Loan TAEG 7.0%

Focus on your health, leave worries behind

To finance VAT-exempt or reduced-VAT healthcare expenses and tax-deductible treatments

Apply for your loan to finance health expenses from €1,000 and up to €75,000

Choose the term between 24 and 120 months

Add insurance to your loan for protection in case of unemployment

You can finance the expenses of your loan to make the payment easier

There’s always more to discover

A few more benefits

Life Insurance

Covers total and permanent disability due to accident

In the event of death, the insurer pays the insured amount to Millennium

80% of our Clients subscribe

Payment Protection Plan

Covers situations of unemployment, medical leave, or accidents

Includes salary protection plan

Includes compensation for death or permanent disability

Rates and charges

Now the math

The rate is fixed until the end of the contract term

Annual Percentage Rate of Charge (TAEG)

7.0%

Nominal Annual Rate (TAN)

6.000%

7.0% TAEG (annual percentage rate of charge) and 6.000% TAN (annual nominal rate) with monthly installments of €73.62, for a simulation of a €5.000 loan with an 84-month term. Total amount charged to the consumer: €6,272.08, with no formalization fee, including interest and Stamp Duty for the use of credit and interest.

Subject to credit risk analysis. The granting of the credit is subject to Banco de Portugal's macro-prudential rules.

Subject to credit risk analysis. The granting of the credit is subject to Banco de Portugal's macro-prudential rules.

These are the amounts and terms you can choose from

€1,000 to €3,000

24 to 48 months

€3,001 to €25,000

24 to 84 months

€25,001 to €75,000

24 to 120 months

And these are the charges and expenses

No formalization fee

Loan opening Stamp Duty

The rate is fixed until the end of the contract term

Annual Percentage Rate of Charge (TAEG)

6.4%

Nominal Annual Rate (TAN)

5.500%

6.4% TAEG (annual percentage rate of charge) and 5.500% TAN (annual nominal rate) with monthly installments of €72.37, for a simulation of a €5.000 loan with an 84-month term. Total amount charged to the consumer: €6,167.08, with no formalization fee, including interest and Stamp Duty for the use of credit and interest.

Subject to credit risk analysis. The granting of the credit is subject to Banco de Portugal's macro-prudential rules.

Subject to credit risk analysis. The granting of the credit is subject to Banco de Portugal's macro-prudential rules.

These are the amounts and terms you can choose from

€1,000 to €3,000

24 to 48 months

€3,001 to €25,000

24 to 84 months

€25,001 to €75,000

24 to 120 months

And these are the charges and expenses

No formalization fee

Loan opening Stamp Duty

Want to apply for a Personal Health Loan?

Before you make a decision...

Assess the expense you plan to make, considering various factors.

Make sure the loan installments won’t compromise the budget of your household.

Verify the conditions of the loan and read all the pre-contractual and contract information.

If you change your mind after applying, you can cancel it on the website or app within 14 days.

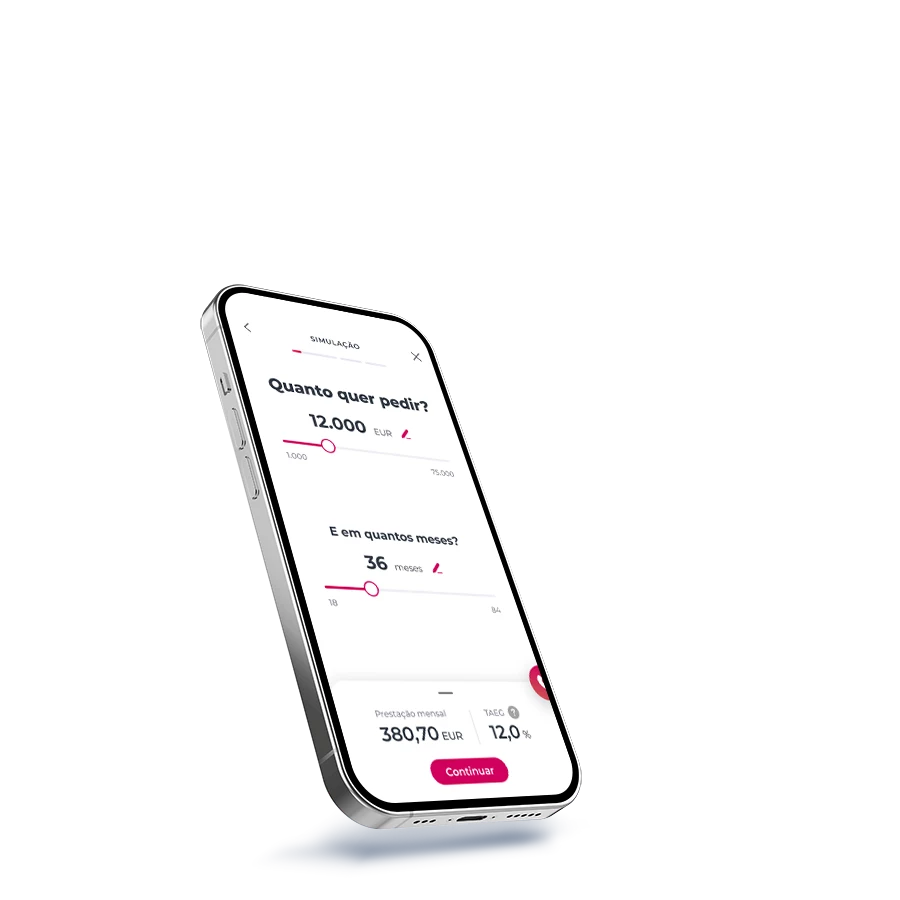

1,2,3 and that’s it!

Applying for a loan is simple

Go to a Millennium branch

Go to a Millennium branch

and apply for your Personal Health Loan.

and apply for your Personal Health Loan.

Sign the documents

Sign the documents

after carefully reading them.

after carefully reading them.

Get the money in your account

Get the money in your account

after the loan is approved.

after the loan is approved.

What do you need?

What do you need?

To be over 18 years old

To be over 18 years old

Proof of income documents

Proof of income documents

(latest income statement and/or last 3 payslips)

(latest income statement and/or last 3 payslips)

ID documents of the parties involved

ID documents of the parties involved

Proof of medical expenses, excluding VAT, with reduced VAT, and/or with a medical prescription

Proof of medical expenses, excluding VAT, with reduced VAT, and/or with a medical prescription

1,2,3 and that’s it!

Applying for a loan is simple

Go to a Millennium branch

Go to a Millennium branch

and apply for your Personal Health Loan.

and apply for your Personal Health Loan.

Sign the documents

Sign the documents

after carefully reading them.

after carefully reading them.

Get the money in your account

Get the money in your account

after the loan is approved.

after the loan is approved.

What do you need?

What do you need?

To be over 18 years old

To be over 18 years old

Proof of income documents

Proof of income documents

(latest income statement and/or last 3 payslips)

(latest income statement and/or last 3 payslips)

ID documents of the parties involved

ID documents of the parties involved

Proof of medical expenses, excluding VAT, with reduced VAT, and/or with a medical prescription

Proof of medical expenses, excluding VAT, with reduced VAT, and/or with a medical prescription

We might request subject A's NIF and the IRS validation code. For requests over €25,000 these details are mandatory.

Related topics

You might like these too...

Life insurance for Personal Loans

Life insurance for Personal Loans

Protection that ensures the payment of your loan

Protection that ensures the payment of your loan

Personal Loan Payment Protection Plan

Personal Loan Payment Protection Plan

Never miss a payment from your personal loan

Never miss a payment from your personal loan

Médis Health Insurance

Médis Health Insurance

Your go-to health insurance

Your go-to health insurance

Life insurance for Personal Loans

Life insurance for Personal Loans

Protection that ensures the payment of your loan

Protection that ensures the payment of your loan

Personal Loan Payment Protection Plan

Personal Loan Payment Protection Plan

Never miss a payment from your personal loan

Never miss a payment from your personal loan

Médis Health Insurance

Médis Health Insurance

Your go-to health insurance

Your go-to health insurance

Subject to credit risk analysis.

The concession of credit is subject to the macroprudential rules of the Bank of Portugal.

Advertising

Does not dispense with the consultation of legally required pre-contractual and contractual information.

Need help?

We are here for you

Need help?

Need help?

Here you can find the answer to all your questions

Here you can find the answer to all your questions

Looking for a branch?

Looking for a branch?

Find the nearest branch

Find the nearest branch

Need to call us?

Need to call us?

Call whenever you need to

Call whenever you need to

Need help?

Here you can find the answer to all your questions

Here you can find the answer to all your questions

Looking for a branch?

Find the nearest branch

Find the nearest branch

Need to call us?

Call whenever you need to

Call whenever you need to